Federal Reserve Launches Program to Bail Out Banks

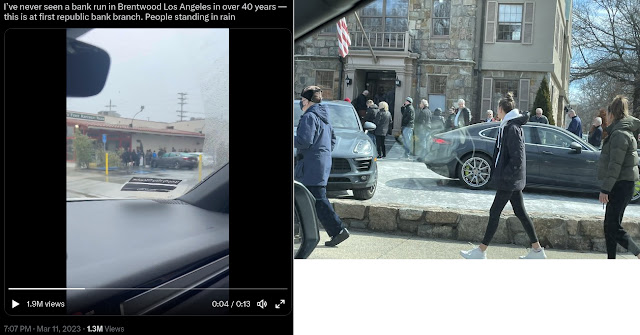

MARCH 13, 2023 BY SCHIFFGOLD In the wake of two bank failures, the Federal Reserve and the US Treasury announced a bank bailout program. Last week, Silicon Valley Bank was shuttered by federal authorities after the bank suffered significant losses selling bonds in order to raise capital. When that news hit, depositors rushed to pull funds from the bank, making it functionally insolvent. Then over the weekend, federal authorities shut down Signature Bank . On Sunday, the FDIC created “bridge banks” to handle both insured and uninsured customer deposits . Banking regulators assured depositors that they would have full access to all of their funds. Meanwhile, the Federal Reserve announced a loan program that will allow other banks to easily access capital “to help assure banks have the ability to meet the needs of all their depositors.” The Bank Term Funding Program (BTFP) will offer loans of up to one year in length to banks, savings associations, credit unions, and other eli