Farmers on the Brink

Farmers on the Brink

“Farming looks mighty easy when your plow is a pencil and you're a thousand miles from the corn field.” – Dwight D. Eisenhower

It was a spooky time to be out at sea off the US East Coast on Halloween in 1991. A strong storm system over the maritime provinces in Canada merged with the remnants of Hurricane Grace, forming a new, epic, and dangerous Nor’easter. The winds of this new storm breached 70 miles per hour and a wave as high as 100 feet was measured off the coast of Nova Scotia, but the storm was not renamed as either a tropical storm or a hurricane – instead, it is known only colloquially as simply the Perfect Storm. Six fishermen from Massachusetts perished when their vessel Andrea Gail sunk in open waters, and the story of the storm and of that tragedy became the subject of a best-selling book and a blockbuster feature film.

While the concept of a perfect storm is often too casually assigned in popular culture, it is difficult to find a more apt description of what has been unfolding in the global agriculture markets over these past several months. The tempest caused by the European energy disaster has merged with the hurricane of consequences flowing from Russia’s invasion of Ukraine, forming the genesis of a generational crisis in food that will leave few unaffected. While we’ve been warning about just such a scenario for some time, after spending the past two weeks traveling across the US Midwest and conferring with our contacts in the agricultural sector, even we are a little spooked by what we’ve learned. In a financial crash, the correlation between all asset classes converges to one. The coming crash in global food supply will be driven by a similar phenomenon across virtually every input into farming – they are all spiking to historic highs simultaneously, supply availability is diminishing across the spectrum, and the time to reverse the worst of the upcoming consequences is rapidly running short.

Other than that, things are great.

We begin with the price of fertilizer, which has been soaring to record highs across the globe. Key sources of nitrogen, potassium, and phosphorous – important inputs into soil fertility, crop yield, and plant maintenance – have all gone vertical. Ammonia is derived directly from natural gas, and the price of natural gas outside of the US has gone vertical. It's no surprise that the price of ammonia has tripled over the past twelve months. Belarus is the third-largest supplier of potash in the world and its state-owned miner, Belaruskali, declared force majeure after sanctions were imposed by the US and Europe. The number two supplier of potash globally? Russia. Perhaps front-running the Russian move on Ukraine, China halted phosphate exports last fall in an effort to ensure adequate domestic supply. The combined impact of these events can be seen in the Green Markets North American Fertilize Index, which tracks a blend of fertilizer prices globally:

Weed control is an important element of farming, and herbicides are an irreplaceable tool in the farmer’s repertoire. The most heavily used herbicide in the world is the controversial molecule glyphosate, known widely by its retail brand name Roundup. Invented by Monsanto (which is now owned by Bayer) in the 1970s, glyphosate has been linked to certain blood cancers and is targeted for elimination by many environmental groups. Despite these concerns, glyphosate remains a systemically important molecule – many seeds have been genetically modified to be resistant to it, allowing for its widespread use while minimizing damage to crops, and generics have expanded the market as it came off Monsanto’s patent.

Glyphosate is effectively little more than an elegantly modified fertilizer, containing both phosphorous and nitrogen. It is derived from similar starting materials – including ammonia – and, as such, its price has soared amid chronic supply shortages. This has caused the price of other herbicides to rise as farmers desperately seek substitutes, as described by this article in The Western Producer (emphasis added throughout):

“The much-ballyhooed glyphosate shortage is just the first domino to fall, according to a leading crop protection company.

‘The knock-on effect on basically every other herbicide molecule is starting to manifest itself,’ said Cornie Thiessen, general manager of ADAMA Canada. ‘We are seeing quite a domino effect in the market because of the glyphosate challenges.’

Bayer was already warning customers in late 2021 about a potential glyphosate shortage.”

If farmers skimp on herbicides to get by this season, it only makes dealing with weeds more challenging in the future. As one expert warned us, it only takes one year of negligence to do several years of damage to a field.

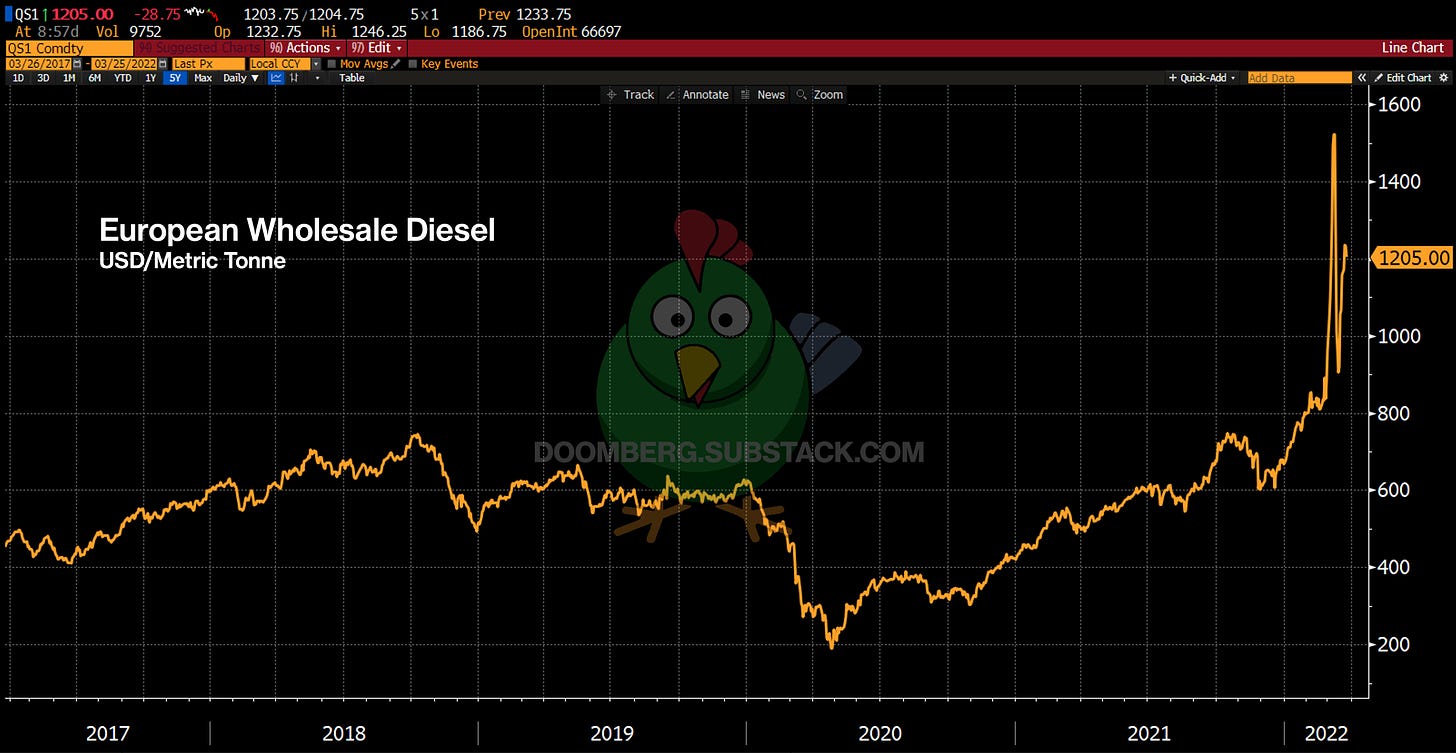

Diesel is another significant input into farming, and it too is facing a global supply crunch. Javier Blas, an energy and commodities columnist at Bloomberg whose Twitter account is an absolute must-follow, recently published an editorial sounding the alarm:

“The dire diesel supply situation predates the Russian invasion of Ukraine. While global oil demand hasn’t yet reached its pre-pandemic level, global diesel consumption surged to a fresh all-time high in the fourth quarter of 2021. The boom reflects the lopsided Covid economic recovery, with transportation demand spiking to ease supply-chain messes.

European refineries have struggled to match this revival in demand. One key reason is pricey natural gas. Refineries use gas to produce hydrogen, which they then use to remove sulphur from diesel. The spike in gas prices in late 2021 made that process prohibitively expensive, cutting diesel output.”

Once again, we discover the vital role natural gas plays in many downstream verticals, a key theme of many Doomberg pieces. With inventories at record lows and supplies constrained, the retail price of diesel in the US smashed previous record highs. In Europe, which depends heavily on Russian imports for both diesel and its semi-processed oil precursor, the wholesale market is on the verge of breaking. Here’s an updated version of the chart in Blas’ editorial:

As expensive as it is to fuel the field equipment needed to farm, keeping them operational at all is becoming an ever-growing challenge. The same chip shortage constraining automobile production has struck the farming equipment industry, making new equipment and spare parts harder to come by. Farmers in Iowa recently vented their frustration at a Republican forum on agriculture:

“…they bemoaned the hit-and-miss availability of parts to fix their equipment — the result of pandemic disruptions in the production of those parts. Iowa Rep. Ross Paustian, R-Walcott, is a farmer who said his neighbor was forced to buy a hydraulic pump for his tractor from a Nebraska dealership because it was the only place in the country that had it stocked.

Jim Boyer, an Emmet County farmer, had a similar, personal anecdote. He’s awaiting a $40 emissions-related sensor for his tractor, and he’s not sure if it will arrive anytime soon.

‘I cannot drive that tractor — a quarter-million-dollar piece of equipment — because I cannot get that sensor,’ he said.”

Compounding these challenges with machinery is a burgeoning labor shortage that is rapidly adding pressure to this brewing catastrophe. Although the labor issues in the US span well beyond agriculture, there are aspects that exacerbate the impact on farmers, including the physical labor intensity and seasonality of many roles, as well as the reliance on foreign laborers to fill key positions US citizens have historically shunned. This is especially challenging in light of vaccine mandates at border crossings. Here’s a recent report from Wisconsin Public Radio which describes the challenges well:

“While some farms employ workers all year round, Strader said many jobs are seasonal, starting in March and April and going until late fall when harvest ends.

With producers on edge about hiring for this year, Strader said many farms started recruiting earlier than usual and developed a contingency plan for how to make it through the season without employees. That could mean discontinuing certain markets or scaling back the variety of produce that they’re growing.”

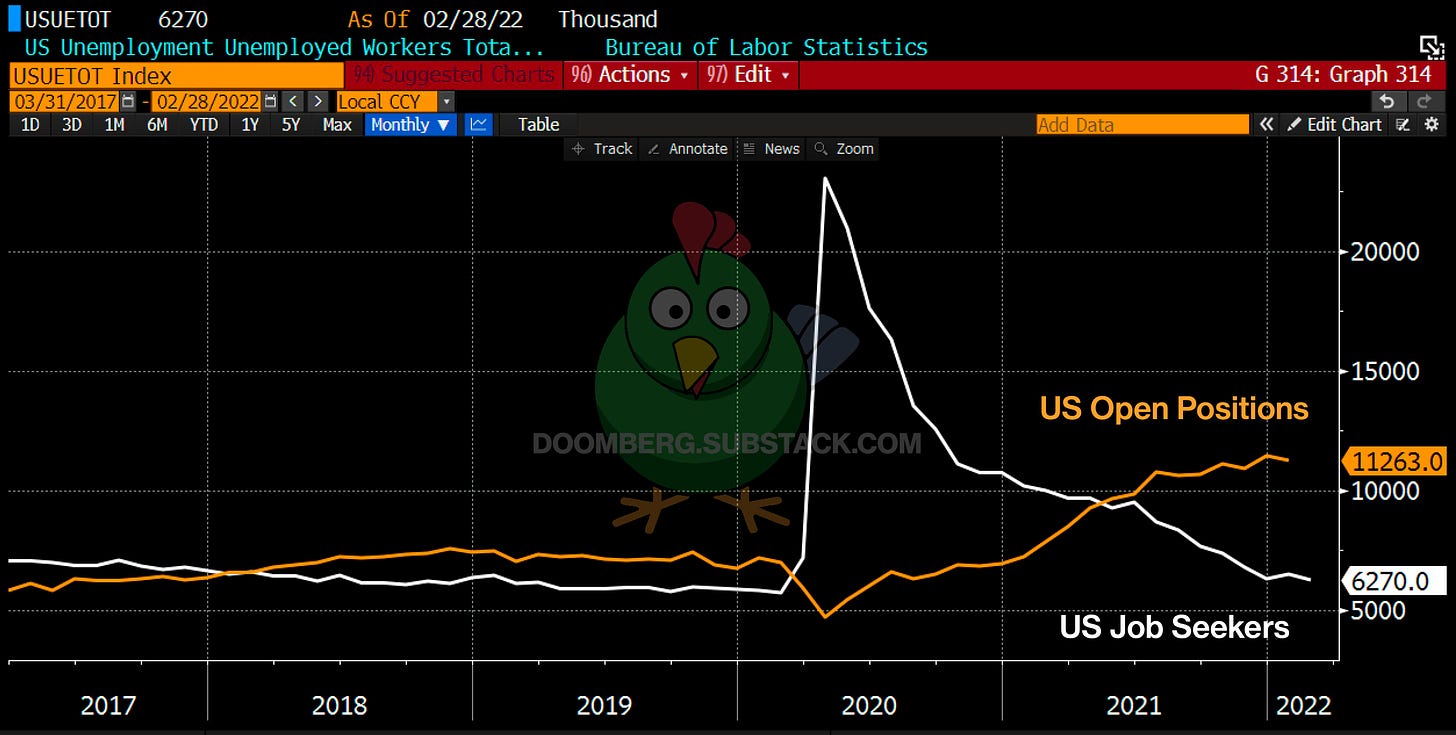

Farmers are also competing with other sectors for a limited pool of labor. The gap between job openings and unemployed but willing workers across the entire US continues to widen:

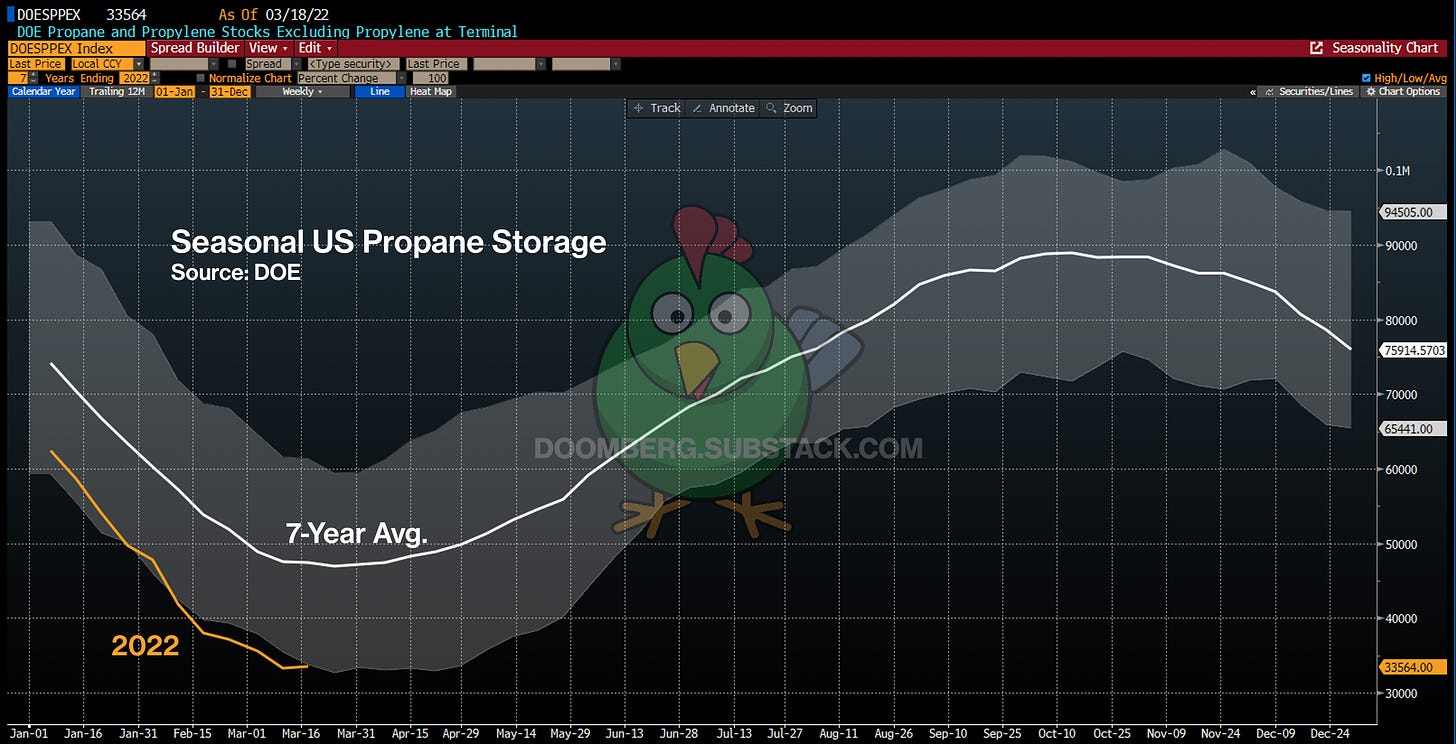

Even generously assuming farmers can cobble together enough fertilizer, herbicide, machinery, and labor to produce a good harvest this fall, they may be left to deal with yet another crisis of supply that few off the field have on their radar: propane. As Tracy Schuchart – yet another absolute must-follow on Twitter – has been flagging for several months, the US exits the winter of 2021-2022 with concerningly low levels of propane inventory, well-below typical averages for this time of year:

Here is the supply situation in chart form, with the shaded region signifying the high- and low-inventory levels over the past seven years:

What does propane supply have to do with farming? Grain drying. Here’s a primer on the importance of drying, from Wikipedia:

“Hundreds of millions of tonnes of wheat, corn, soybean, rice and other grains as sorghum, sunflower seeds, rapeseed/canola, barley, oats, etc., are dried in grain dryers. In the main agricultural countries, drying comprises the reduction of moisture from about 17-30% w/w to values between 8 and 15% w/w, depending on the grain. The final moisture content for drying must be adequate for storage.”

Many farms are located in rural areas without ready access to natural gas, and thus some 80% of grain dryers in the US, for example, rely on propane as a fuel. In a piece we wrote in December called An Urgent Call on Line 5, we chronicled how progressive politicians and environmental groups were targeting an important pipeline artery that runs from Canada, under the Straits of Mackinac, and across the State of Michigan. Line 5 is crucial to the stability of the US supply of propane, and yet – despite the catastrophic energy crisis we find ourselves in – the Attorney General of Michigan was recently captured on video spouting unserious nonsense:

“Acknowledging the legal battle she’s waging against Line 5 is an uphill and unpopular battle, Michigan Attorney General Dana Nessel blamed ‘propaganda’ from the pipeline’s proprietor, which she said has ‘really changed public perception and opinion.’

Nessel vowed to continue the fight against Line 5 and defended the attempts by Gov. Gretchen Whitmer’s administration to shut down the nearly 70-year-old pipeline during a recorded video chat with the Royal Oak Area Democratic Club. The conservative group Michigan Rising Action shared the video with Breitbart.”

We believe we are at the onset of a global famine of historic proportions. In a staggering defiance of logic, many US politicians are still attacking the lifeblood of our own energy production infrastructure, looking to score political points against “the other team,” blaming price-taking producers of global commodities for gouging, threatening producers of energy with windfall profits taxes, resisting calls to remove bureaucratic hurdles to new production, and refusing to open an introductory physics textbook to help guide them through the suite of policy choices that require true leadership to get right. They remain stuck in an endless loop of platitudes, blamestorming, corruption, and ignorance.

As Eisenhower aptly identifies in our opening quote, distance has an anesthetizing effect on the observer of any occurrence. One wonders how many people will starve before our politicians get serious. The populations most at risk of falling off the edge are half a world away and we worry that that number is uncomfortably high.

At Doomberg, we pride ourselves on seeing patterns early and being months ahead of the news flow. We are consistently human-centric. Never have we been more certain in our beliefs while fervently wishing that we are wrong. A global famine is no joke, and correctly forecasting one would bring no joy.

Comments

Post a Comment