MONETARY UTOPIA...

The author goes with

"The Community Economy Needs Its Own Money"!

The solutions will come not from those profiting from inequality and scarcity but from relocalizing "money"

and production to create degrowth community economies.

We think we understand "money"--we don't. We think the current versions of "money" are the final versions--they aren't.

Understanding "money" requires some heavy-lifting, but it's important, so let's dig in.

The most accurate description of "money" (in quotes because it's not what we think it is) is Art Berman's shorthand:

Energy is the economy.

Money is a call on energy, the capacity to do work.

Debt is a lien on future energy.

We think that creating more "money" can solve all problems. It can't. Creating more "money" only adds another crisis to the fundamental crisis, a scarcity of affordsable energy and resources.

In my new book, Global Crisis, National Renewal: A (Revolutionary) Grand Strategy for the United States, I identify the two problems neither nation-states nor global markets can resolve:

1) Soaring inequality caused by the concentration of capital, power and agency in the hands of the few and the resulting decapitalization and powerlessness of the many.

2) Scarcity of the essential resources that are the foundation of the globalized industrial economy.

The primacy of "money" (finance) is evidenced by the proposed solutions to inequality and scarcity, all of which are financial in nature: Universal Basic Income (UBI) / Modern Monetary Theory (MMT) and other schemes of creating "money" out of thin air and distributing it to those whom the system has failed, i.e. the bottom 90%, to stave off social unrest.

New Finance's menu of decentralized finance (DiFi), blockchain, cryptocurrencies and Web3 is also entirely financial: the core innovation is a new method of creating and tracking "money."

The problems that need to be solved are:

1) the fair distribution of essential resources, capital and agency.

2) protecting the systemic sources of dynamic stability: transparency, competition, accountability, variability and dissent.

3) decentralize and relocalize production, political agency and capital to institutionalize fast adaptation / problem-solving to radically reduce dependency on fragile global supply chains, radically improve productivity and efficiency and replace the "waste is growth" Landfill Economy with a degrowth economy.

The key to these solutions is the productive community economy, a localized economy with its own production, capital and agency, i.e. the control of production, capital and the distribution of resources.

Neither conventional money-printing nor the blockchain/defi/crypto menu fundamentally change the power structure of who controls resources, power and capital. As with all financialized "solutions," these presume that finance can fix everything because it's the master resource.

Both also assume that creating "money" out of thin air and distributing it within a market structure will solve all problems. Both assumptions are false: energy is the master resource and "money" is only a solution if it connects labor to local productivity.

All the creation of "money" out of thin air accomplishes is to maintain the status quo that favors 1) the already-rich who own the vast majority of assets and who can trade one asset class for another at will 2) those closest to the sources of this newly issued "money"--in the case of cryptocurrencies, 3) early adopters who become the New Aristocracy by virtue of their dominant ownership / control of the currencies, platforms, etc.

The critical element of every issuance of "money" is: how is the "money" distributed? Who gets the new money? Consider the case of bitcoin, which is decentralized in the sense that anyone with sufficient computing power can mine bitcoin, i.e. be issued bitcoin for maintaining the currency's blockchain.

Despite this decentralized distribution, the reality is the mining and the ownership of bitcoin is highly concentrated, just like all other wealth: 0.01% of Bitcoin holders control 27% of all bitcoins in circulation.

There are two dynamics at work: 1) early adopters were able to amass vast numbers of bitcoins for very modest sums, and 2) the wealthy few with access to the "money" spigots of central banks and fractional reserve private banking can borrow fiat currency at near-zero rates and use this "money" to buy bitcoin.

There may be limits on how many bitcoins are issued but there is no limit on how much fiat currencies can be issued, so those closest to the fiat currency spigots have the means to accumulate all other assets, including bitcoin / cryptocurrencies.

The net result is that decentralized finance that distributes new currency to miners (those maintaining the blockchain) or similar distribution structures are only decentralized in name; in practice, these currencies are just another asset class that can be bought up by those with access to fiat "money".

The same is of course true of any asset (for example, debt such as mortgages) generated by decentralized finance: the vast majority of every supposedly decentralized asset ends up being owned by the same super-wealthy class who owns the vast majority of all assets.

Given that cryptocurrency mining is very capital-intensive, those with capital can dominate the process of accumulating bitcoin via their essentially unlimited lines of low-cost credit. This is how a theoretically decentralized system is centralized by the wealthy who own most of the assets and who have access to low-cost credit.

In other words, the proposed "solutions"--conventional or supposedly decentralized--leave the structures that generate inequality untouched.

Real solutions must directly address the sources of inequality: how "money" / capital are distributed.

The only systemic solution is to issue new currency solely as payment to labor for producing essential goods and services in ways that improve efficiency, reduce consumption and increase productivity--doing more with less energy, resources, friction and labor.

Once currency can only be issued to labor performing high-utility work in a community economy, the entire structure of "money" changes. Rather than being closest to the "money" spigot, the super-wealthy are farthest from the spigot and those doing useful work are the only recipients of new "money." Since this labor-only currency cannot be borrowed into existence via private fractional reserve banking, there is no way for anyone to outbid everyone with unlimited low-cost credit because there is no unlimited low-cost credit.

In a community economy, those doing useful work can receive not just a wage for their labor but a share of what they've created with their work.

This process of turning labor into capital is the core mechanism needed to create and sustain a middle class which has a stake in the system--ownership of income-producing assets.

In the current financial system, conventional or supposedly decentralized, the only means available to those doing useful work to gain a meaningful ownership stake (i.e. income-producing assets) is to become a high-risk speculator in one or more asset bubbles. This is not a stable foundation for a middle class, an opportunity-based economy or a dynamically stable society. It is a recipe for soaring instability and collapse.

Returning to the three problems listed above--fair distribution of resources, capital and agency, protecting transparency, competition, accountability, variability and dissent, and decentralizing and relocalizing production, political agency and capital--only a community economy can solve these problems in a sustainable, degrowth fashion, and the community economy can only do so if its money is controlled by those in the community doing the useful work.

This system of "money" is a labor-backed currency as it is only issued to labor which has demonstrably performed work that is of high utility to the community. This labor-backed currency also enables the transformation of labor into capital owned by individuals and the community at large.

A supposedly community-based economy that is entirely dependent on "money" accumulated by the super-wealthy and corporations is nothing more than a fiefdom of centralized financialization. A supposedly community-based economy that has no power over the money, credit, resources and agency within its community is nothing but a simulacrum of a truly community economy.

In other words, if the super-wealthy accumulating newly issued "money" (either borrowed-into-existence fiat or bitcoin issued to wealthy miners) can come in and buy up all the assets of your community, it isn't a community economy, it's just another fiefdom in the financialization empire that benefits the few at the expense of the many.

A truly community economy must have its own "money" that can only be issued to those doing work deemed useful by the community rather than by a remote concentration of capital and political power.

A truly community economy must have locally owned assets and capital that cannot be bought or transferred to distant owners. The key to a community economy is to own local productive assets essential to well-being and not allow these assets to be controlled by self-interested, profiteering owners who aren't members of the community.

This requires not just protecting assets from outside capital but also a completely localized methodology of assessing value and profit. As I explain in the book, much of the real-world costs of global production are not even factored into price, environmental damage being a prime example.

In the current quasi-religion that worships profit and growth, value is determined by price and profit: the lower the price, the greater the value of the good or service, and the greater the profit, the greater the value of the asset.

In a community economy, value is based on how essential the good, service or asset is to the well-being, sustainability and adaptability of the community, and on how well it serves the community and the goals of degrowth.

The value of an asset or goods and services being produced by the community cannot be reduced to the false metrics of profit. Locally produced food is not profitable or profitless, it is priceless because it generates an irreplaceable source of value: independence from fragile global supply chains and centralized production that is owned by the super-wealthy.

In other words, local production of essentials such as food and energy are priceless, as there is no substitute at any price. To be dependent is to be powerless.

Whether local production is profitable by the leave-out-all-costs standard of global corporations and banks is pointless; the one true source of value--and thus the highest form of profit--is independent, locally owned production of essential goods and services which both sustain the community and can be traded with other community economies.

Waiting on the shore, dependent, decapitalized and powerless, hoping the central state and profit-maximizing global market will deliver solutions to inequality and scarcity is to wait for ships that will never come, for the state and market are the sources of inequality and scarcity.

The solutions will come not from those profiting from inequality and scarcity but from relocalizing "money" and production to create degrowth community economies that are nodes in a global network, sharing currency, credit, problem-solving and the essentials of sustainability and well-being.

There is much more in the book on these topics. I invite you to read the first chapter (PDF) and the Introduction--they're free.

We think we understand "money"--we don't. We think the current versions of "money" are the final versions--they aren't.

Understanding "money" requires some heavy-lifting, but it's important, so let's dig in.

The most accurate description of "money" (in quotes because it's not what we think it is) is Art Berman's shorthand:

Energy is the economy.

Money is a call on energy, the capacity to do work.

Debt is a lien on future energy.

We think that creating more "money" can solve all problems. It can't. Creating more "money" only adds another crisis to the fundamental crisis, a scarcity of affordsable energy and resources.

In my new book, Global Crisis, National Renewal: A (Revolutionary) Grand Strategy for the United States, I identify the two problems neither nation-states nor global markets can resolve:

1) Soaring inequality caused by the concentration of capital, power and agency in the hands of the few and the resulting decapitalization and powerlessness of the many.

2) Scarcity of the essential resources that are the foundation of the globalized industrial economy.

The primacy of "money" (finance) is evidenced by the proposed solutions to inequality and scarcity, all of which are financial in nature: Universal Basic Income (UBI) / Modern Monetary Theory (MMT) and other schemes of creating "money" out of thin air and distributing it to those whom the system has failed, i.e. the bottom 90%, to stave off social unrest.

New Finance's menu of decentralized finance (DiFi), blockchain, cryptocurrencies and Web3 is also entirely financial: the core innovation is a new method of creating and tracking "money."

The problems that need to be solved are:

1) the fair distribution of essential resources, capital and agency.

2) protecting the systemic sources of dynamic stability: transparency, competition, accountability, variability and dissent.

3) decentralize and relocalize production, political agency and capital to institutionalize fast adaptation / problem-solving to radically reduce dependency on fragile global supply chains, radically improve productivity and efficiency and replace the "waste is growth" Landfill Economy with a degrowth economy.

The key to these solutions is the productive community economy, a localized economy with its own production, capital and agency, i.e. the control of production, capital and the distribution of resources.

Neither conventional money-printing nor the blockchain/defi/crypto menu fundamentally change the power structure of who controls resources, power and capital. As with all financialized "solutions," these presume that finance can fix everything because it's the master resource.

Both also assume that creating "money" out of thin air and distributing it within a market structure will solve all problems. Both assumptions are false: energy is the master resource and "money" is only a solution if it connects labor to local productivity.

All the creation of "money" out of thin air accomplishes is to maintain the status quo that favors 1) the already-rich who own the vast majority of assets and who can trade one asset class for another at will 2) those closest to the sources of this newly issued "money"--in the case of cryptocurrencies, 3) early adopters who become the New Aristocracy by virtue of their dominant ownership / control of the currencies, platforms, etc.

The critical element of every issuance of "money" is: how is the "money" distributed? Who gets the new money? Consider the case of bitcoin, which is decentralized in the sense that anyone with sufficient computing power can mine bitcoin, i.e. be issued bitcoin for maintaining the currency's blockchain.

Despite this decentralized distribution, the reality is the mining and the ownership of bitcoin is highly concentrated, just like all other wealth: 0.01% of Bitcoin holders control 27% of all bitcoins in circulation.

There are two dynamics at work: 1) early adopters were able to amass vast numbers of bitcoins for very modest sums, and 2) the wealthy few with access to the "money" spigots of central banks and fractional reserve private banking can borrow fiat currency at near-zero rates and use this "money" to buy bitcoin.

There may be limits on how many bitcoins are issued but there is no limit on how much fiat currencies can be issued, so those closest to the fiat currency spigots have the means to accumulate all other assets, including bitcoin / cryptocurrencies.

The net result is that decentralized finance that distributes new currency to miners (those maintaining the blockchain) or similar distribution structures are only decentralized in name; in practice, these currencies are just another asset class that can be bought up by those with access to fiat "money".

The same is of course true of any asset (for example, debt such as mortgages) generated by decentralized finance: the vast majority of every supposedly decentralized asset ends up being owned by the same super-wealthy class who owns the vast majority of all assets.

Given that cryptocurrency mining is very capital-intensive, those with capital can dominate the process of accumulating bitcoin via their essentially unlimited lines of low-cost credit. This is how a theoretically decentralized system is centralized by the wealthy who own most of the assets and who have access to low-cost credit.

In other words, the proposed "solutions"--conventional or supposedly decentralized--leave the structures that generate inequality untouched.

Real solutions must directly address the sources of inequality: how "money" / capital are distributed.

The only systemic solution is to issue new currency solely as payment to labor for producing essential goods and services in ways that improve efficiency, reduce consumption and increase productivity--doing more with less energy, resources, friction and labor.

Once currency can only be issued to labor performing high-utility work in a community economy, the entire structure of "money" changes. Rather than being closest to the "money" spigot, the super-wealthy are farthest from the spigot and those doing useful work are the only recipients of new "money." Since this labor-only currency cannot be borrowed into existence via private fractional reserve banking, there is no way for anyone to outbid everyone with unlimited low-cost credit because there is no unlimited low-cost credit.

In a community economy, those doing useful work can receive not just a wage for their labor but a share of what they've created with their work.

This process of turning labor into capital is the core mechanism needed to create and sustain a middle class which has a stake in the system--ownership of income-producing assets.

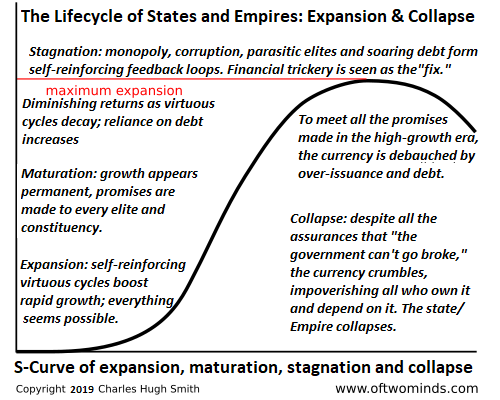

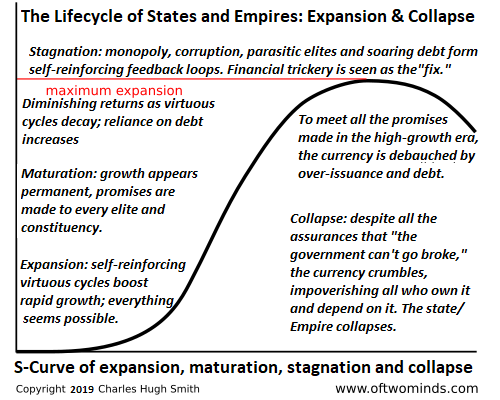

In the current financial system, conventional or supposedly decentralized, the only means available to those doing useful work to gain a meaningful ownership stake (i.e. income-producing assets) is to become a high-risk speculator in one or more asset bubbles. This is not a stable foundation for a middle class, an opportunity-based economy or a dynamically stable society. It is a recipe for soaring instability and collapse.

Returning to the three problems listed above--fair distribution of resources, capital and agency, protecting transparency, competition, accountability, variability and dissent, and decentralizing and relocalizing production, political agency and capital--only a community economy can solve these problems in a sustainable, degrowth fashion, and the community economy can only do so if its money is controlled by those in the community doing the useful work.

This system of "money" is a labor-backed currency as it is only issued to labor which has demonstrably performed work that is of high utility to the community. This labor-backed currency also enables the transformation of labor into capital owned by individuals and the community at large.

A supposedly community-based economy that is entirely dependent on "money" accumulated by the super-wealthy and corporations is nothing more than a fiefdom of centralized financialization. A supposedly community-based economy that has no power over the money, credit, resources and agency within its community is nothing but a simulacrum of a truly community economy.

In other words, if the super-wealthy accumulating newly issued "money" (either borrowed-into-existence fiat or bitcoin issued to wealthy miners) can come in and buy up all the assets of your community, it isn't a community economy, it's just another fiefdom in the financialization empire that benefits the few at the expense of the many.

A truly community economy must have its own "money" that can only be issued to those doing work deemed useful by the community rather than by a remote concentration of capital and political power.

A truly community economy must have locally owned assets and capital that cannot be bought or transferred to distant owners. The key to a community economy is to own local productive assets essential to well-being and not allow these assets to be controlled by self-interested, profiteering owners who aren't members of the community.

This requires not just protecting assets from outside capital but also a completely localized methodology of assessing value and profit. As I explain in the book, much of the real-world costs of global production are not even factored into price, environmental damage being a prime example.

In the current quasi-religion that worships profit and growth, value is determined by price and profit: the lower the price, the greater the value of the good or service, and the greater the profit, the greater the value of the asset.

In a community economy, value is based on how essential the good, service or asset is to the well-being, sustainability and adaptability of the community, and on how well it serves the community and the goals of degrowth.

The value of an asset or goods and services being produced by the community cannot be reduced to the false metrics of profit. Locally produced food is not profitable or profitless, it is priceless because it generates an irreplaceable source of value: independence from fragile global supply chains and centralized production that is owned by the super-wealthy.

In other words, local production of essentials such as food and energy are priceless, as there is no substitute at any price. To be dependent is to be powerless.

Whether local production is profitable by the leave-out-all-costs standard of global corporations and banks is pointless; the one true source of value--and thus the highest form of profit--is independent, locally owned production of essential goods and services which both sustain the community and can be traded with other community economies.

Waiting on the shore, dependent, decapitalized and powerless, hoping the central state and profit-maximizing global market will deliver solutions to inequality and scarcity is to wait for ships that will never come, for the state and market are the sources of inequality and scarcity.

The solutions will come not from those profiting from inequality and scarcity but from relocalizing "money" and production to create degrowth community economies that are nodes in a global network, sharing currency, credit, problem-solving and the essentials of sustainability and well-being.

There is much more in the book on these topics. I invite you to read the first chapter (PDF) and the Introduction--they're free.

Comments

Post a Comment