A Grand Unified Theory of the FTX Disaster

A Grand Unified Theory of the FTX Disaster

The Wars of Wars: Where the Wars Intersect

"No matter what political reasons are given for the war, the underlying reason is always economic." -A. J. P. Taylor

This is the work of many hundreds of people, distilled and organized in a way that hopefully brings the Bigger Picture to light—at least insofar as we all can research and interpret it better. Apologies to those participating whose work is not included in the scores of links provided.

So far as I can tell, everyone has this story wrong. Many people put together some frame of the puzzle just fine, but this can be a dangerous distraction, so I'd like to take a shot at sorting it out. After all, it's only human extinction on the line.

Follow me on this…

I may edit parts in or out, or write additional articles to clarify related events.

TL;DR - You may want to break this up into two or three reading sessions. This is by far the longest article I've written. It has to be. And it won't be the tightest or best-edited. But it's the most important one to date, so I don't want to hold back. My apologies.

The FTX-Alameda (FTX-A) tale is a prime example of my true motivation for writing at Rounding the Earth, and the reason why I have to fragment the focus: these different threads of war are absolutely necessary for understanding the Bigger Picture. The goal was always to lay out lessons embedded in the articles that might help more people open their eyes to the specifics of what is taking place, and therefore to be able to do something about it. This is the moment when it should become clear why I've been doing what I've been doing.

The stakes are pretty high—this is a historical battle in the larger World War E. There is no simple preview, but here are some of the topics we hit:

A giant cryptocurrency exchange, FTX, and its companion quant trading/investment firm, Alameda Research, have collapsed in what appears to be a leveraged Ponzi-esque event that poisoned many other businesses in the nascent crypto-finance ecosystem. This isn't exactly the right story, and I am to clarify.

FTX was likely one of several available attempts by the Globalist Elite to establish the intended new global financial network and currency.

A second attempt to control digital currencies is likely planned to take place through the regulatory system, using the FTX debacle as the excuse.

The flood of information about the first point seems meant to obscure the second, third, and other points.

The pandemic is the fog of war intended to create the opportunity and obscure the activities behind this plan.

This plan connects a lot of stories, including the activities of Bill Gates and Jeffrey Epstein. It weaves through MIT Media Labs along the way, but goes to the heart of the powers who ultimately control the military-intelligence-banking complex—and that include the pedophile elite. Whitney Webb has done us great favors tunneling toward much of this, but hasn't yet reached the core (an overly tall task for any one person).

The endgame is conceived as an intellectually (genetically) superior human race, but that may be merely a conceptual construct of an insane network of situationally brilliant, if overconfident psychopathic elites. The mass gathering of genetic data and gene-drive technology likely play a role.

Much of the next few pages may repeat much of what you've read, but I try to sprinkle the build-up with some important thoughts that may help readers avoid being channeled down the nerfed narrative. After that, things get uglier than you're probably imagining. I'll try to make you laugh once or twice in the meantime. Buckle up.

The Players

Much has already been said and written about the unusually young crowd running both FTX and Alameda—some that is correct, some that is incorrect, and much that is likely to be misunderstood. So, I'd like to proceed carefully, and ground this story with context.

Know that among the crowd we're going to talk about, and their tight peer group, are numerous students in educational programs that I crafted and helped run for many of the world's most "precocious youth". Sam Bankman-Fried (SBF) still has a profile there, though others around him were more active members of the community.

The FTX-A story isn't really the SBF story. The pool of players is far larger, and in some cases also murkier. There are hints everywhere about the web of relationships, and it will have to be another article (mine or somebody else's) that fleshes out even a basic skeleton of the grand summary. Perhaps the New York Times can help with that process.

The full cast of characters would be impossible to know and reveal, which is the very reason why a strong centralized government should always have been viewed as an operation anathema to liberty and organic human development. Part of the magic trick of reaching this point in our timeline has been to raise most of the children as lobotomized cattle, branded with virtue-signaling ideologies like "Progressivism" that leap past all logic to a desired utopian result, and resist critique or cognitive correction with a jello-like kung fu. "What is it that you dislike about progress?!"

The cast of characters you might not notice in this film includes a mega-billionaire with enough influence to keep his life entirely off Wikipedia, a curious gathering of researchers at MIT, and also some familiar faces from the pandemic you might not have realized would pop up in the largest ever cryptocurrency catastrophe (though you might should guess). Also Jeffrey Epstein.

Now, let's ground this story with a discussion of SBF. It is worth noting that SBF profiles all seem to include his Stanford Law Professor parents, Barbara Fried and Joseph Bankman. And perhaps that is appropriate in an age in which successful 30-year-olds often appear as grown-up children—like rejuvenated extensions of parental will, arrested in development, potentially capable of carrying out their parents' whimsical dreams of glory.

Among other things, Joseph and Barbara are known as compliance lawyers who work on tax theory and policy. It is interesting that such work gets signaled as government-friendly given that their son became the largest player in the new currency market largely decoupled from government finance.

If any of this sounds like a scathing rebuke of parenthood among the cognitive elite American Mandarin class, imagine that I toned it down several notches for public consumption. Yes, among my many clients families were plenty of these. And 90% of the headaches came from just 2% of the parents.

What I've gathered talking to people who have been around SBF, superficially or closely (none of whom want to reveal their names) is that he's a spoiled, sadistic, hedonistic, ruthlessly dishonest bully of a manchild. But if you want indisputable facts, he was a high school math camper who graduated from MIT with an undergraduate degree in physics in 2014. After that, he went to work at one of the well-known quant funds, Jane Street Capital, where he had interned the previous Summer. After three years of what I hear was moderately successful trading, SBF left Jane Street and moved back to California.

Back in the Bay Area, SBF attached himself to the Centre for Effective Altruism (EA). If you're not familiar with EA, you can read through the material on the website before realizing that it's just one more Geek Cult that young intellectuals of arrested development and yearn for a return to deep dorm room conversation by providing them with a largely pre-baked socially acceptable set of virtue signals that conveniently span a full narcissistic mask. And, like most cults, it seeks out that for which its target audience aspires while simultaneously demeaning the journey: "Hey, feckless white boy, this is the path to socializing with pretty women."

Is it any wonder that the Pick-Up Artist (PUA) community focuses its sales force on Bay Area nerds?

As these men find refuge and comfort in these underground online forums, the ability to express their problems is unfettered. A desperate cry for help turns into hunger and the want for more. Many go to large extents whereby the detriments are forgotten.

The innate desire to win someone and claim them as a prize has extended itself into a large underground community that has taken wide online presence. Although it has connected many insecure and confused men across the world, it has raised many ethical issues in regards to the men themselves and the treatment of women in the dating scene.

I don't know if I'm fairly painting-by-colors the SBF portrait just yet. After all, what I think he recognized with EA is the psychological tool fit for the Woke era: a pseudophilosophy that absolves the power-hungry of their lack of ability or interest in connecting with a or the human community. All you have to say and do is artfully articulate the Woke Utopia as your core set of values (and promise to give away money), and nobody should bother you about any of your actions. Dispensing with the need for human connection might have been just what he needed to plow forward with the next epoch in his life's story.

SBF quickly quit his brief job at the Centre for EA and established his own (cryptocurrency-focused) quant trading firm, Alameda Research, in late 2017. After some early success with one cool trade, crazy rich people came out of the woodworks to shower him with billions of dollars and stardom, but we'll get to that part of the story later.

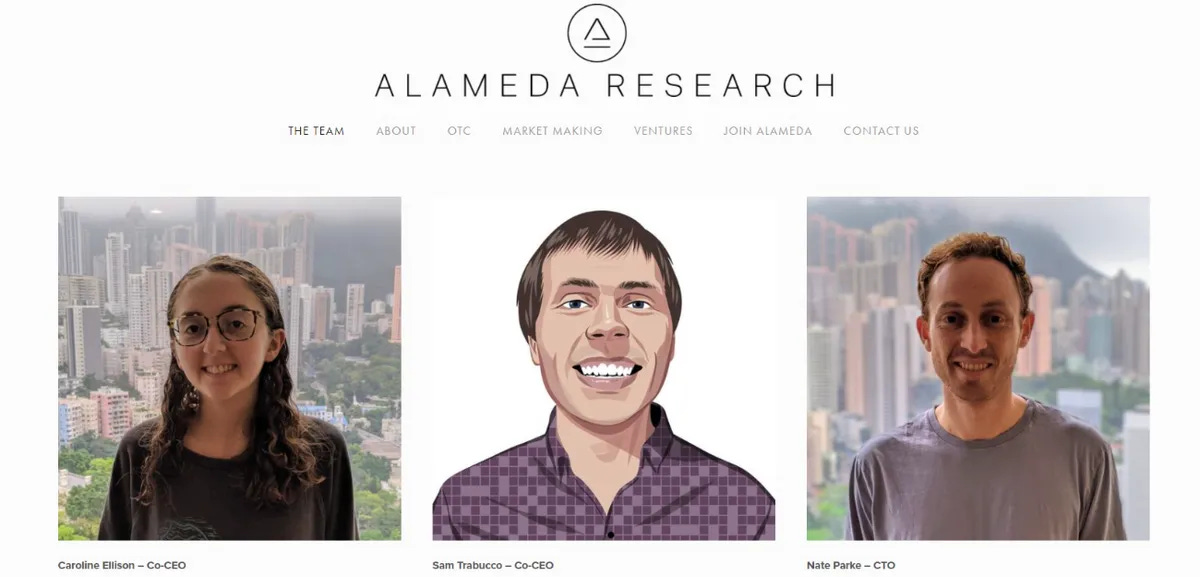

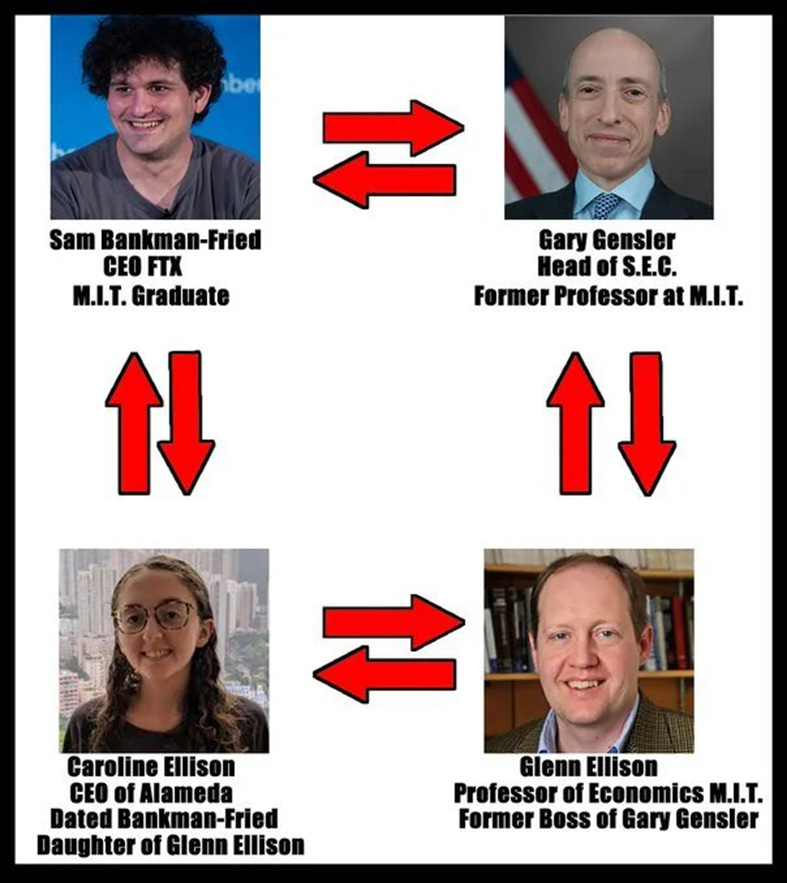

The second central player in this story is Caroline Ellison, another former Jane Street trader whom SBF brought in to help run Alameda. She is SBF's ex-girlfriend, though it's oddly difficult to find a picture of the two of them in the same place.

Caroline is another child of ample intellectual opportunity. Her father, Glenn Ellison, is a Professor of Economics and Department Head at MIT, usually ranked as the world's top school for Economics. During my years as an educator I helped author some of the events in which she participated, so I'm aware of her exceptional math abilities. How many high school kids with blushed cheeks know what it means to apply Representation Theory to particular polynomial fields? Three decades ago, you could replace "high school kids" with "undergraduate math majors" and the answer wouldn't be all that different.

What I understand less is how she wound up among the particular corrupt clique of power players. From Forbes,

Before she found herself at the center of crypto’s most massive meltdown, Caroline Ellison was a star student. She was a Harry Potterhead. She was a camp counselor. She was a writer of live action role playing scenes. Ruth Ackerman, a math professor who taught Ellison at Stanford 10 years ago, called her former student “bright, focused, very mathy” — a challenge, she said, to reconcile with Ellison becoming wrapped up in one of the largest alleged frauds of the past decade.

“The first I heard of the current controversy was when people started contacting me on LinkedIn, telling me to withdraw my endorsement of her skill as a computer scientist,” Ackerman told Forbes.

I learn more from this about the society that calls the professor asking for withdrawal of an endorsement of a relatively objective skill than I do about Caroline. But perhaps what there is to know is a product of that environment. Who really remains sane enough to make all the best decisions around such people? No wonder so many of the whiz kids are reaching for the EA cult and calling it a day on the moral growth front.

Others are already writing about drug-fueled orgies among the FTX-A circle. We could skip the examinations of everyone's sex lives, but for the purposes of this story, Caroline's public commentary does uniquely add to the data pool. Through her we hear that the FTX penthouse in the Bahamas was a polyamorous community where she came to believe in the "imperial Chinese harem" model:

None of this non-hierarchical bullshit. Everyone should have a ranking of their partners, people should know where they fall on the ranking, and there should be vicious power struggles for the higher ranks.

Really, is this the product of some form of insidious abuse that we haven't yet fully described as a culture? Now, 26 billion points for Slytherin if you can square this circle:

Is this a fully mature CEO of a multi-billion dollar quant somethingorother crypto-Ponzi centerpiece, or the sexualized twelve-year-old daughter of one of the world's most powerful university professors? It really looks like Peter Pan's Lost Boys had a little girl tag along, somewhat heterosexualizing the adventure. What could possibly result in such arrested development along one vector dimension? Is this just a particular case of growing up in a heavily cushioned bubble? Or something else?

I'll leave you to ponder that while we move forward.

There is much about all of this that looks cartoonish on the surface. The phrase, "controlling most major world governments" sounds like quite the hyperbole until you've fully widened your scope of the players in this story.

This all seems sloppy for a circle of young adults with genius IQs, likely backed by a solid cadre of lawyers. Something else explains this. We'll come back to that. We have a few more personalities to cover.

Sam Trabucco, yet another math camper and contest champion, has a reputation as a top notch gambler and game player. He got started trading at the Susquehanna International Group (SIG), the world's largest equity options trading firm (where I also learned the option trading game). Part of the SIG training program includes a lot of hours of no limit hold'em. Perhaps that experience helped him know when to jettison from his position as Co-CEO with Caroline at Alameda back in August. It seems likely that Sam had a solid grasp of the Bigger Picture developing between FTX and Alameda, and recognized troubled waters ahead.

Nishad is a former Facebook engineer who has been described by a peer as having done "bogstandard machine learning" work, which is good enough for most trading teams—particularly the ones that might be faking their trades. He and Gary Wang were described to me as "quiet, deep thinkers" by somebody I talked with who had superficial contact with them at various programs over the years. Nishad and Gary seem unlikely to be among a mastermind inner circle, and one person I talked with wondered if they were prodded down an unstable path after being seduced into the projects: low-confidence followers. Both have already jumped ship, leaving SBF and Caroline likely working with real adults to bail water.

FTX's Chief Regulatory Officer Daniel Friedburg was the lawyer/fixer from the Ultimate Bet and Absolute Poker cheating scandals (secret tapes here). This does not allay concerns anyone might have that FTX-A planned an illegal course from early on (h/t 2ndsmarestguyintheworld).

Though I've managed to gather some details about the members of the FTX Penthouse orgy crew, I don't think it's necessary to the story.

There is a strange paradox among the whiz-kids-turned-finance-power-players muddying the story of FTX-A, and it needs to be untangled. Were these kids sloppy-stupid while organizing these Ponzi-like entities that would blow up under such a wide array of circumstances?

I guarantee that these are people who understand public-private key cryptography. In fact, one of them took my course on Number Theory that brings students up through the basics of modular arithmetic and systems of linear congruence when he was 11 years old. It is likely that he knew at least basic cryptography math prior to even arriving at MIT. That something seems incongruous about this story reveals a disturbing reality: the real security behind this whole operation was either a set of completing damning shared secrets, mafia security, or both.

I'm betting on both.

As the prying eyes of the world examine the players and the details around the unique event that is the FTX-A collapse, the players are busy playing geeky misdirection games to cover their tracks. However, this story calls too much attention to so many others that feel more well tied together than ever before.

Now, if you're thinking this is just a story of a bunch of narcissistic brats who lost a bunch of money, I understand your reaction. But know that this misses the larger points. You need to dig deeper. Keep reading…

A Carefully Engineered Public Relations Campaign

The rise of SBF looks plotted out by experienced and expensive PR veterans—assassins of creative image building. From the building blocks of "MIT" (where most everyone is somewhere between "pretty darn smart" and "supergenius"), a stint at a well-known quant trading firm (Jane Street Capital), and one sweet and sexy trade (arbitraging the Japan Bitcoin premium), enough was on the table for the Mad Men Illusionists to go to work with cloth tailored from the silken fabric of effective altruism.

The next Warren Buffett! The next JP Morgan! And an "effective altruist" to boot! He's even the vegan who's going to save the animals as your heart will melt each time he hands you a hundred dollar bill that you're definitely not buying steak with, right?

Surely Sequoia, the mammoth VC fund that projects an image of Neo-Futurist Capital Gods, understood the manufacturing of the SBF brand when they threw money at him and projected that unrealistic image through their cultivated influencer network.

Every startup has a startup story. Apple was two hackers in a Los Altos garage. Google was two grad students in a Stanford dorm room. Alameda Research was just one guy in a Berkeley apartment, making a single cryptocurrency trade. That guy was Sam Bankman-Fried, or SBF to his friends. Yet the trade he made, which eventually led to the crypto-trading platform FTX, is far from the standard Silicon Valley creation tale. In 2017, when he was merely 25, SBF collapsed the so-called kimchi premium, an anomalous delta between the price of Bitcoin in much of Asia and its price in the rest of the world. It was a daring feat of arbitrage—SBF is the only trader known to have pulled this off in any meaningful way—one which quickly made him a billionaire and achieved the status of legend.

Never mind that SBF only made $20 million off that trade and then reportedly squandered most of it, and that his billions were entirely due to valuation pumped up from capital infusions.

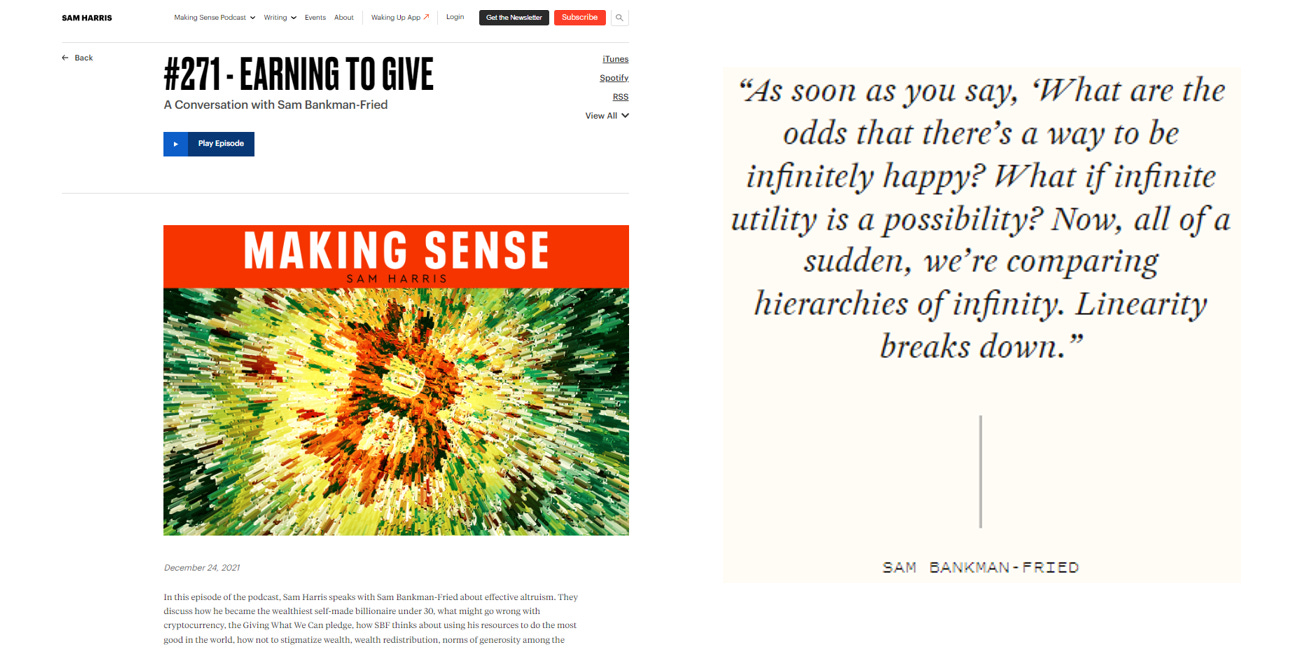

But if you were paying attention, there were definitely cracks in the facade. Granted, only a portion of the wider world has figured out that Sam Harris is a paper-thin intellectual woo guru, but this must have been a signal of trouble for at least some adroit observers.

OMG, SBF talked about "hierarchies of infinities" and probably understands the Spiritual Singularity to come after the breakdown of…linearity. After heaping effusive unearned praise onto SBF, I'm guessing Harris is going to try to sweep this one under the rug and walk away without drawing attention.

It only gets worse.

Just in case veganism, utopian pseudophilosophies, and Clinton Foundation appearances are boring, SBF spent or committed to $350 million on sports partnerships.

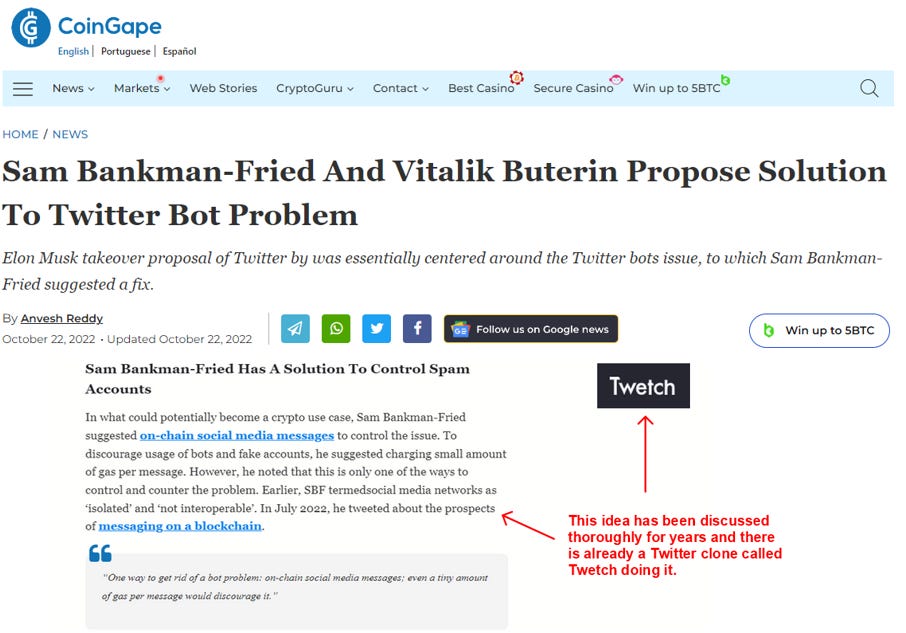

With SBF pumped up so high, crypto news outlets give SBF credit for inserting several-year-old ideas, well-known to the entire ecosystem, you have to know he's getting special treatment. This was just an opportunity to push his name alongside Elon Musk's:

One must wonder whether this was a paid advertisement. One way or another, in what seemed like the blink of an eye, SBF and FTX were everywhere. You couldn't swing a dead cat without hitting somebody working on the PR campaign.

The Rise and Fall of FTX and Alameda Research

If the finance talk bores you, or you find it incomprehensible (that's understandable if you've never been involved in any of this for a living), scroll down to the next section and beyond. The most interesting stories are beyond that point.

Binance, a China-based organization, is the world's largest cryptocurrency exchange. This likely irritates Western leaders—particularly those in and around the military-banking complex. If nothing else, this is evidence that the world of digital currency is not simply a Ponzi scheme as some naysayers dismiss it. Indeed, most of the world's currency is already electronic and has been for many years now. Whether or not you agree, all I can do is encourage you to learn more. That said, establishing a powerhouse successor seems to have been a priority among those who funded and organized the FTX-A Death Star.

You've probably read much on this topic already, or want a simplified story before moving on, so I'll see if I can take you where you might not have gone.

Step 1: Establish Alameda Research trading firm.

Step 2: Complete one kick ass trade.

Step 3: Build a well-projected media image of the Altruistic Death Star.

Step 4: Build the Death Star (FTX-Alameda).

Step 5: Explode.

Alameda Research was likely established with the Japanese (and maybe South Korean, which is a harder problem) Bitcoin premium arbitrage in mind. SBF pulled that off, and even if he and his team squandered much of the winners, that was enough to propel them to Step 3, which we've covered. At that point, as the story goes, SBF talked with Binance CEO Changpeng Zhao (CZ) who suggested that SBF build an exchange.

I question this last piece because it doesn't make sense on numerous levels:

Why would CZ encourage a competitor to his business?

It was likely understood that Alameda needed an independent (or "independent" given the closeness of the relationships) partner to engineer the Global Digital Central Bank (GDCB) model that we'll talk about later.

Next, as the story goes, SBF went out looking for capital and tough nuts like Sequoia and Softbank basically handed him the keys to the vault. It's unclear whether this was before or after what must have been a phenomenal team of lawyers designed the FTX-A corporate blueprint.

A simple hedge fund typically includes at least three separate vehicles for the purpose of taking in funds from investors, moving them into another account to which the hedge fund operates, and then a trading account aside from that. Perhaps blueprints like this exist, but I've never seen anything like it. Nor have I ever seen the level of guaranteed returns FTX offered investors

One thought I've had is whether Bitcoin was held back (short selling paper coordinated with the Chinese mining ban), but would be pushed forward by coordinated powers once the Death Star was fully operational. That could conceivably help cover such returns.

These are not the only details of the story that feel oddly contrived. One thing that you should never expect from a top quant firm is the level of public discussion of their operations projected out of FTX-A. Both times I went to work at top quant funds, I was immediately given talks about discretion and corporate spying. Educational materials were not even put in writing outside of what we wrote in our personal notebooks, and it would have been total betrayal to share those with anyone.

FTX-A wanted the world to know that it really was one of the cool kids (major hedge funds) already, so they churned out videos to support the image. In reality, the primary reason why this might not get in the way of profits is that some of their trading cannot be replicated because some trades take organizational capabilities specific to cryptocurrency (and perhaps also to running your own exchange).

Many on the internet have pointed out the images of amphetamines and other drugs designed to provide dopamine sitting on SBF's desk. You can see him squiggling constantly in his seat. FTX-A employed a psychiatrist and another coach, perhaps to enable their own risk-benefit assessment of chosen drug-regimens.

One of the projects undertaken at FTX was something called Project Serum. This is one that should have raised eyebrows.

So, you're telling me that this team of kids who made their careers learning how to trade are running these fancy finance companies and are simultaneously good enough developers to understand how to solve the Holy Grail of trustless decentralized finance trading?

Could they use some of that brainpower to design a small peptide inhibitor for a novel coronavirus? Asking for a friend.

Let's talk about the liquidity crunch.

It started with a leaked Alameda balance sheet on November 2, though most of the world was unaware of the seriousness of the situation until after Midterm elections had passed. That leaked balance sheet showed that a substantial portion of Alameda's assets (several billion dollars worth) were in the form of FTT, the FTX (fiat) token of highly volatile and speculative value. It is "Crypto Winter" already in the historical almost-four-year cycle with volume in the markets depressed following a catastrophic breakdown in the unrealistically overhyped yield farming corner of decentralized finance (DeFi), so large numbers of eyeballs began sifting through FTX-A, revealing a plethora of worrying signals.

At this time, a lot of information feels chaotic at least partially because there are innocent panicked people at all levels below the FTX-A Royalty layer, but communication broke down around the center. Some of this may be to dodge clawbacks. Imagine getting your money out only to have some auditor come after you and take some of that away to distribute to those who did not? It's a competitive situation. Some of this is due to employees and contractors moving back home. Expect a lot of additional facts to come to light.

Now, let's take a look at the carnage from this past week. I'm not going to dwell on rewriting this part of the story as it's still changing quickly. From WallStreetOnParade.com,

According to Reuters, Sullivan & Cromwell has been named as one of the advising law firms to the disgraced crypto exchange, FTX, in its bankruptcy proceedings. Sam Bankman-Fried, the co-founder and CEO of FTX, vaporized the high-profile crypto firm from a $32 billion valuation to smoldering ashes last week.

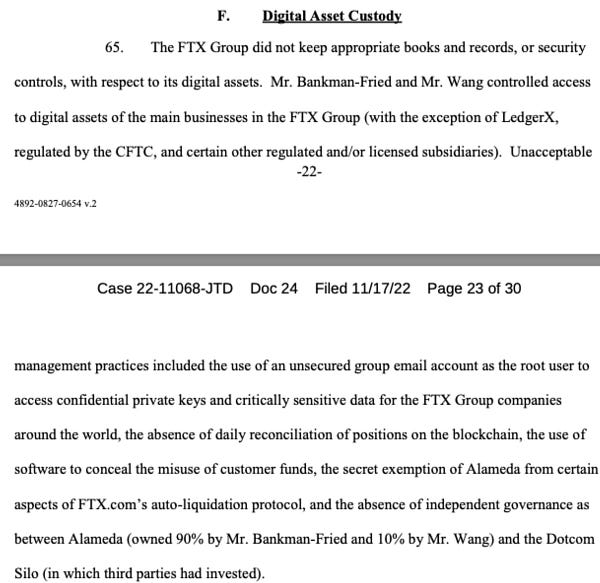

Reuters reported that Bankman-Fried had moved as much as $10 billion of FTX customers’ money to his separate hedge fund, Alameda Research, through a “backdoor” in its software. Alameda had lost much of the money on wild bets while $1 billion to $2 billion had just “disappeared,” according to Reuters. The Financial Times reported that FTX held just $900 million “in easily sellable assets” against $9 billion “of liabilities the day before it collapsed into bankruptcy.”

The FTX news grew even more bizarre over the weekend with the New York Times reporting that $515 million may have been stolen or hacked from FTX after the bankruptcy filing. This raises serious concerns about the capability of those put in charge of the bankruptcy proceedings to safeguard what’s left of the assets.

Hacked? Back-doored during an inside job? Who knows at this juncture.

What is known is that a lot of the idiosyncrasies of the crypto markets played a role. So much of crypto finance is new that even the geniuses in the space are constantly rethinking things and making new insights. It's an exciting, Wild West atmosphere in many ways, and FTX-A appears to have underestimated that factor. For example, one of FTX-A's exposures was to Three Arrows Capital (3AC), which seems to have been engaged in statistical arbitrage of the premium associated with Bitcoin trust Grayscale (GBTC).

The premium began to move in one direction earlier this year and speculation of fractional reserves (not truly holding the requisite Bitcoin assets) turned into contagion. Such unexpected questions of fidelity result in price crashes—particularly during Crypto Winter after the breaking of Terra/LUNA peg in May that sent half of the decentralized finance (DeFi) space into disarray.

A friend of mine suggests that GBTC may be fully funded as intended, evidenced by their interest in becoming an ETF. I'm sure we'll all find out in the coming weeks.

This is all exactly how the DeFi space is not supposed to work. Were all of these assets held by individuals in wallets (addresses), provable on a public ledger, there would be no need for paranoia. But the gold rush is being led by people behaving like Tiger parents bootstrapping their toddlers to the rotting flesh of yesteryear's Great People of History. This isn't your grandparents' financial system.

And this is all going to require a lot of expensive therapy.

The visible scope of the carnage as this Titanic mess sinks continues to grow by the day. Careless investors are out many billions, collectively. I've talked with multiple people who lost millions. There are cries for heads to roll. Part of the problem is that SBF & Co. seemed to reach out and lace together as many entities as possible and as quickly as possible during their Crypto-zerg. Scores of bankruptcies will take place, and if the illiquidity contagion isn't controlled, the problem could get worse than that.

The latest Forbes article purporting to deconstruct Caroline Ellison naively challenges the notion that Caroline, SBF, and their circle ever really believed in the tenets of effective altruism.

Doubt now has emerged over whether Ellison, Bankman-Fried or their compatriots actually believed in the tenets of effective altruism, or if it served as an effective way to shield their alleged wrongdoing. In text messages published by Vox on Wednesday, a reporter asked Bankman-Fried if his talk about ethics was “mostly a front.” His response: “yeah.” Ellison at one point, perhaps in a moment of sardonic self-awareness, appeared to have renamed her blog “Fake Charity Nerd Girl.”

You mean to say that there are philanthropaths who virtue signal charitable attitudes that disarm people with torches and pitchforks while snickering about it in private, and even get bold enough to flash the joke in your face once in a while? You don't say!

Maybe that explains why the philosophy of EA is simple enough that it has come to mind for perhaps 90% of eleven-year-old school children during an essay about what they want to do when they grow up.

Meanwhile, SBF continues to play the game, signaling to whoever might buy it that this was all just a big whoopsie.

Can you really blame a kid who was on top of the world for no good reason? Let's see if he can convince the world that it's okay when people walk into the bank and the banker says, "So, this thing happened where I spent a bunch of your money on hookers and blow at my penthouse in the Bahamas that was also purchased with your assets. Call it an error of judgment."

This was all really just a windup for the real pitch. Here is comes…

And there it is: "If we fail, bring in the regulators. Because they're good people doing a hard job, but it has to be done to protect you from the likes of me, even though they can't keep up."

Brush off the cringe. This is only going to get darker. A lot darker. Put the children to bed and pour a glass of something strong…

Establishing a New Global Financial Order in One Fell Swoop?

We might as well jump right to it. I submit that it is highly likely that FTX-Alameda's planned best hope was to establish a new Global Central Digital Bank (GCDB). This GCDB would be the ultimate issuer of Central Bank Digital Currencies (CBDCs, though eventually the plural would not be needed under the then-inevitable governance structure), such as the one now being pushed on Australia. This is why SBF would be elevated above all other [actually] successful hedge fund managers and cryptocurrency entrepreneurs to share the stage with Bill Clinton, the head of the U.S. Treasury, and the CEO of Blackrock. Many financial engineers had a part in constructing the Death Star.

What is the Death Star, exactly?

Much has been said about the obviously inappropriate relationship between FTX and Alameda. Thankfully, Arnold Kling provides the correct explanation from the chair of an actual Economist:

Let’s retell this story using entities of the U.S. government. The Treasury is like FTX, issuing tokens that it calls bonds. The Fed is like Alameda Research, taking these tokens on its balance sheet to try to support their price.

You’re going to say, “Wait. The Fed is issuing its own tokens, called money. The analogy does not hold.”

But Quantitative Easing did not work by issuing money. Instead, the Fed borrowed from banks, by paying interest on reserves and doing “reverse repos.” Just like Alameda Research, it took a levered position in Treasury tokens. Now the Fed is bankrupt. It has to be bailed out by the Treasury (you and me). Unlike FTX, the Treasury can still get away with issuing tokens.

Who could even think up such a scheme?

Gensler is a journeyman insider. A former whiz kid himself, Gensler made partner at Goldman Sachs at the age of 30 (the youngest in history at the time). He later served as Assistant Secretary of the Treasury for Financial Markets, Under Secretary of the Treasury for Domestic Finance, and Chair of the Commodity Futures Trading Commission (CFTC), all prior to his current position as Chair of the Securities and Exchange Commission, a position made possible by Joe Biden's election in 2020. It should not surprise anyone then, as cryptonews reports, "Speculation is mounting in the community that Securities and Exchange Commission (SEC) chairman Gary Gensler could have worked with FTX co-founder Sam Bankman-Fried to find legal loopholes the exchange could take advantage of."

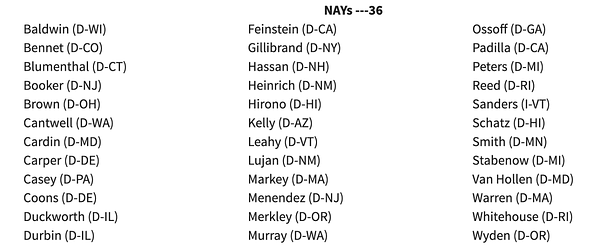

Gensler also served as a Senior Advisor to Hillary Clinton, for whom SBF's mother Barbara Fried worked as an attorney. Barbara Fried is also co-founder of the political fundraising organization Mind the Gap, which pushed $20M into the hands of Democrats running in ("undervalued and underfunded") competitive elections in 2018, then far more during the 2020 election where it helped spearhead mail-based voter registration—a topic we'll come back to later.

Clearly this is not just SBF's story. But does that mean that these globalist power players had the engineering of a GCDB in mind from the start?

This tweet makes no sense at all if they did not have the establishment of a GCDB in mind. There is no reason why the FTT token should have any value at all aside from the expected money saved by token holders trading on FTX (the defining feature of the token) plus the product of the probability and final value of the established GCDB. And this is exactly the reason to usher in regulation: because it cements industry leaders. Just as Amazon rode the tax-free online shopping wave in a way that current competitors cannot, FTX-A would have risen in an unregulated environment where future competitors would be hampered. From the Intercept:

“I think that the CFTC makes a lot of sense, though, as the market’s regulator,” Bankman-Fried told the paper. As the young industry flounders, it resorts to a method tested by its predecessors: funding the lawmakers who might regulate it. “They’re really experienced, competent, and efficient and have a deep knowledge of markets and of crypto markets, and you could do a really good job of that.”

Meanwhile, while the dust is still settling on the FTX-A scandal, the Federal Reserve Bank of New York quietly announced a pilot program for the new digital dollar. Probably means nothing.

Controlling Politics

If you're one of the billions of people whose instincts point toward a world of sophisticated election engineering, you ain't seen nothin' yet.

There is nothing illegal, of course, with spending millions of dollars during an election cycle. Unless that money isn't yours. But let's agree that this "ownership of the money" thing seems like a gray area for a whole lot of people who don't understand Cantillon-fueled currency theft.

Numerous others writing about the FTX scandal have explained what appears to be a money laundering operation through Ukraine. I'll try to repeat it in a simple way, then move on:

POTUS Biden & Co. sent billions to Ukraine.

Ukraine put vast sums in the hands of FTX

SBF & Co. spent tens of millions on primarily Democratic candidates during the Midterm elections.

It is noteworthy that the "Aid for Ukraine" website apparently set up by SBF and reportedly took in $60 million in donations is last picked up by the Wayback machine ten days prior to the U.S. Midterm elections.

One thing that such a scheme generally secures is the willingness of everyone involved to defend everyone else. If one participant falls (legally speaking), they can take all their co-conspirators with them.

Again, others have written about how SBF was Biden's second-largest donor, the $70 million SBF & Co. spent on Democratic Party candidates during the 2020 Midterms and the billion dollars he planned to spend going forward, so I'm not going to lay all that out in detail.

Then money handed out like cheap Halloween candy was not entirely pushed to Democrats. A good strategy must also involve capturing enough of both sides of the aisle to push an agenda. Buying influence with a former Bush-era HHS bureaucrat fits a lot of Venn intersections.

In order to keep the public in the dark, it is necessary to cover all bases—this means intelligent politicians who know the vaccine-pushing organization that is the HHS.

Given the razor-thin margins in recent elections, I don't need to go out on a limb to discuss the likelihood that these donations make a difference at every level of policy-making.

Timing: One might wonder if the November 8th revelation of FTX-A's financial woes was held back until after the elections.

Obligatory reminder: All of this is in addition to and aside from the 2018 FBI Masterclass prepared for the media crowds on how to use mailed ballots to engineer an election, punctuated with the observation (paraphrased), "It will be years before the FBI has the capabilities to stop this," and then memory holed (try and see how long it takes you to find this on the internet) with an MIT stamp of approval.

Timing: Is it becoming clearer why Big Tech firms known for their close ties with intelligence and the DoD waited until after the Midterms to lay off tens of thousands of employees? Absent Democratic Party control needed to run these operations with an entirely free hand, Bitcoin moves closer to escape velocity.

Whatever may or may not be true about the Bigger Picture, know that you're not going to be allowed by Big Tech to ask the President's son about any of it.

With Midterms out of the way, the Democrats felt free to vote us into a continued state of COVID emergency. Huzzah!

From SBF & Co.'s perspective, whether or not they succeeded in establishing the GCDB, they took a lot of money from Bitcoiners competing with the globalists and used it to fund the election of those most opposed to Bitcoin's promise of decentralized (like democratic, ahem) power. They might simply call that a 'W' on the scorecard—particularly if they can navigate their ways out of jail time.

On the media side, we see the traditional Titans of the Mainstream running a well-practiced interference circle jerk for FTX-A:

WaPo: Dude gave money to politicians. Move along.

Vox: Look, it's a narcissist! And he regrets filing for Chapter 11. Move along.

Vox: Impact on politics overrated. (Do we have to stop and argue with this nonsense? Or just look for who butters who's bread?)

Forbes: Caroline Ellison was a weird, nerdy, narcissistic sociopath, and new darling of the alt right (ha!). Move along.

NPR: Fortunately this isn't the real economy. Move along.

Forbes: Gensler just wants to build a resume. Move along.

EA: "We disavow!" Move along.

Jane Street: "We are disappointed in SBF." (This one may be fair and true.)

There's nothing to see here?

We remain on the economic trail.

The Pedophile Elite

"And it's in all those things we won't ever say;

And it's in all those things we won't ever be;

And it's in all those things we'll pay not to see." -Story, Great Northern

Yes, I'm going there. And this section isn't for the faint of heart. But without it, we don't have the complete picture, and we can't do anything about it.

Do you think that the pedophile elite really exist?

I can think of no moments in history when sexual blackmail seemed like a good way to compromise and leverage powerful people except all of them.

FLASHBACK: Once upon a time the FBI and mainstream media ran interference and helped memory hole allegations in court that then Vice President George H. W. Bush partook in a child trafficking ring run out of Franklin, Nebraska.

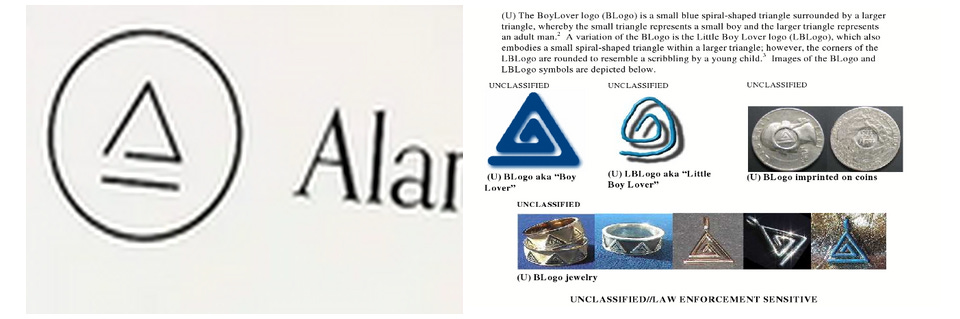

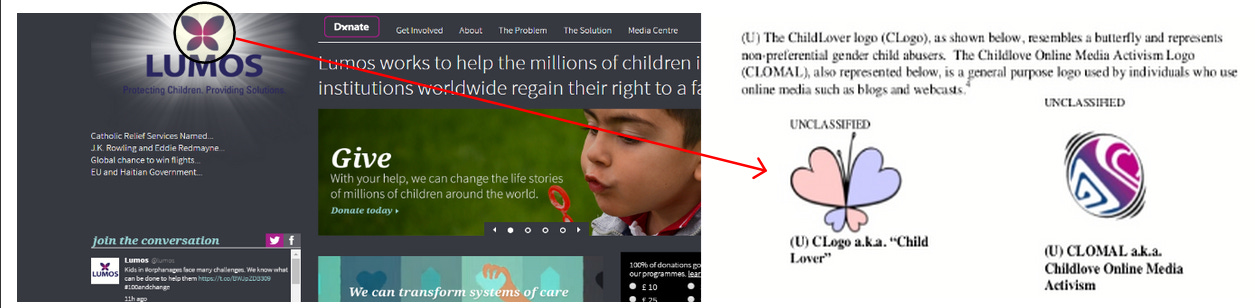

I haven't yet decided exactly how much to make of it, but there is a disturbing similarity between Alameda's logo and the recursive twisted symbols and logos that the FBI compiled in order to identify possible organized pedophilia groups.

I find it disturbingly often in the publicly available PR materials of politicians—and Democrats in particular. When you Wayback Machine Gavin Newsom's Twitter profile to March 2020, there is what appears to be an artificially inserted arm behind his wife with fingers forming the inversion:

Could be nothing. Don't let it ruin the rest of the article. It's not as if SBF hangs out with Bill Clinton and wears a t-shirt in his Twitter profile advertising the "little girl lover" symbol, and dated a woman who still looks like she's twelve. Wait!

Would it be crazy if EA turned out to outwardly represent a fluffy pseudophilosophy, but was internally a globalist network for elite and aspiring elite pedophiles?

But surely a nice little Harry Potter obsessed nerdy girl like Caroline wouldn't associate with…

Okay, I could jump to conclusions, but I won't. I'm just…collecting data, for now. One way or another, there are bigger predators in these waters.

Coming to grips with the vastness of the West's pedophilia problem was a gradual series of eye-opening events for me. During childhood, I was fortunate not to be around dangerous pedophiles myself—at least not that I was aware might have been there. Among friends in my community, pedophilia was merely an edgy joke about something that seemed so rare as to be nonexistent. But shortly after I went to work as a bond trader on Wall Street, I found myself sitting at a desk next to a freshly minted Princeton graduate named Paul "Should I Double-Bag It?" Ellis who bragged effusively about his sex tourism in Southeast Asia. Shockingly, office leadership seemed more concerned about the lawsuit risk (there was one woman in the 17-person unit) associated with his loud blathering about sex with prepubescent girls than what this meant about his character. Or perhaps it's good to be a Princeton graduate in a room almost half-filled with Princeton graduates?

In 2003, I was first introduced to the basic details behind a drug and pedophile ring by my oldest brother Andrew when I flew out to visit him in Lahaina, Maui. I'll skip past the story about how my brothers and I grew up in a quasi-cult that had been infiltrated and controlled by military intelligence. There is a lot to talk about there, but it turned out that at a camp in Virginia run by the quasi-cult that none of us ever attended, a great deal of sexual abuse took place. However, Andrew started dealing drugs in high school, and through a member of the quasi-cult came into contact with the military-intelligence-and-CIA-connected (operated?) drug mafia known as "The Rainbow Family" that followed the Grateful Dead and Phish ever-touring concert festivals. As the story goes, they sourced the same LSD used in MK-ULTRA—from the same underground lab(s) that reportedly operated out of a hidden room at MIT, a Cambridge apartment, and at the recently demolished MIT dormitory known as Bexley Hall.

At the time, Andrew was the web developer for bossfrog.com, which sells events and adventures in Maui, so we got free tickets on snorkeling trips, helicopter rides, and luaus. For a week, we partied it up for the price of [good] tips. When we were good and drunk one night, he shared with me that he had fled to Maui after being pressed to pimp prostitutes, including children, to the Silicon Valley crowd where he worked in California. Working as a web developer at a well-heeled startup, Andrew was really the go-to guy for drugs having imported his connections from the Rainbow Family and elsewhere. For a hot minute, he was an Armani-suit-wearing dreadlock-hippie drug dealer with a fancy sports car who barely had to leave the office to find a client. But the demands his suppliers put on him to connect his clients to the sex traffickers drove him over the edge. After a substantial drug deal, he took the $50,000 meant for the suppliers on a trip to Vegas, got high (on whatever drugs he might have used at the time), and gambled it all away. That same week, the CEO of his company was arrested by the FBI on fraud charges. So, Andrew up and fled to Maui (and I was confronted by two well-armed members of the Rainbow Family in Chicago for the $50,000 bill for his life). Though I'd paid his bill off with the entire contents of my bank account (and then a little), he was eventually spotted in Maui and still beaten nearly to death (I believe his later death was largely the result of that attack, along with the alcoholism, depression, weight gain, and diabetes that ensued, spiraling him into oblivion).

FLASHBACK: In 2016, former Chief of Staff to powerful Tennessee Senator Lamar Alexander Ryan Loskarn died from an apparent suicide after being arrested for his involvement in a gay pedophile ring in Washington D.C.

A strange and violent childhood allowed me little room for naivety, but somehow in my mid-20s I found society to be a whole lot sicker than I'd imagined. And who knows where my bother's story might have gone if he didn't have his moral limits. But if you really want to fall down the rabbit hole, start working through the life and death of computing prodigy and hacktivist Aaron Swartz. I suspect that his disappointed realizations about the dark corners of Cambridge were not terribly distant from my own. This was, after all, a young man who found the community at Stanford to be surprisingly uninteresting and unmotivated.

As the mainstream narrative goes, Swartz, then a 24-year-old fellow at Harvard, was caught in 2011 hacking MIT in order to liberate gated (JSTOR) journal articles that he could have freely downloaded from his account at Harvard, then hung himself without a note using somebody else's after being sentenced in court for violating the draconian Computer Fraud and Abuse Act (CFAA). Outside that mainstream narrative is another tale,

A quick look at MIT Media Lab reveals some questionable characters at the helm.

- Negroponte’s major promoter and sidekick has been Steward Brand, who evolved from being a back-to-nature founder of the Whole Earth Catalog to a raving advocate of “nuclear power, genetic modification and geoengineering”. (Let’s hope he relocates to Fukushima where he can personally enjoy all three wondrous advances.)

- Walter Bender, founder of Sugar Labs, which developed the One Laptop per Child project’s XO-1 Children’s Machine, the communication tool of choice for pedophiles to communicate with their little brown lovers.

- Frank Moss, who was trained at the Technion Institute in Haifa, a center for the Israeli Defense Force’s cyberwarfare R&D projects. The Media Lab itself is heavily involved in military-related projects with the US Air Force, the Space and Naval Warfare Systems Center, the Army Research Office and Google, which is a high-tech contractor in artificial intelligence for DARPA.

- Joi Ito, who once ran a nightclub in Roppongi, Tokyo’s drug-peddling and prostitution district run by a yakuza boss whose interest lies in Caucasian models performing coprophilia and bondage, increasingly favorite video themes besides child porn among the American university technocrati. Since he never earned a higher degree, Ito’s main qualification is apparently his status as godson of Timothy Leary. For those who were/are too stoned to comprehend political reality, Leary began his drug experimentation as a psychologist for the MK-ULTRA mind-control program and became a proselytizer of hallucinogens under a CIA psy-op campaign to disable the antiwar movement.

MIT Media Lab is yet another spin-off from the all-powerful MK-ULTRA and DARPA. No wonder it’s been producing child porn and involved in overseas pedophilia. The One Laptop program is a clever vehicle to provide early sex education to children across impoverished Asia and Africa who have yet to reach pubescence.

A few years ago, when I first heard about this alternative narrative, I began trying to track down people who knew Swartz. It turns out that there aren't a lot of people to talk with about him, but we did have one friend in common who wouldn't even speak over the phone about any of it. I'll stop that thread right there, except to say that through a series of discussions with numerous people around that person about many aspects of this story (and some branching off of it), I came to believe that the mainstream narrative was something Swartz agreed to roll with in order to save those around him whom he cared about. By chance, that was all right around the time I came to know the name Jeffrey Epstein for the first time.

The well-connected Epstein was a member of both the Trilateral Commission and the Council on Foreign Relations, two organizations that likely have players in every major global event. And it may or may not be coincidence that Epstein's close friend Bill Clinton helped build the SBF and FTX-A brand recognition.

After Epstein's donations to MIT Media Labs (MIT's well-nerfed internal report goes back to 2002), which totaled millions of dollars, often sent through him from sources including Bill Gates, came to light, Joi Ito resigned amid media coverage that seemed to nerf the story as best as possible. He did receive a letter of support signed by over 100 individuals—including Lawrence Lessig who had served as Swartz's lawyer. As Whitney Webb has been pointing out in interviews, the story of Jeffrey Epstein is about much more than the lurid details of his sexcapades with underage girls. Epstein was a specialist in financial crime—something the mainstream media somehow always fails to delve into. But these two crimes go hand-in-hand most closely in a world in which politicians are hard to blackmail with a garden variety sex scandal. After JFK had dozens of affairs in a single year, and the U.S. later elected three consecutive presidents working to bury rape accusations (Reagan, Bush, then Clinton, in case you never heard), catching a politician in bed with a live boy or a dead girl may be the only blackmail plan with teeth.

FLASHBACK: (Operation Flicker) In 2006, a DoD investigation into a child pornography ring began that eventually found over 5,000 [dot]mil (military/DoD) email addresses among those accessing a well-trafficked child porn site. The investigation continued into 2009 after Barack Obama took office as POTUS. In a handful of cases, prosecutions were successfully sought while the rest were swept under the rug. All that remains of the page that housed the Inspector General's report on Operation Flicker is an empty page underscored with the words, "Integrity, Independence, and Excellence".

Among the precocious Swartz's many projects was the user-driven news aggregation Reddit. Swartz's own project Infogami merged with a similar burgeoning project to form the still popular site. After Swartz's death, reddit took a turn into censorship under moderators such as u/maxwellhill, who claimed the same birth month as Ghislaine Maxwell and went inactive just before Ghislaine Maxwell's arrest in 2020. Given the account's frequent removal of politically ring-wing posts, and interest in topics surrounding child sexuality, the common sense default assumption is that Ghislaine Maxwell worked with Reddit using that account. Another moderator account (u/anutensil) with similar interests and activities was likely hers or her sister's and is an anagram of Anne Sluti, a teenage girl whose abduction and lengthy rape ordeal was the subject of the 2009 Hollywood film Taken in Broad Daylight.

Early on during the pandemic, former Reddit-CEO Ellen Pao got into hot water for a tweet in which she seemingly admitted that Ghislaine Maxwell's trafficking of underaged girls was an open secret. A few months later, a fight broke out among Reddit's moderators when Reddit CEO Steve Huffman hired a so-called "pedophile enabler" whom he claimed was "poorly vetted".

All this to what ends? Why would Epstein's madame take such an interest in Swartz's online community if Swartz were not getting close to their most serious plans?

What if the ultimate goal were, among other things, to establish a Global Digital Central Bank?

Epstein worked (as a donor or fundraiser) with MIT Media Labs since its founding, and Joi Ito was elevated to Director to shepherd MIT's Digital Currency Initiative (DCI), which was incidentally involved in Facebook's attempt to establish Libre as a dominant digital currency. Also incidentally, Gary Gensler served as Senior Advisor to the DCI project. All this seems like quite a coincidence, but it makes complete sense on a level of financial mega-power plays. If morality doesn't factor into your decision calculus, who would you want involved in an attempt to establish a new global financial control center? How about the world's leading Economics and technology center that just so happens to have relationships with what might be the world's most powerful sex blackmail ring?

It really does seem as if Epstein touched all the currently important power circles. The association followed CRISPR Cas9 expert Eric Lander when Biden nominated him for Director of the Office of Science and Technology Policy shortly before stepping into the Oval Office. As the head of Harvard's Broad Institute with a position at MIT that allowed him to work with gene drive technology at both campuses, he would be the man in position to steer the administration's possible deployment of the technology. From an article in the New Yorker,

Critics called the experiment irresponsible and suggested that the scientists had violated an established code of conduct. “This paper demonstrates the enormous safety risks that any such attempt would entail, and underlines the urgency of working to forestall other such efforts,” Marcy Darnovsky, of the Center for Genetics and Society, told National Public Radio when the report was published. “The social dangers of creating genetically modified human beings cannot be overstated.”

There seems to be little disagreement about that. But the Chinese researchers were not trying to create genetically modified humans. They were testing the process, and every crispr researcher I spoke to considered the experiment to have been well planned and carried out with extraordinary care. The scientists also agreed that the results were illuminating. “That was an ethical paper, and a highly responsible project,’’ Lander told me. “What did they do? They took triploid zygotes’’—a relatively common genetic aberration—“from I.V.F. clinics. They deliberately chose those because they knew no human could ever develop from them. And what did the paper say? ‘Boy, we see problems everywhere.’ That was good science, and it was cautionary.”

Obligatory reminder: Melinda Gates divorced Bill In May 2021 and then talked publicly about her discomfort with Bill's numerous meetings with Epstein after Epstein was already convicted as a child sex offender.

Now we come back to the primary Bitcoin-Cryptocurrency ecosystem (assuming we left it) and see some potential connections.

Recently deceased-maybe-murdered cryptocurrency entrepreneur Nikolai Mushegian might be considered a near mirror-image of SBF. In the weeks leading up to his death, Mushegian both inked a deal with the popular cryptocurrency exchange Coinbase to use his stablecoin technology, and also tweeted multiple times about intelligence agencies and elite pedophiles running a "sex trafficking entrapment blackmail ring" whom he believed would torture him to death. While we cannot be certain about exactly what happened between that last tweet and his body being found in the ocean a few hours later, it makes sense to wonder if a child sex entrapment blackmail ring would be one of the tools used to force consensus in moving toward a global financial stronghold. And given Bitcoin's wedge position, it makes sense that this would happen in the cryptocurrency space.

Some Bitcoiners knowledgeable in the space point to Tether (the most utilized stablecoin) co-founder and former child actor Brock Pierce as potentially involved. After all Pierce's teenage years seemed to leap from what other child actors described in the documentary An Open Secret as willingly engaging in sex with adult men, to flying around on the private jet of wealthy man, spending his money around the world until it was all gone. The result of a blackmail deal? Pierce later reached a settlement in a case involved coerced sex with teenage boys while other defendents fled the country. I'm told that his circle has purchased a military base in Puerto Rico and was working to buy a decommissioned Air Force base there in 2021. I'm told he also engineered the election of New York City's new mayor, which is a good connection to Wall Street's geography. That could come in handy in an era of shifting monetary systems.

Then again, Coinbase was FTX's primary competitor among Western exchanges, and given the true breadth of FTX-A's extended community, they could certainly have ordered an assassination of a competitor in the backyard of another rival, potentially clearing the chess board. Or was Mushegian potentially spoiling everyone's Death Star?

Pro tip: don't hold your breath waiting for any further investigation into Mushegian's death, which was ruled an accidental drowning despite his fearful tweets.

On March 17, 2020, the University of Minnesota announced that researcher David Boulware would run a series of experiments testing the ability of hydroxychloroquine (HCQ) for its ability to prevent or treat COVID-19. As I've previously noted, that announcement was ignored by the media prior to Trump's press conference two days later in which the public became aware of experiments involving HCQ and remdesivir that began in China and were spreading into the West. This seems in every way to have been part of an organized conspiracy of silence, which in turn allowed for the production of a fear-based campaign associating HCQ with Trump, cherry-picking rare adverse effects of the drug which gets consumed in the billions of doses annually.

In those trials (see here, here, and here), which were evaluated independently only, were publicly billed as showing that HCQ "failed" to show efficacy despite HCQ outperforming the placebo arms in each. These trials involved a non-inert placebo, were halted while heading toward powering for statistical significance, and were statistically evaluated in ways that did not layer the demographics in a reasonable way. David Wiseman, PhD, and numerous others worked up re-evaluations of various of these trials (here, here, here, and elsewhere) showing statistically significant results under improvement frameworks and corrected measurement of time-to-treatment, but were ignored without commentary by the publishing journals.

One of the funders of Boulware's research on HCQ was software entrepreneur David Baszucki.

Baszucki is best known as the co-founder and CEO of Roblox, a game that competes with Minecraft for an audience that consists primarily of children, teenagers, and also a handful of adults. Participants can create their own environments within the Roblox platform, and invite others in to play leading to a largely ungovernable gaming experience. With children out of school during the pandemic, Roblox saw its user base explode by tens of millions of users—including fully half the U.S. school children under 16 and three-quarters of all those ages 9 to 12. In March 2021, Roblox IPOed with a $41 billion valuation—an instant pandemic-pumped blowout valuation.

Video games are part of the concoction of digital drugs Yuval Noah Harari suggests is the method for dealing with the useless people who might otherwise revolt against the status quo powers.

FLASHBACK: While live on CSPAN, Senator Barney Frank, who admittedly hired gay prostitutes while serving in Congress, threatened to out members of Congress [for something] when brought up on ethics charges relating to a gay/straight escort service operating out of his Capitol Hill apartment (by one of those prostitutes whom he lavished with jobs and perks) that reportedly included underaged boys. Frank continued to represent Massachusetts in the House for an additional 24 years thereafter.

But Roblox harbors a dark secret that it must take a serious PR team to hold at bay: The Roblox team (here, here, here) and community members (here, here) have been the subject of an astounding list of pedophilia and child sex abuse claims (a Twitter search shows a daily stream of discussion on the topic and it's a topic that shows up on the Roblox devforum) that seem bizarrely ignored by regulators.

Roblox draws children in using many lures, including music video debuts by star performers such as Lil Nass. Already a member of Time's 25 Most Influential People on the Internet list at the age of 20, is best known for videos filled with loud gay erotica, including this one that celebrates drug-fueled sex, and in which he seduces Satan with a lap dance.

I'm not here to tell adults how to live their lives, or even parents how to raise their children. But I'm guessing that most wouldn't call this "age appropriate" and are entirely unaware of what children experience through the Roblox platform.

Late in 2021, Roblox announced an initiative "supporting the innovative and hard-working educators who leverage our platform."

Does anyone wonder if David Boulware had an inkling of the additional fortunes he might make this game's icky founders?

Pandemic Engineering

From the moment of the repo market crash on September 17, 2019, I expected some sort of theater to usher in a new post-dollar era. But I could not yet imagine a controlled Pandemic Theater like the one we're living through. I think I get it now. At least mostly.

We've seen a whole lot, but do the dots all connect?

From a more detailed explanation of the Roblox story at TheWayOut,

The lockdowns supported by Speaker Pelosi led directly to billions of dollars in profits for Roblox CEO David Baszucki. In turn, the Pelosi family was given access to the Roblox IPO stock offering which increased 55% on its first day of trading, resulting in large profits for the Pelosi family.

Thus, it is nothing more than a straightforward summary of factual observations that:

1) Roblox’s CEO funded an influential study of early treatment for Covid-19, which concluded that hydroxychloroquine was “not proven effective” for treating Covid-19.

2) Because the authors of the influential study did not conclude that a benefit was present, strict lockdown measures were enforced. Moreover, an Emergency Use Authorization (EUA) was issued for other products, which ultimately included vaccines.

3) Speaker of the House Nancy Pelosi was in a position to promote and legislate lockdowns, which prevented children from playing with each other outdoors and instead drove them toward using the Roblox online gaming platform and social media outlet.

4) The Roblox CEO, David Baszucki, made billions of dollars, according to news reports, because children were locked down.

5) The Pelosi family were granted access to Roblox stock at its initial public offering and likely acquired millions of dollars when Roblox increased by 55% on its first day.

How many billions of dollars add up to a perverse incentive to make a Pandemic out of a molehill? Or is this more about social control?

One really has to wonder if the imagery is being stage-managed for consumption by America's children. What is the endgame in all of this?

Obligatory reminder: Two of Boulware's other funders for his HCQ trials were Chinese organizations.

Now that we've circumnavigated the globalists, let's focus back in on FTX for the moment. What connects FTX specifically to the pandemic, if anything?

SBF donated $5M to ProPublica to "establish a world-class reporting team" in order to "support investigations into ongoing questions about the COVID-19 pandemic, biosecurity and public health preparedness." That's the same ProPublica that recently published a Lab Leak hypothesis article similar to Vanity Fair's that seems to be an attempt at taking control of what one might deem the "Level 2 Narrative".

SBF's brother Gabriel Bankman-Fried founded Guarding Against Pandemics.

Barbara Fried spent years studying the economic and psychological impacts of blame and punishment. This is exactly the sort of behavioral economics fed to the Nudge Units during the pandemic.

SBF's aunt Linda Fried is a Professor of Public Health and Epidemiology at Columbia University, previously served as a Director at Johns Hopkins Medicine, is an elected member of the National Academy of Medicine, and is a member of the MacArthur Network on an Aging Society, and also serves on the World Economic Forum's (WEF) Futures Council on Longevity and Human Enhancement. (WEF profile)

Not only did SBF fund the TOGETHER Trial, which used a nonstandard dosage of IVM and is still under scrutiny for a wide variety of statistical anomalies, but he hired his Effective Altruism "reluctant prophet" guru buddy who waxes poetically about the cheap drugs that were denied approval during the pandemic. Specifically, Will Macaskill was brought into the board of the FTX Foundation's Future Fund where he could talk more about how to give money away—to the right causes [of the pandemic?].

The FTX Future Fund committed $10 million to HelixNano for the development of a "next-generation coronavirus vaccine".

Boulware also headed up the ivermectin study arm of the TOGETHER trial. It's hard to make this stuff up. There are those who point out that the Bankman-Fried bros didn't throw money into the trial until after the IVM results were published. But smart people will understand that this does not demonstrate a lack of influence. This is clearly not an unsophisticated crowd.

It is noteworthy that on January 11, 2020, The Lancet published a five paragraph article (Fried et al, 2020) and an international cohort of thirteen others lamenting the health effects of chronic loneliness among the elderly. They declared no competing interests. In June of last year, Frontiers (yes, that Frontiers) published (Fried, 2021) Fried's solo-authored "The Need to Invest in a Public Health System for Older Adults and Longer Lives, Fit for the Next Pandemic" again lamenting the isolation, but this time as experienced during the pandemic. Of course, it calls for the establishment of more public health jobs for such tasks as feeding the elderly during such once-in-a-century events. Again, no conflicts of interest were declared. Thumbing through her body of work on PubMed, it is sincerely difficult to find anything that could be accurately described as Science. It's hard to imagine I couldn't produce all 412 articles (usually with several to many authors) spanning several decades during a year of writing on Substack, which I mention only because I'm wondering what it is that she gets paid to do.

Through Guarding Against Pandemics, the Bankman-Fried brothers ingratiated themselves to the DoD and the vaccine-virology public health machinery.

Bankman-Fried spokesperson Mike Levine told me that Torres was a target for the group because he “has pushed for federal funding that would lead to prototype vaccines for multiple families of known viruses with pandemic potential, replenish the Strategic National Stockpile and support the domestic manufacturing of personal protective equipment, enable rapid testing, and encourage the development of therapeutics like antivirals and monoclonal antibodies.” Left unmentioned was Torres’s outspoken support for crypto both on social media and in the pages of the New York Daily News.

“Our strategy during this primary season has been to support champions for pandemic prevention,” Levine wrote in an email to The Intercept. He said the PACs hope to demonstrate to politicians “who are not yet champions for pandemic prevention that doing the right thing on pandemic prevention funding and security policy will help them build a coalition of political allies who will support future campaigns.”

Of course, the excuse can always be, "We know The Science, and we know that the Public Health officials know The Science, so this must necessarily be the best way forward." But ossification of such conclusions is precisely what the inventors of science argued against, historically.

Obviously SBF and the FTX-A crowd were not the only ones funding aspects of the plandemonium. But the FTX-A money machine was a large one, and the money spent may have purchased the wind that would have flown their magic internet money kite, setting the GDCB in motion.

Isn't it strange how globalists, wannabe central bankers, and elite pedophiles oddly rowed the boat in the same direction together in order to support exactly the sorts of plans that would create or prolong a pandemic?

De/Repopulating the Earth?

There is a very real worry among some groups, globalists or otherwise, that the Earth is populated largely with idiots.

However, rather than following a well-demonstrated route of re-engineering education (we know how to do that), there is a strong contingent among the cognitive elite—particularly among the transhumanist oligarchs and their elite VC and Big Tech communities—who see themselves as truly (and often genetically) superior beings. Some of them want to repopulate the world with copies of themselves. If that sounds eerily like runaway artificial intelligence, you're probably tapping into a mindset many are trapped within.

Among these "pronatalists" (at best an inappropriate term for whatever these people might be), was Jeffrey Epstein.

They both said they were warned by friends not to talk to me. After all, a political minefield awaits anyone who wanders into this space. The last major figure to be associated with pronatalism was Jeffrey Epstein, who schemed to impregnate 20 women at a time on his New Mexico ranch. Genetic screening, and the underlying assumption that some humans are born better than others, often invites comparisons to Nazi eugenic experiments. And then there's the fact that our primary cultural reference point for a pronatalist society is the brutally misogynist world of "The Handmaid's Tale."

These are the sorts of people who can agree to cattle-tag a whole planet while ostensibly opposing one another in a hot war that threatens to kill millions in a nation with too little of its own national power.

Meanwhile, Epstein's buddy Gates was busy both funding gene drive technology, something the public knows little about to this juncture. This technology utilizes the RNA-guided genome editing tool CRISPR-Cas9 to spread synthetic DNA-modifications through entire populations. Think deeply on that power—the power to edit the human population. To what ends?

Gender ratios could be changed. I'll just leave that one there.

Gates also hired a PR firm to influence policy on gene drive technology. And now we have a public message. The expressed purpose of such technology is for altruistic purposes such as making mosquitos sterile. That's one way to prevent malaria or Zika, and conveniently makes for a great controversy to distract everyone's attention from the greater threat to humanity: centralized management of the human genome. My friend J.J. Couey has been warning about this.

As you would expect of a technology this powerful, the DoD is an even larger funding of gene drives.

This sounds like one of those highly complex existential risks we should proceed carefully with.

From an article in PNAS (Brossard et al, 2019) (emphasis mine):

In November of 2017, an interdisciplinary panel discussed the complexities of gene drive applications as part of the third Sackler Colloquium on “The Science of Science Communication.” The panel brought together a social scientist, a life scientist, and a journalist to discuss the issue from each of their unique perspectives. This paper builds on the ideas and conversations from the Colloquium session to provide a more nuanced discussion about the context surrounding responsible communication and decision-making for cases of post-normal science. Deciding to use gene drives to control and suppress pests will involve more than a technical assessment of the risks involved, and responsible decision-making regarding their use will require concerted efforts from multiple actors. Gene drives represent a classic case of “post-normal science” (4) for which purely technical expertise is not enough to address the complexities surrounding a scientific issue that has not only technical but also social, ethical, and legal dimensions. Unlike “normal” scientific issues for which risk assessment can be based for the most part on scientific inputs, post-normal science has to rely on a multitude of perspectives when assessing risks and benefits. Along the same lines, reflecting on communication about the post-normal science of gene drives can only benefit from multidisciplinary approaches. Our aim is therefore to use our collective experiences and knowledge to highlight how the current debate about gene drives could benefit from lessons learned from other contexts and sound communication approaches involving multiple actors.

It's not as if we're living through a moment in which our politically-connected modelers have gotten a whole lot wrong, and rushing into known unknowns and unknown unknowns thrust us into total chaos. What could go wrong?

Extinction of humanity?

A gene drive harnesses one of the ways that cells repair DNA, called “homing,” that snips out one copy of a gene and replaces it with a copy of whatever corresponding gene variant (allele) is on the paired chromosome. It would be like cutting out a word in this sentence and replacing it with a copy of the word below it. If done to a gene that affects fertility in a fertilized ovum – aka the germline – the intervention can lead, within a few generations, to mass sterility and a plummeting population – a “gene drive” towards extinction.

How much do you trust a globalist community that just gathered a dozen already speed-driven kids to build a global banking network between drug-fueled orgies in the Bahamas to tinker with the germline?

Obligatory reminder: If depopulation is about to take place, this is the exact moment in time when it makes sense to run a global "swab everyone" campaign to collect the largest possible database of genetic information.

I'm not sure what else to say for the moment. There are pieces to this puzzle still missing, but there is enough on the table that the image of World War E is starting to emerge: This pandemic was likely seeded by infectious clones, spurred by iatrogenic euthanasia as a smokescreen for a financial and technological coup ahead of the loss of control the military-banking complex would experience from a genuine currency competition.

It seems reasonable to explore links between a de/repopulation plan and each of these and other many related solvable problems:

A fragmenting medical system

Dramatic lack of trust in mass broadcast information streams

Lack of trust in election integrity

Did anyone really think there was a plan to repopulate the Earth with SBF and Caroline Ellison?

Never mind.

Satoshi Nakamoto vs. The New World Order

The stakes could not be higher. The Almighty Dollar is likely on its last legs as the vehicle for global financial quasi-slavery. The globalists have been organizing for decades around plans to extend their umbrella as a unified global financial network at the time the status quo reserve currency weakened. Certainly the reigning banking regime recognized the potential for a BRICS currency decades in advance. James Rickard's book Currency Wars demonstrates the Pentagon's knowledge and war games expected at this time. What Rickards doesn't write about is Bitcoin, which was invented only around the time those currency war games were taking place.

The game theory surrounding a three-currency competition gets murkier. We might even wonder if a pandemic was planned and eventually tacitly agreed upon as a new sort of fog of war under which a new financial world order could be established. We'll come back to that point later.

It is important to understand that none of this story relates to fundamental weaknesses in Bitcoin's model. In fact, Bitcoiner's view events like this as tests of the strength of the Bitcoin network, then go back to the drawing board to consider whether a rare change in the code might improve the system.

This story also demonstrates that those who don't understand morality cannot fathom Bitcoin.

If you're new to Bitcoin, and have wondered why Satoshi Nakamoto chose to remain anonymous, does that seem a little clearer, now?

Summary and Additional Details

Now, let us summarize: Under a pandemic-induced fog of war, the military-banking complex may be enabling an elite pedophile class of blackmail agents at least partially organized around MIT to establish a Global Digital Central Bank to enslave the human race, cull populations, and subject them to genetic information control.

One additional thought worth thinking about is whether these seemingly related global events were at least somewhat telegraphed, and whether this is the reason power consolidation occurred in China, Russia, and Saudi Arabia over the past few years. One way to retain national strength in the midst of Fifth-Generation warfare involving a constant stream of confusing signals is to line the ducks up in a row and move as a single unit.