Banks, Banks, Banks: The Elephant Nobody Even Sees

Banks, Banks, Banks: The Elephant Nobody Even Sees

Our faith in the wobbling world of hyper-financialization will soon be tested.

It's interesting, isn't it, that amidst a tsunami of commentary about banks, nobody mentions the proverbial elephant in the room, which is the overwhelming dominance of finance in the economy and society, a dominance which raises the big question: is the dominance of finance healthy for the economy and society?

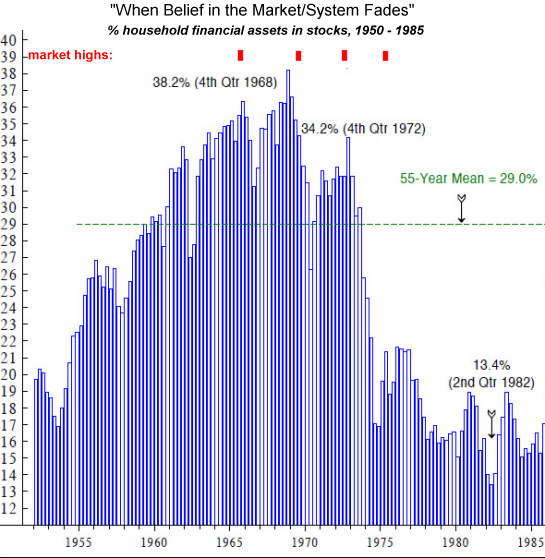

The reason why nobody even sees this elephant is we've come to believe "it's always been this way" and "this is the natural order of things." Both are false. Yes, debt and lending have been integral to "money," trade and civilization from the beginning, as David Graeber so memorably detailed in his book Debt: The First 5,000 Years. But essential isn't the same as dominant.

Without much in the way of recognition or inquiry, we've allowed finance to become the foundation of the entire economy. The entire economy will now grind to a halt without trillions of dollars of credit sluicing through every rivulet, stream and river of commerce. From overnight lending facilities to 30-year mortgages, debt/credit is the lubricant of the economy.

What's been forgotten is the economy that once relied not just on credit but on savings and cash. In the pre-financialization economy, capital and credit were scarce; capital commanded a premium, and lending / credit sluiced through very narrow channels: conservatively underwritten conventional 30-year mortgages, debit cards such as American Express that had to be paid in full every month (and such cards were hard to get, by the way), and conservatively underwritten loans to enterprises.

Credit cards required evidence of fiscal prudence and had low limits, generally just enough to buy an appliance and pay it off in a few months.

What we take for granted--auto loans and credit card limits equal to or higher than an annual wage--would have been viewed as incomprehensibly imprudent and fantastical. Loans for vehicles were available, but only to the credit-worthy and if the buyer put down 50% in cash.

At higher levels of finance, outright scams such as SPACs (Special Purpose Acquisition Company) were not allowed. The foundation of absurd stock market overvaluations--corporate buybacks--were also restricted.

The astounding expansion of credit and financialized skims and scams are now the lifeblood of the economy, and any pause in their endless expansion triggers shivers of terror. Good golly, what kind of horrors would we suffer if J. Citizen can't buy a $50,000 car or truck with $1,000 down? How could we survive without 3% down payment mortgages? What doom would await us if corporations were no longer able to raise billions of dollars in the credit markets and use that money to buy back their own shares?

Rather than be viewed correctly as a necessary evil that must be strictly constrained lest it eat the heart of the real economy, debt/credit is now seen as our most precious bodily fluid, without which we perish. In this peculiar psychosis of hyper-financialization, the reality that ultra-loose credit and capital that carries no premium inevitably jacks up prices and costs to the moon, fatally distorting the real economy, is not even visible.

What is visible is the "necessity" of putting a lavishly over-priced Disney World vacation on a credit card and the "necessity" of a $60,000 new pickup truck. Or what the heck, a new $110,000 Wagoneer. We all deserve everything credit enables, from buying meme stocks on margin to designer jeans.

OK, so we have $160,000 in student loan debt-- a university degree was "necessary" regardless of cost. (Needless to say, the issuers and owners of all that debt are as wealthy as we are poor. That's how credit works.) And we really needed a vacation, so that's one $20,000 credit card maxed out. Then there were "surprises" (what we once called "normal everyday life") such as a broken water heater.

Hey why is everything so poorly made now? Globalization. You know, quality no longer matters, only the "low" (heh) price. ( Stainless Steal.)

We're too tired to cook real food (but manage to spend hours every day staring at screens after work) so we need to order meal delivery, and keep the house well-stocked with unhealthy snacks and beverages, and so on top of all the other "surprises" in an inflationary global economy, there's another $20,000 credit card maxed out.

Our clunker car needed repairs so it was necessary to get a $30,000 auto loan for a new car--the cheapest one on the lot.

This profligacy and dependence on ever-expanding credit just to sustain "normal life" is scale-invariant, meaning every city, county, state and federal agency also needs ever-expanding credit just to stave off collapse, and every zombie company / entity also needs ever-expanding credit just to avoid the slippery slope to bankruptcy and liquidation.

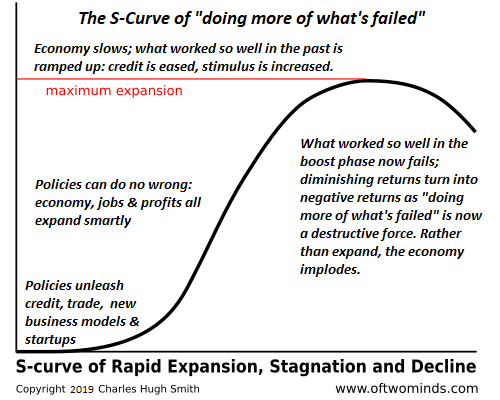

The elephant nobody even sees much less gets alarmed about is the entire financialization era has slipped over the top of the S-Curve. Doing more of what worked in the past only accelerates the slide to further extremes, more distortions, increasing instability and eventual "adjustment," i.e. reckoning.

Our faith in credit, debt and finance is forced, as we've forgotten how to live without it. Kind of like, you know, ahem, an addict for whom the next fix is not seen as a disaster but as the restoration of an unstable pretense of stability.

Our faith in the wobbling world of hyper-financialization will soon be tested. Once we lose faith in this state of fiscal psychosis, then we can awaken to the reality that the cure for unaffordable lifestyles is a collapse of hyper-financialization and the asset bubbles it inevitably inflates.

Source: Of Two Minds

Comments

Post a Comment