China and the Great Reset

China and the Great Reset

Michael Rectenwald

In this essay, I first aim to show that China is the model for the Great Reset. China’s economic and political system, “socialism with Chinese characteristics,” is the globalists’ blueprint for West.* Second, I address the role that China itself may play in the new globalist order. In addition to being a model, is China a partner, or a competitor with the Great Reset agenda? The answer to this question depends, in part, on understanding the relationships between China and the Western globalists. The terms of these relationships may be gleaned from Western investments in China’s economic and political system, and from the involvement of Chinese officials and other China-based notables in Western globalist NGOs, international governance bodies, corporations, banks, and universities.

Capitalism with Chinese Characteristics

The title of this section represents a play on the description of the Chinese economy by the Chinese Communist Party (CCP). Several decades ago, when China’s growing reliance on the for-profit sectors of its economy could no longer be credibly denied by the CCP, its leadership approved the slogan “socialism with Chinese characteristics” to describe the Chinese economic system.

Formulated by Deng Xiaoping, the phrase became an essential component of the CCP’s attempt to rationalize Chinese for-profit development under a socialist-communist political system. “Capitalism” would support socialism until communism was reached.

According to the party, the growing privatization of the Chinese economy was to be a temporary phase—lasting as long as one hundred years, according to some party leaders!—on the way to a classless society of full socialism-communism. The party leaders claimed, and still maintain, that socialism with Chinese characteristics was necessary in China’s case because China was a “backward” agrarian country when socialism-communism was introduced—too early, it was suggested. China needed a capitalist booster shot.

Whether the CCP leaders believe their own rhetoric or not, the ideological gymnastics on display are spectacular. The slogan embeds and glosses over a seemingly obvious contradiction to sanctify or “re-communize” Chinese for-profit development as a precondition of full socialism-communism.

I’m not the first to play on “socialism with Chinese characteristics” with the phrase “capitalism with Chinese characteristics.” Yasheng Huang, et al., have written a book by the same title.

But for my purposes, in “What is capitalism with Chinese characteristics?,” the Chinese scholar Wei Zhao ably characterizes the Chinese system:

[The] Chinese social structure is a kind of relational market, which has a tributary State on the top and [the] remaining part is composed by small merchant capitalists, without any middle class in between. Therefore[,] there is no separate sphere of “economy” or “market” [apart] from [the] political State or communitarian society.

Under the above formulation, the “tributary State” must include the favored corporate giants, banks, and investment firms.

The Great Reset, I am suggesting, effectively represents the development of the Chinese system in the West, only in reverse. Whereas the Chinese political class began with a socialist economic and political system and introduced “capitalism” (or privately held for-profit production) later, the West began with some degree of capitalism and is now aiming to implement a socialist political system directing the economy. It’s as if the Western oligarchy looked to the “socialism” on display in China and said, “yes, we want it.”

This modeling of the West on China is attested to by numerous figures. One of the earliest figures was Maurice Strong, the late environmentalist, United Nations Under-Secretary General, first executive director of the United Nations Environment Programme (UNEP), and early World Economic Forum (WEF) board member. In a 2010 interview with The Guardian, Strong averred:

We know that pure capitalism hasn’t worked. In China, they have used their system – which they call a socialist market economy – quite well to achieve their objectives. It’s also in a continuous process of evolution. I’ve had a working relationship with China nearly all my adult life. I’ve seen the remarkable progress they’ve made and are still making. They’re quick learners. They tend to be among the best in terms of business and industry. They have learned how to use the methods of capitalism to meet their own goals of socialism. China is among the best managed countries today.

Maurice Strong

Maurice Strong was one the mentors of Klaus Schwab, the founder and chair of the WEF. Schwab’s other mentor was Henry Kissinger. Of course, it was Kissinger, who, in a series of then-secret meetings in Beijing, “normalized” relations with China. This normalization was a precondition for the flourishing of socialism with Chinese characteristics, which was fostered by Western investments. Kissinger, I should note, is a member of the Bilderberg steering committee, a member of the Council on Foreign Relations (CFR) Board of Directors, a founding member of the Trilateral Commission, a member of the WEF, and a protégé of David Rockefeller.

In the New York Times, David Rockefeller praised Maoist China after visiting the communist country:

Whatever the price of the Chinese Revolution, it has obviously succeeded not only in producing more efficient and dedicated administration, but also in fostering high morale and community of purpose.

General economic and social progress is no less impressive. Only 25 years ago, starvation and abject poverty are said to have been more the rule than the exception in China. Today, almost everyone seems to enjoy adequate, if Spartan, food, clothing and housing.

David Rockefeller

Mind you, Rockefeller made these statements in 1973, after the Great Leap Forward, during which over 40 million people died of starvation. And he stated this in the middle of the Cultural Revolution, when many millions more were murdered. Certainly, as well placed as he was, Rockefeller was not unaware of these facts. After Mao’s death, Rockefeller encouraged Kissinger to normalize relations with China.

Klaus Schwab

In a recent interview with CTGN TV, the state-run foreign-language news channel based in Beijing, Schwab remarked regarding China: “I think it’s a role model for many countries.” Schwab also recommended that stakeholder capitalism, his brainchild, be implemented worldwide:

We have to define the specific elements of the global system … Now the base has been formed. But we have to go one step further. We have to have a strategic mood. We have to construct the world of tomorrow. It’s a systemic transformation of the world. So, we have to define how the world should look like, which we want to come out of this transformation period…

Now you ask how to do it? I think it needs what we feel in the World Economic Forum [is] a multi-stakeholder approach. It’s certainly governments who have to be in the lead, but business, most of the solutions will come through innovations from business. And we have to integrate the large population. And, we have to mentor the population, to show, through our good examples, that the future requires this change, and that such change, at the end, ultimately, will be beneficial for them.

The object of the Great Reset appears to be to establish a Chinese-style system that includes vastly increased state control of the economy, the collusion and close coordination between governments and the private sector (or economic fascism), and the “mentoring” of the population. This mentoring necessarily includes the kind of authoritarian measures and surveillance technologies that the Chinese government uses to control its population, which is why Schwab heralds the technologies of the Fourth Industrial Revolution (4-IR): individual carbon footprint tracking, a ubiquitous Internet, smart cities, algorithms undertaking governmental tasks, augmented reality (AR), virtual reality (VR), mixed reality (MR), the metaverse, social credit scoring, digital identities, central bank digital currencies (CBDC), nanorobotic brain-cloud interfaces, etc. Eliminating the free market and individual autonomy requires a great deal of socioeconomic and political control, which such 4-IR technologies provide.

Could this modeling after China also account for the Maoist-like cultural revolution that has swept much of the world with wokeness? Is the woke revolution the necessary precursor to socialism with Chinese characteristics in the West?

In a telling move, the WEF has attempted to distinguish stakeholder capitalism and China’s “state capitalism.” In their article, “What is the difference between stakeholder capitalism, shareholder capitalism and state capitalism?,” as part of the Davos Agenda, Klaus Schwab and Peter Vanham argue that stakeholder capitalism is neither the “state capitalism” of China nor the “shareholder capitalism” of most of the Western world. Leaving aside their obvious criticism of shareholder capitalism—that it supposedly fails to meet the needs of all so-called stakeholders in society—I’ll address their treatment of state capitalism. State capitalism, they assert, “solves a major shortcoming of shareholder capitalism because there are mechanisms in place to ensure that private and short-term interests do not overtake broader societal interests.” The state does this in three ways:

First, it keeps a strong hand in the distribution of both resources and opportunities. Second, it can intervene in virtually any industry. And third, it can direct the economy by means of large-scale infrastructure, research and development, and education, health care, or housing projects.

Yet, under state capitalism, they concede, “the government wields too much power.” They recommend stakeholder capitalism as the alternative to both state and shareholder capitalism. Under stakeholder capitalism, they suggest, “all those who have a stake in the economy can influence decision-making, and the metrics optimized for in economic activities bake in broader societal interests.” Just how are these societal interests “baked in?” Through Environmental, Social, and Governance (ESG) indexing. Stakeholder capitalism claims to represent us, without allowing us any say. It is a “benevolent” dictatorship scheme.

They represent their comparison of the three systems in a table:

Figure 1: Stakeholder vs. shareholder and state capitalism

As we know from Schwab’s book and the WEF website, the state is one of the major stakeholders under stakeholder capitalism. Schwab and Malleret wrote the following in Covid-19: The Great Reset:

One of the great lessons of the past five centuries in Europe and America is this: acute crises contribute to boosting the power of the state. It’s always been the case and there is no reason why it should be different with the COVID-19 pandemic.

Schwab and company repeatedly call for “the return of big government.” And one of the reasons for stakeholder capitalism, Schwab and Vanham suggest, is to avert environmental catastrophe, which they deem an “acute crisis.” What they say about state capitalism is no less true of stakeholder capitalism: the government “keeps a strong hand in the distribution of both resources and opportunities…it can intervene in virtually any industry,” and “it can direct the economy by means of large-scale infrastructure, research and development, and education, health care, or housing projects.” The WEF has recommended such heavy-handed interventions in countless pages posted to its website. There is no doubt that stakeholder capitalism is closer to state capitalism than it is to shareholder capitalism. Yet, the state is conspicuously absent from their table. Could that be because stakeholder capitalism and state capitalism are barely, if at all, distinguishable? Stakeholder capitalism is state capitalism plus environmentalism, environmentalism snuck through the backdoor of corporate stakeholders. Environmental measures are delivered to “stakeholders” via Environmental, Social, and Governance (ESG) indexing. ESG indexing dictates production and consumption according to these criteria. But it is not as if the population at large has any say in ESG scoring or its effects.

The WEF has lauded the wonders of China’s state capitalism, including in “Geo-economics with Chinese Characteristics,” and “8 things you need to know about China’s economy,” among many others.

Despite the WEF’s weak attempts to distinguish stakeholder capitalism from state capitalism, China’s “state capitalism” appears to be the model for the economic and political system being promoted for the West, and the Great Reset is the most forthright articulation of that system—although its articulation is anything but perfectly forthright. The “Chinese characteristics” that the Great Reset aims to reproduce in connection with Western capitalism involve a vastly increased state interventionism in the economy, a great abridgment of property rights for the majority, and a technocratic mastery of the population—as well as the neo-Malthusian agenda. Neo-Malthusian regulation of population and resources is the basis of so-called “sustainable development,” the environmentalist ethos of stakeholder capitalism.

Corporate Socialism

Another term for describing the world economic system that the Great Reset brings about is “corporate socialism.” This term also helps us to understand why the globalists favor a kind of socialism, and how they have managed to enroll the world’s leading corporations, commercial banks, asset managers, and central banks into the project. By corporate socialism, I don’t mean what Democratic socialists and other leftists may mean by that term: “corporate welfare,” tax cuts and bailouts for corporations at the expense of workers, etc. My usage follows that of the late historian and Hoover Institute scholar, Antony C. Sutton:

Old John D. Rockefeller and his 19th century fellow capitalists were convinced of one absolute truth: that no great monetary wealth could be accumulated under the impartial rules of a competitive laissez faire society. The only sure road to the acquisition of massive wealth was monopoly: drive out your competitors, reduce competition, eliminate laissez-faire, and above all get state protection for your industry through compliant politicians and governmentregulation. This last avenue yields a legal monopoly, and a legal monopoly always leads to wealth.

This robber baron schema is also, under different labels, the socialist plan. The difference between a corporate state monopoly and a socialist state monopoly is essentially only the identity of the group controlling the power structure ... We call this phenomenon of corporate legal monopoly—market control acquired by using political influence—by the name of corporate socialism.

Corporate socialism helps to explain why Western banking elites and international businessmen invested in the Bolshevik Revolution and why they transferred industrial technology to the Soviet Union even after World War II. These were monopolists who saw in socialism—which is a monopoly system if there ever was one—a means for establishing a captive colony from which they could benefit, after Russia had been prevented from developing into a market economy, whose players might have otherwise competed with Western companies and banks. That is, while the Soviet Union became the ostensible enemy of the U.S. and Western Europe, upper layers of the Western financial and industrial establishment invested in the socialist state, likewise defrauding the Cold War.

Corporate socialism may also explain why similar if not the same elements have invested and continue to invest in China, and why the globalist thought leaders promote the Chinese system, while at another level, the national political class and others simultaneously refer to China as a threat to U.S. interests and national security.

To update and extend Sutton’s thesis in connection with the parallel track of China, one may explore investments by U.S. companies, banks, and asset managers in China soon after Mao’s death and Deng’s rise to power. What we find is that just as Western globalist elites supported the Soviet Union before and during the Cold War, they did the same in the case of China, beginning in 1979, if not before. As Michel Chossudovskywrites in Towards Capitalist Restoration?:

The 1979 visit of Deng Xiaoping to the US was followed in June 1980 by the equally significant encounter in Wall Street of Rong Yiren, chairman of CITIC, and David Rockefeller. The meeting, held in the penthouse of the Chase Manhattan Bank complex, was attended by senior executives of close to 300 major US corporations. A major agreement was reached between Chase, CITIC, and the Bank of China, involving the exchange of specialists and technical personnel to “identify and define those areas of the Chinese economy most susceptible to American technology and capital infusion.”

CITIC, by the way, is currently a WEF partner.

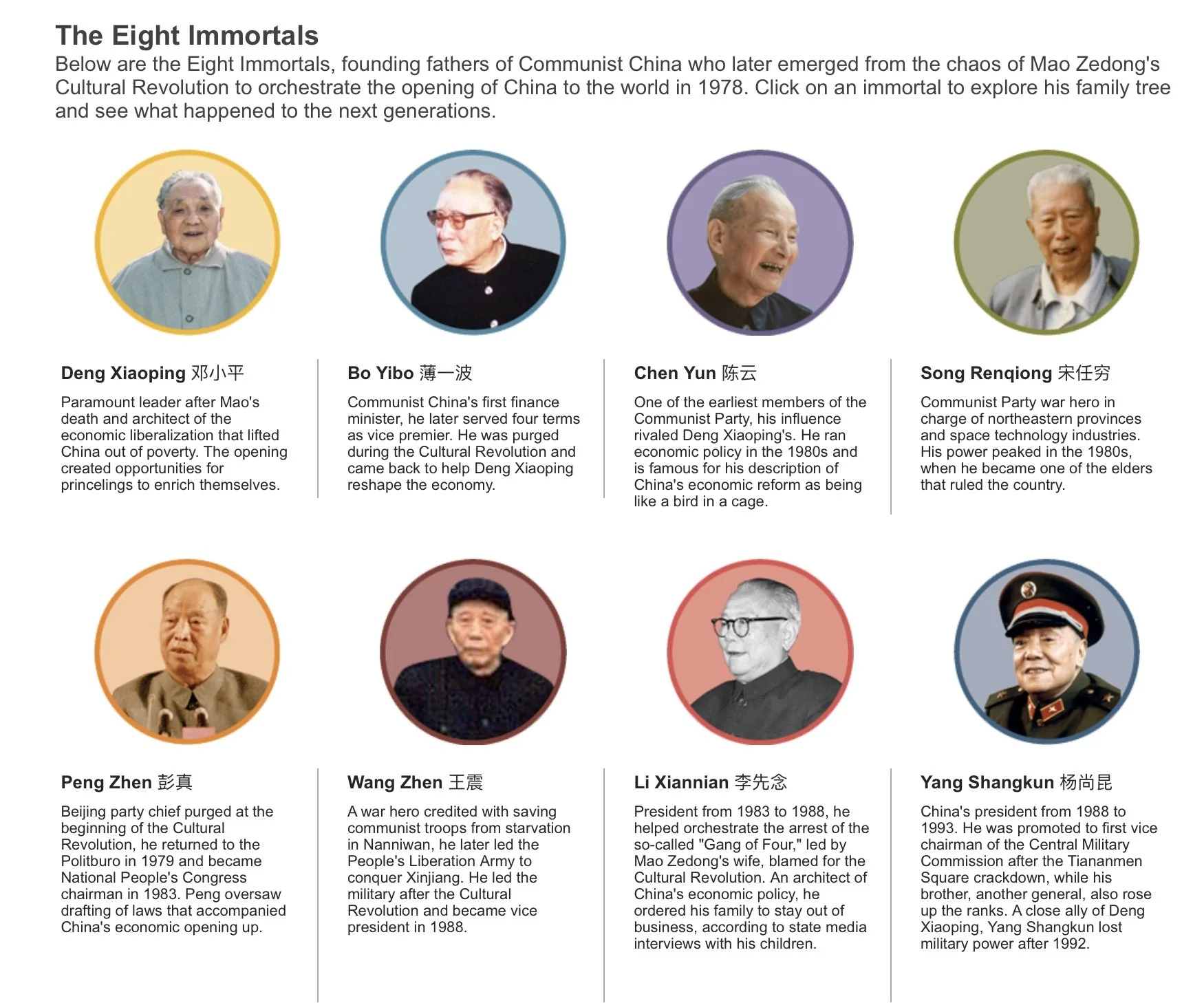

In 2012, in an article entitled “Heirs of Mao’s Comrades Rise as New Capitalist Nobility,” Bloomberg News characterized the early investments by U.S. and other Western interests in socialism with Chinese characteristics. The article traces the fortunes of new Chinese nobles known as the Eight Immortals. These “immortals” survived Mao’s Cultural Revolution, were restored to their high-ranking positions in the CCP after Mao’s death, and implemented Deng’s socialism with Chinese characteristics:

They emerged from the Cultural Revolution after Mao’s death in 1976, during which many of them had been in internal exile, to find an economy in ruins. Gross domestic product in 1978 was $165 a person, compared with $22,462 in the U.S. With Japan, South Korea, Taiwan and Hong Kong booming, the Immortals were surrounded by capitalist success stories…

Chen Yun, [one of the immortals and] the architect of China’s planned economy, wanted to keep control of the state in the hands of Party veterans and their families, and Deng agreed…

Within months, Wang Jun, the general’s son, was made head of business operations at the newly formed Citic, known then as China International Trust & Investment Corp. The group, founded by Rong Yiren, was set up to attract overseas investment at a time when the country’s foreign exchange reserves were $840 million. He turned it into a sprawling empire to drive China’s growth. Citic now runs China’s biggest listed securities firm, backs a Beijing soccer team and develops luxury real estate projects. China’s reserves today [2012] stand at $3.3 trillion.

In fact, Western globalist interventions in China began even earlier. In 1914, the Rockefeller Foundation created and funded the China Medical Board, a non-profit foundation, which operates to this day. And, as I show in The Great Reset and the Struggle for Liberty: Unraveling the Global Agenda, as a young man, Mao had been promoted in his early communist career by Yale University vis-à-vis Yale-in-China.

As The Yale Daily News reported in February 1972, the Yale-in-China student union offered Mao the editorship of its newspaper, a position that Mao accepted, turning the paper into an organ for “thought reorientation” into Marxist channels. The union later offered Mao space for his “culture bookshop.” Mao established branches of the bookstore, where he sold Marxist literature and used the proceeds to establish several socialist youth corps and to fund the Communist Party. Thanks to his success, Mao was chosen as one of the delegates to the 1st National Congress of the Chinese Communist Party at Shanghai in 1921. “From there it was only a small step to becoming one of the founders of the Communist movement in his Country,” noted The Yale Daily News. Likewise, Western elements were not only responsible for helping to develop socialism with Chinese characteristics; they also helped to establish Chinese communism in the first place.

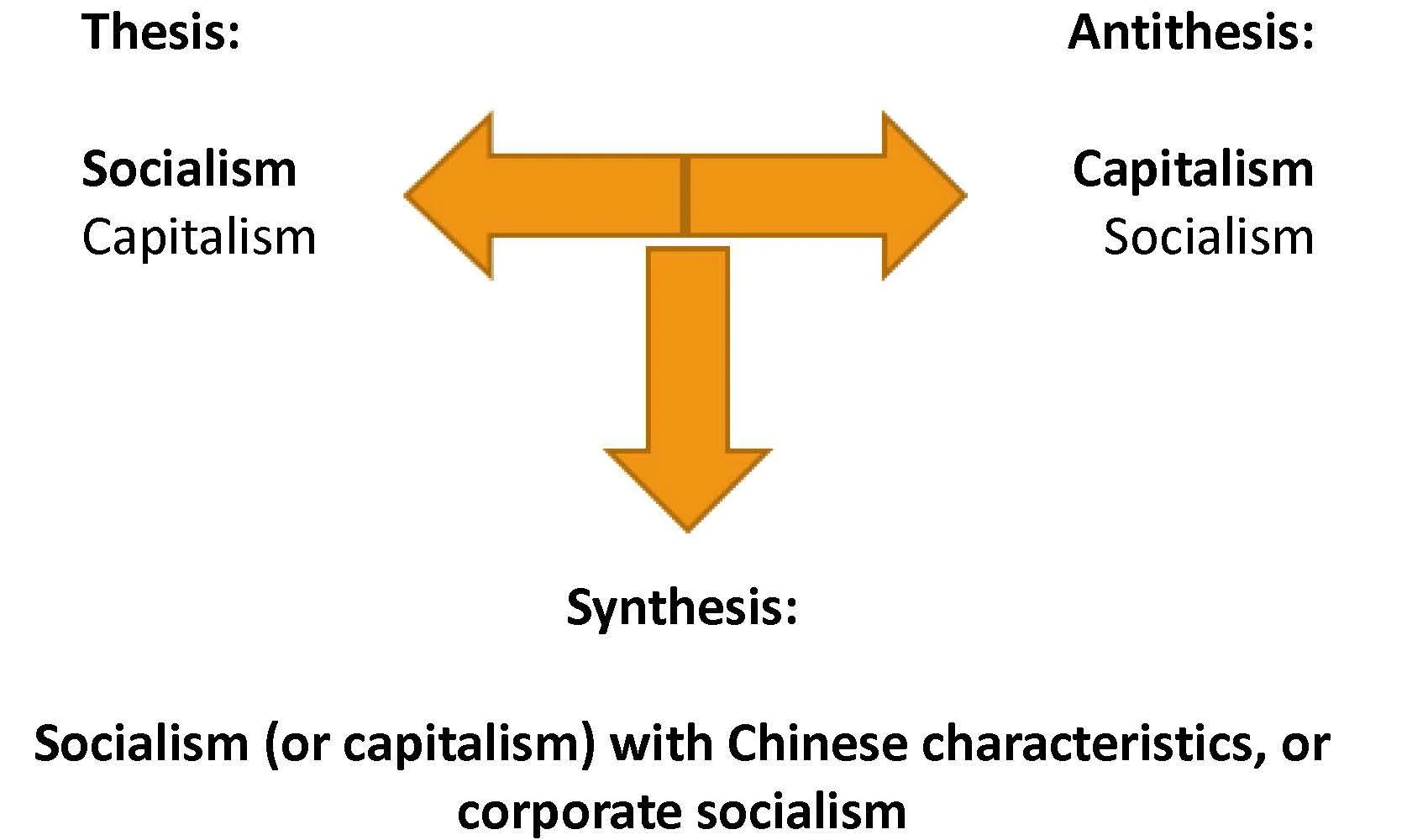

We might think of the activities of the subversive elites in terms of the Hegelian-Marxist dialectic, that is, in terms of the thesis-anthesis-synthesis paradigm. First, you establish socialism, then you oppose it with capitalism. The opposition yields a third term: socialism or capitalism with Chinese characteristics, otherwise known as corporate socialism. For the West, you merely invert the thesis and antithesis, but the result is the same.

China as Participant in the Great Reset

The Great Reset is a project aimed at establishing socialism—or capitalism—with Chinese characteristics. Moreover, it is the culmination of the efforts of numerous organizations that have fostered and contributed to the WEF and its agenda over decades. These include not only the UN but also a network of NGOs founded on the same principles as the WEF and sharing members with it. It’s not as if the WEF appeared out of the thin blue air and began issuing edicts on the global economy and global governance. Rather, as I pointed out at the last AFA talk, the WEF is heir to a long line of globalist ideas and policies that extend back to the early twentieth century.

In fact, the WEF is modeled after the Rhodes Society, founded in 1903. It derives from successors to Lord Alfred Milner’s Round Tables. These successors include the Royal Institute of International Affairs (RIIA, otherwise known as Chatham House, founded in 1920), the Council on Foreign Relations (CFR, founded in 1921), the Bilderberg Group (founded in 1954), and the Club of Rome (founded in 1968). The WEF (founded in 1971) is essentially a fraternal twin of the Trilateral Commission (founded in 1973).

We can trace a direct line of succession from each organization to the next. Each of these organizations convenes meetings of prominent government officials, business leaders, media moguls, and academics. Each organization drafts international political treaties and global governance policies and draws up plans for the global economy. And these organizations—although the WEF is somewhat of an exception here—hold their meetings under the Chatham House Rule. This rule of secrecy stipulates that the ideas discussed during meetings can be disseminated but their sources and those party to them must remain undisclosed.

As I show in The Great Reset and the Struggle for Liberty, at least 67 WEF members have also been members of one or more of these Round Tables predecessors. Many of these WEF/Round Table members have also held positions in one or more global governance institutions. The WEF has deep roots in these older Round Table groups and is buttressed by them. These philosophical and organizational connections make clear that the Great Reset has been in the making for many years, if not decades.

Today, several Chinese figures hold memberships in these Round Table NGOs and global governance organizations and are connected to the WEF, either through the WEF’s corporate partners, as WEF contributors, or otherwise. And numerous China-based companies are among the WEF’s partners.

Fred Hu

Perhaps the most prominent of these Chinese nationals is Fred Hu, the founder and chairman of Primavera Capital Group. As a member of the CFR’s Global Advisory Board, an agenda contributor to the WEF, and having worked at the IMF, Hu is deeply enmeshed with Western globalist organizations. Among the companies in Primavera’s portfolio are the Alibaba Group and Peter Thiel’s Palantir Technologies, both of which are WEF partners. Hu was chairman of Greater China, a partner at Goldman Sachs, and is the non-executive chairman of Yum China Holdings Inc. Goldman Sachs is a WEF partner.

Hu is a policy advisor to the Chinese government on financial and pension reform, the restructuring of state-owned enterprises, and macroeconomic policies. He is a director of several corporate boards including Ant Group, Hong Kong Exchanges and Clearing Limited (HKEX), ICBC, and UBS. HKEX and UBS are WEF corporate partners. UBS, a major exponent of ESG indexing, is the third largest asset manager in the world, behind BlackRock and the Vanguard Group. Ant Group partners with Alibaba’s Alipay in managing China’s social credit scoring system. Hu is a member of Harvard University’s Global Advisory Council, a member of the advisory committee of the Jerome A. Chazen Institute of International Business at Columbia University and is also a trustee of the Rockefeller-created and endowed China Medical Board, founded in China in 1914.

Zhu Min

Another prominent Chinese figure associated with the globalist NGOs and affiliated global governance organizations is Zhu Min. Zhu sits on the Board of Trustees of the WEF and is the group executive vice president of the Bank of China, a WEF partner. Zhu has held positions with the World Bank, as deputy governor of the People’s Bank of China (China’s central bank), and as deputy managing director of the IMF. He is also a trustee of Princeton University. Zhu received an M.P.A. from the Woodrow Wilson School of Public and International Affairs at Princeton and an M.A and Ph.D. in economics from Johns Hopkins University, where he also taught.

Victor Chu

Victor Chu is a senior adviser of the RIIA or Chatham House, current co-chair of the International Business Council of the WEF, and chairman and CEO of First Eastern Investment Group, a leading Hong Kong-based international investment firm and a pioneer of private equity investments in China. Chu was chairman of the Governing Council of University College London (UCL). He is a member of the International Advisory Board of the Atlantic Council. Chu is also a board member of Airbus SE and Nomura Holdings, both of which are WEF partners.

Liming Chen is the Greater China chairman of the WEF. He is a BASF supervisory board member. Prior to his service at the WEF, he was the chairman of IBM Greater China Group from early 2015 to mid-2022. He also served as the president of BP Greater China from 2008 to 2015. BASF, IBM, and BP are WEF partners.

Chen Naiqing is a member of the Trilateral Commission and former vice president of the Chinese People’s Institute of Foreign Affairs (CPIFA). She was ambassador to Norway from 2003 to 2007 and ambassador for Korean Peninsula Affairs from 2007 to 2008. Ambassador Chen served as minister counselor at the Permanent Mission of the People’s Republic of China to the United Nations from 2008 to 2009 and minister counselor, Embassy of the People’s Republic of China in the United States from 2009 to 2012. Chen also held several other state positions, including first and second secretary to the Permanent Mission of the People’s Republic of China to the United Nations.

Zhang Xin is a WEF member, a member of the CFR Global Board of Advisors, and a member of the Harvard Global Advisory Council. Zhang is a co-founder and CEO of SOHO China, a trustee of the Museum of Modern Art (MoMA) in New York, a trustee of Asia Society, and a trustee of the Asia Business Council. Zhang is a member of the Breakthrough Energy Coalition, spearheaded by Bill Gates, which funds technology developments to enable a zero-emissions energy future.

Zhou Jinfeng is a member of the neo-Malthusian Club of Rome and secretary-general of China Biodiversity Conservation and Green Development Foundation (CBCGDF), a China-based NGO “participating at the leading edge of biodiversity conservation, environmental protection and sustainable development.”

Further research might establish connections between these prominent Chinese nationals and the CCP “immortals” discussed earlier, not to mention other CCP connections. But suffice it to say that they represent some of the contemporary beneficiaries of socialism (or capitalism) with Chinese characteristics. Their memberships in globalist NGOs, their roles in international governance bodies and banks, and their relationships to WEF partners, suggest that they have been enrolled into the globalist agenda as part of an effort to bring China into the fold.

At least 70 China-based companies are among the over 1,000 partners of the WEF. They include, as mentioned, the Alibaba Group. Alibaba is China’s top e-commerce and cloud platform player and runs Sesame Credit, part of the Chinese social credit scoring system. As of August 23, 2022, Black¬Rock Inc. held over $500 million in Alibaba stock. BlackRock is, of course, the world’s largest asset manager and the number one exponent of ESG indexing and thus stakeholder capitalism. BlackRock is a corporate partner of the WEF and was the first fully foreign-owned firm permitted by China to set up an onshore mutual fund business there. BlackRock’s CEO, Larry Fink, sits on the WEF Board of Trustees, as does Marc Benioff, the CEO of Salesforce, a WEF partner that funds and partners with Alibaba. As J. Michael Evans, the president of Al¬ibaba boasted at the 2022 WEF annual meeting, Alibaba is involved in developing personal carbon footprint tracking.

Alibaba’s major competitor is Tencent Holdings, which is also a WEF partner. Tencent owns WeChat, the largest social media network in China. Tencent also runs a social credit scoring system connected to WeChat. BlackRock holds Tencent stocks and pursued a partnership with the tech giant in 2019.

Alibaba and Tencent both play major roles in China’s Belt and Road Initiative (Digital Silk Road in particular).

Among other China-based partners of the WEF are at least five banks, including all four of China’s state-owned banks: the Bank of China (the fourth-largest bank in the world), the Agricultural Bank of China, the China Construction Bank, and the Industrial and Commercial Bank of China (ICBC).

The previously mentioned CITIC Group is also a WEF partner. As suggested earlier, CITIC was founded in 1979 by Rong Yiren and was set up with the support of Deng Xiaoping to attract overseas investment. It was a central player in the shift to socialism with Chinese characteristics, which involved, in part, an agreement between CITIC, Chase Manhattan Bank, and the Bank of China to attract “American technology and capital infusion.”

Selected Chinese companies partnering with the WEF

More research could be done to investigate additional connections. But, as we have seen, Chinese individuals and firms are deeply involved with the WEF and its predecessor globalist NGOs and international governance bodies. And Western globalist organizations, international governance bodies, corporations, banks, and asset managers are fully invested in China. One way to understand these relationships is in terms of symbiosis. At least in the short term, China stands to gain through the globalist prerogatives of the Great Reset project, and the Great Reset stands a much better chance of succeeding given China’s participation. Together, globalists from the East and West are undertaking the long march toward global socialism (or capitalism) with Chinese characteristics, despite the recriminations from political figures on both sides.

Source: Michael Rectenwald

Comments

Post a Comment