Incentives Create Trajectories, Corporate Model

Incentives Create Trajectories, Corporate Model

or, "let's start foregrounding the gleichschaltung"

Manipulate paper.

A new research article examines the aggressive growth of CPCPs — corporate-owned primary care practices. But one of the authors brings all the background up front in a Twitter thread that starts here:

Big corporations like CVS and Amazon are moving into the primary care business, and so are venture capital firms. Part of the incentive structure driving that move is vertical integration, and just try to figure out where you’ll pick up all your prescriptions when your primary care doctor is a CVS employee (who seems really committed to giving you new prescriptions). But the bigger part is this:

You have to love “intense coding practices.” So the emerging model of primary care is a financial game that manipulates billing practices to capture more money from government. The business is resource extraction; the pretext is medical care.

Why?

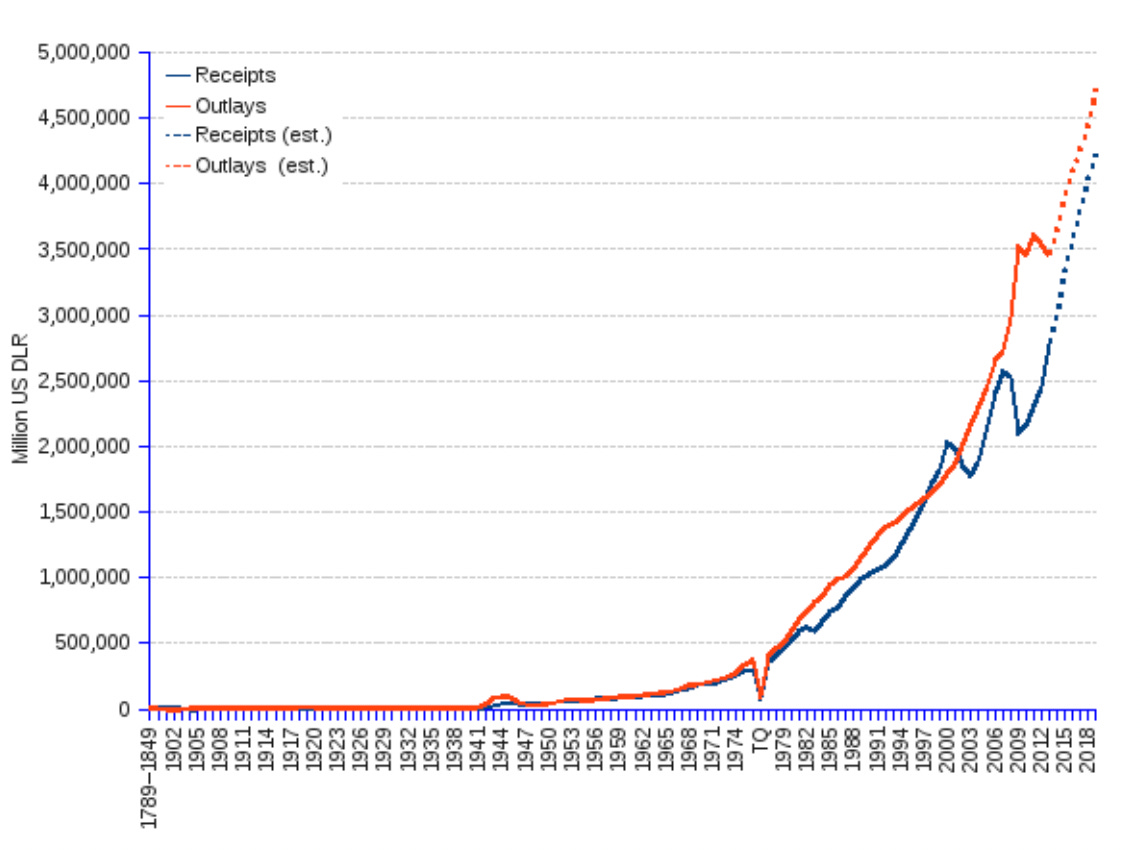

The federal government spent about $2 trillion a year at the start of the Obama administration, and now spends close to $7 trillion a year. The growth of federal spending looks like this, in a chart from this statistics website, though it leaves off the last few extremely significant growth years:

The bucket of federal money has become so obscenely rich with lard that the buzzards increasingly don’t bother to fly over the other buckets. That much incentive creates a very clear set of behaviors in response. It makes sense for large corporations to notice how much money there is to be made from subsidy farming, regulatory capture, and general wallowing in the ocean of free government money.

And so capitalism — identify a market, use your money to create a product to serve it, market the product to individual consumers who will choose to buy it — seems to be an increasingly unlikely prospect for giant corporations in the emerging future. Pfizer and Moderna created novel pharmaceutical products with government funding, then sold the resulting product in bulk to governments, which now market the product.

The result of a process that had close to zero corporate focus on selling to consumers: one of the most profitable products in the history of Big Pharma. If you’re a CEO, this model calls out to you in the night with a sweet and sexy voice. Why not do this? Why not focus on slicing off pieces of the federal treasury, when there’s so much of it?

And so Twitter was remarkably receptive to an endless flood of government requests for the removal of tweets and accounts…

…and Bank of America reacted to the felony trespassing of January 6 by using banking data to tell the FBI which of their customers were near the Capitol that day, without having been asked.

Of course large corporations flatter and pamper the federal government — it’s their biggest potential “customer,” a giant source of future cash.

It would take a lifetime to untangle all the connections and incentives, and all the implications for policy and behavior, in this metastasizing series of patron-client relations. And it’s a topic we mostly don’t discuss, especially in a theatrical and substance-decentering “politics.” Giant corporations are increasingly incentivized to be state-focused instead of market-focused. What do the top 100 corporations look like in twenty years?

Related, see this essay from American Greatness publisher Chris Buskirk, which describes the social decay caused by the financialization of the American economy. Sample spot-on paragraph:

As productivity growth has slowed, the economy has become more financialized, which means that resources are increasingly channeled into means of extracting wealth from the productive economy instead of producing goods and services. Peter Thiel said that a simple way to understand financialization is that it represents the increasing influence of companies whose main business or source of value is producing little pieces of paper that essentially say, you owe me money. Wall Street and the companies that make up the financial sector have never been larger or more powerful. Since the early 1970s, financial firms’ share of all corporate earnings has roughly doubled to nearly 25 percent. As a share of real GDP, it grew from 13–15 percent in the early 1970s to nearly 22 percent in 2020.

Compare this description of an economy based on producing value from “little pieces of paper” to the emerging model of corporate-owned primary care practices that focus on the extraction of government funding through “intense coding practices.” We’ve incentivized the exchange of symbols, in profit-producing practices that make less and less in the world of real things.

“Tell Me How This Ends.”

Comments

Post a Comment