A Look at 10 Red States Leading the Charge Against Financial Tyranny

A Look at 10 Red States Leading the Charge Against Financial Tyranny

By The Sharp Edge

While dysfunctional D.C. battles it out over the debt ceiling to reign in uncontrolled federal spending, ‘Quid Pro Joe’ (who is under Congressional investigation for laundering bribes by foreign nationals) recently pledged hundreds of millions more in aid to corrupt Ukraine, which has been exposed for embezzling funds. If that wasn’t enough, ‘The Big Guy’ committed another $250 million through USAID to the World Bank, which has the power to launder with immunity.

Meanwhile, the 2023 banking collapse is turning out to be worse than the 2008 crisis, and the Treasury Secretary is warning that more bank mergers may be around the corner, as wealth consolidates into a handful of woke megabanks, like JPMorgan Chase and Bank of America, which continue to target the regime’s political enemies. According to 19 state attorneys general, JPMorgan Chase has repeatedly de-banked Christian and conservative organizations. Furthermore, a House Weaponization Subcommittee report detailing FBI whistleblower testimony, disclosed how Bank of America colluded with the FBI to hand over confidential data of customers in the D.C. area on January 6th, highlighting individuals who had ever purchased a firearm using B of A products. Adding insult to injury, the weaponized IRS, which recently beefed up its workforce and arsenal to target Americans, received a green light from the Supreme Court to obtain bank records of individuals who aren’t even under investigation.

If you think all of this is bad, just imagine what our absolutely corrupt federal government could do with a central bank digital currency. Of course, the Fed is looking to CBDCs as the solution to the financial crisis they’ve created. Problem – Reaction – Solution, as the old Hegelian Dialectic goes. Central banks around the world are working feverishly on implementing a CBDC system, and globalists are salivating over the “absolute control” it would give them.

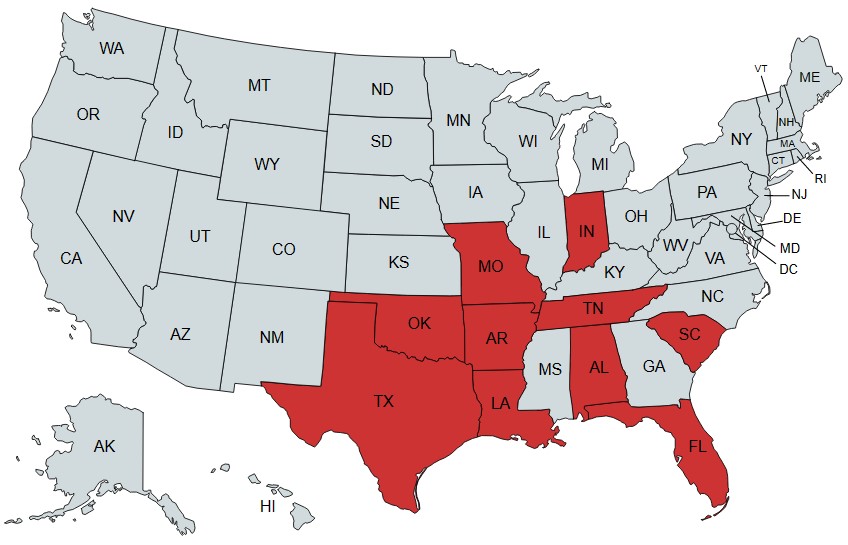

Now, onto the good news. Red states are leading the charge in the financial rebellion. Several Republican states have recently introduced or passed legislation to establish a parallel economy by protecting the use of cash, affirming gold and silver as legal tender, establishing precious metal depositories, and blocking central bank digital currencies. This report highlights a collection of 10 red states which are designing a blueprint for the rest of the country to follow. This is by no means a comprehensive list. There are solid pieces of legislation designed to secure financial freedom working through other states as well. A comprehensive list of legislation in each state can be found here.

Alabama

Alabama’s state legislatures are taking a stand against central bank digital currencies.

A recently proposed bill in the Senate, SB330, “would prohibit any state or local governmental agency from accepting CBDC as a form of payment and would prohibit any governmental agency from participating in testing the use of CBDC by any Federal Reserve branch.”

Another bill introduced this month in the House, HB408, seeks to amend the Uniform Commercial Code to exclude CBDCs from the definition of “money” stating, “The term does not include a central bank digital currency.” Meanwhile, there are two other bills pending in the Alabama legislature, HB348 and SB231, that seek to amend the UCC, but don’t have any language to exclude CBDCs from the definition of money.

The UCC is a set of standards designed to create uniformity among states to facilitate interstate commerce. Recent changes to the UCC, promoted by the Uniform Law Commission, have embedded language to block crypto and enable CBDCs. The recommended UCC changes aim to revise the definition of “money” to state that, “the term does not include an electronic record that is a medium of exchange recorded and transferable in a system that existed and operated for the medium of exchange before the medium of exchange was authorized or adopted by the government.” While the language blocks crypto because it is a “medium of exchange” that existed “before” the medium was adopted by the government, it also paves the way for a CBDC as the implied “medium of exchange” to be “adopted by the government.”

Some states have already passed UCC amendments with embedded language to facilitate CBDCs, as legislation remains pending in several others. More information on the status of UCC amendments sliding through other states can be found here.

Arkansas

Arkansas is making moves to affirm gold and silver as legal tender, remove taxes on gold and silver, and block the tracking of individuals through a central bank digital currency.

In April, Arkansas passed HB1718, which establishes The Arkansas Legal Tender Act to affirm gold and silver as legal tender and remove tax liability by stating, “the exchange of one type or form of legal tender for another type or form of legal tender shall not give rise to any tax liability,” and “the purchase, sale, or exchange of any type or form of specie shall not give rise to any tax liability.”

Also, Arkansas signed HB1720 into law in April. HB1720 explicitly refers to a “central bank digital currency,” and prohibits “the tracking of an individual through the use of digital currency except for limited circumstances,” stating that “A digital currency tracker shall not be used in this state to track an individual’s purchases or location through the use by an individual of digital currency unless: (1) A warrant has been issued in a criminal or civil court case that expressly authorizes the tracking of the individual’s purchases; or (2) The individual knows and consents to the digital currency tracker.”

Florida & Indiana

This month, both Florida and Indiana passed amendments to the Uniform Commercial Code to block central bank digital currencies.

Florida’s SB7054, which passed on May 15, 2023, amends the UCC’s definition of money to state, “The term does not include a central bank digital currency.” Likewise, Indiana’s SB0468, which passed on May 4, 2023, amends the UCC’s definition of money to state, “The term does not include a central bank digital currency that is currently adopted, or that may be adopted, by the United States government, a foreign government, a foreign reserve, or a foreign sanctioned central bank.”

While a handful of states have proposed amendments to the UCC to exclude CBDCs from the definition of money, Florida and Indiana are the first to successfully pass such amendments.

Louisiana

Louisiana’s state legislature is taking steps to block central bank digital currencies in the state.

HCR71, which passed in the House this month and is now pending in the Senate, “urges the United States Congress to not support any legislation or efforts to adopt a central bank digital currency in the United States,” adding that “a United States CBDC raises significant concerns over privacy for individuals and businesses in Louisiana.”

Another bill that passed in the House this month, HB415, relates to banking in the state, amending the definition of “deposit account” to state “The term does not include… a central bank digital currency.”

Missouri

A few Missouri bills working through the state legislature would protect the use of cash, affirm gold and silver as legal tender, establish a gold and silver depository, and block public entities from requiring payments by a central bank digital currency.

SB100 passed in the Senate last February and is working its way through the House. A similar piece of legislation, HB1375, is also pending in the House.

The bills state “No public entity shall require payment in the form of any digital currency. Payment by means of cash, debit card, or credit card shall be considered legal tender and shall be accepted by all public entities. Payment in gold and silver coinage shall also be considered legal tender and shall be accepted by all public entities.”

Furthermore, SB100 and HB1375 provide exemptions for “all tax years beginning on or after January 1, 2024, the portion of capital gain on the sale or exchange of gold and silver that are otherwise included in the taxpayer’s federal adjusted gross income.”

Lastly, these bills direct the State Treasurer to “keep in the custody of the state treasury an amount of gold and silver greater than or equal to one percent of all state funds.”

A separate bill, HB718, which is pending in the House, would establish a Missouri Bullion Depository.

Oklahoma

Meanwhile, Oklahoma is working towards protecting cash, blocking public and private entities from requiring payments using a CBDC, and establishing a bullion depository.

A promising bill, HB1633, which passed in Oklahoma’s House last March and is pending in the Senate, states “an agency shall not require any citizen of this state in conducting transactions with the agency to pay using credit cards nor a central bank digital currency and shall not prohibit cash, cashier’s checks, or money orders as payment” and “businesses providing basic needs selling or offering for sale goods or services during regular business hours shall not require a buyer to pay using credit cards nor a central bank digital currency nor prohibit the use of cash, cashier’s checks, or money orders as payment in order to purchase the goods or services.”

Another bill pending in the Senate, SB816, would establish the Oklahoma Bullion Depository “as a division of the Office of the State Treasurer.”

South Carolina

South Carolina is taking steps to secure financial freedom in the state by affirming gold and silver as legal tender, removing taxes on gold and silver, and blocking CBDCs.

H3080, which is pending in the House, provides “that gold and silver coins minted foreign or domestic shall be legal tender in this state.”

Another bill pending in the House, H3081, amends capital gains tax to provide exceptions for “the portion of the capital gain that was recognized from the sale of gold, silver, platinum bullion, or any combination of this bullion, for which the deduction equals one hundred percent of such capital gain.”

A pair of bills also pending in the House, H4373 and H4442, aim to amend the Uniform Commercial Code to block CBDCs under the definition of money. The UCC amendments state that “The term does not include a central bank digital currency.” Furthermore, H4373 states the bill is designed to “prohibit a banking corporation from offering any service or approving of or conducting any transaction that involves central bank digital currency.”

Tennessee

Tennessee is making headway on affirming gold and silver as legal tender, establishing a bullion depository, and shielding Tennesseans from a central bank digital currency.

A pair of Tennessee bills, SB0519 and HB1479, passed in March to allow “the state treasurer to purchase and sell physical gold and precious metal.” The bills say that “The physical gold and precious metal purchased… must be custodied by the state treasurer in a state depository.”

Another set of bills working through the Tennessee legislature, HB1481 and SB0311, would make “gold and silver coinage legal tender” and authorize “payment of taxes with gold and silver coinage.” Furthermore, the bills would require that “any gold and silver coinage received by this state… must be stored in a depository institution and the value of the gold and silver coinage must be attributed to the balance of the reserve for revenue fluctuations. The gold and silver coinage must not be liquidated until all other funds in the reserve for revenue fluctuations have been expended.”

Also, SB0150, a bill that is pending in the Senate, would enact the Tennessee Bullion Depository Act.

In an interview by Catherine Austin Fitts of the Solari Report, Tennessee Senator Frank Niceley remarked on how proposed legislation could work to create a sovereign state bank and bullion depository to support local banks and shield them against a central bank digital currency.

Texas

Texas is taking action on legislation to protect cash, recognize gold and silver as legal tender, maintain the nation’s first state bullion depository, and oppose a central bank digital currency.

A couple of bills pending in Texas’ Senate, HJR146 and SJR67, propose a constitutional amendment to state that “The right of the people to own, hold, and use a mutually agreed upon medium of exchange, including cash, coin, bullion, digital currency, or privately issued scrip, when trading and contracting for goods and services shall not be infringed. No government shall prohibit or encumber the ownership or holding of any form or amount of money or other currency.”

SB1558, which is also pending in the Senate, is an act “relating to the use of certain gold or silver bullion or specie as legal tender and an exemption from sales and use taxes for certain items containing certain precious metals.”

HB4305, a bill pending in the House, relates “to purchasing gold and silver bullion for this state to hold in the Texas Bullion Depository.” (The Texas Bullion Depository was established through HB483, which was signed into law in June 2015.)

Also, a pair of bills working through the state legislature, HB4903 and SB2334, seek “the establishment of a digital currency backed by gold” which can be redeemed for “troy ounces of gold from the pooled depository account” in reference to the Texas Bullion Depository. This set of bills has received mixed reviews from a rightfully skeptical public who is wary of any form of digital currency, whether backed by gold or not, but supporters of the bills say, “A gold-backed digital currency would create an alternative and allow individuals and businesses to avoid a CBDC.”

Meanwhile, there are a couple of bills making headway, SCR25 and HCR88, which express the Texas legislature’s “opposition to the creation of a central bank digital currency” adding that, “this could lead to unprecedented levels of government surveillance and control over private cash holdings and transactions.”

In Summary

These 10 red states are creating a template on how to fight financial tyranny. Promising legislation moving through these states is paving the way for a parallel economy by protecting cash, affirming gold and silver as legal tender, setting up depositories, and blocking CBDCs. God willing, many more states will take notice and join the financial rebellion before it’s too late.

Source: Corey's Digs

Comments

Post a Comment