“Sustainably” Surveilling and Tokenizing Nature: The Case of O.N.E. Amazon

“Sustainably” Surveilling and Tokenizing Nature:

The Case of O.N.E. Amazon

The architect of BlackRock’s ETFs has teamed up with a group of companies tied to US intelligence and US government debt trading to tokenize the Amazon rainforest and borgify it with a large-scale sensor network in order to create a new form of “digital gold.”

A satellite surveillance company with links to U.S. intelligence, former Trump administration officials, U.S. government debt barons and the stablecoin Tether (USDT) announced plans earlier this year to build the “Internet for Forests” in the Amazon rainforest. The satellite company, called Satellogic, plans to join an initiative to rig up one of the world’s oldest and most important forests with sensors and “machine intelligence infrastructure” led by a group called O.N.E. Amazon. O.N.E. Amazon, in turn, seeks to turn the Amazon rainforest into a digital asset security to be chopped up, tokenized and sold off to investors around the world as a novel form of digital credit. O.N.E. Amazon’s partners in this endeavor, such as Aecom, also have important U.S. intelligence connections.

O.N.E. Amazon is chaired by Peter Knez, who oversaw the creation of ETFs (exchange traded funds) and iShares, which is now owned by BlackRock. Knez, who also served for many years as BlackRock’s Global Chief Investment Officer, also chairs the Venom Foundation, which is developing a proprietary blockchain and token to facilitate the “development and implementation of central bank digital currency (CBDC) and traditional finance products by governments and businesses” around the world. Given that O.N.E. Amazon describes its rainforest tokenization initiative as “crypto with a purpose” and that it is also chaired by Knez, it seems likely that the Amazon-focused initiative may involve Venom in some capacity. Given Satellogic’s ties to past efforts to impose a Bitcoin blockchain-powered carbon market on Latin America, it is also possible that Bitcoin or another prominent blockchain will be used, especially considering the involvement of Jalak Jobanputra, a major investor in the digital currency space and particularly in important Bitcoin-related companies, in allegedly co-founding O.N.E. Amazon.

As we previously reported earlier this year in a piece entitled Tokenized Inc., BlackRock and other titans of finance are attempting to tokenize and financialize the natural world. Considering that the architect of iShares now stands at the helm of O.N.E. Amazon, it is important to reflect on BlackRock’s Larry Fink’s words shortly after the approval of the iShares Bitcoin ETF earlier this year. Fink stated that “We believe ETFs are a technology no different than Bitcoin was a technology for asset storage.” In other words, blockchain and ETFs, per Fink, merely serve as a technological means to store centralized indexes, funds and tokenized assets, in direct contrast to the founding aspirations of Bitcoin as a peer-to-peer digital currency. Now, the very man who developed BlackRock’s ETF machine is seeking to tokenize the Amazon rainforest and transform it into a digital asset of finite supply – essentially turning a major and crucial ecosystem into a “digital gold” or bitcoin analogue.

For years, titans of Wall Street like BlackRock have helped saddle South American countries with unprecedented debt levels, robbing them of their economic sovereignty through dollarization or institutions like the IMF and World Bank. Now, they are seeking to turn the continent’s most crucial resources into a form of “digital gold” that will be enforced by a satellite-sensor system tied to individuals deeply invested in efforts to globalize dollar-denominated debt and also to American intelligence. While the goal is framed as “conservation” of the Amazon, the Satellogic-O.N.E. Amazon proposal seeks instead to enable the exploitation of a protected resource like never before while also building a cybernetic surveillance grid into one of nature’s greatest monuments – not to ensure the forest’s “health” – but to ensure the “integrity” of the digital asset security it is now poised to uphold.

What is O.N.E. Amazon?

O.N.E. Amazon’s promotional video – Source: Vimeo

O.N.E. Amazon aims to create “sustainable impact for the environment and investors by using next-generation technology to bring innovation to conservation.” It was formally launched at COP28 in December 2023 but appears to have begun operations sometime around 2021, if not earlier. The “innovation” O.N.E. Amazon offers is related to its issuance of an upcoming,“regulated O.N.E. Amazon Digital Asset Security.” Per O.N.E. Amazon’s chairman Peter Knez, “each security will represent the perceived value of one hectare of biome in the Amazon rainforest, backed by a 30-year preservation agreement over that land.” The amount of securities to be issued will be capped at 750 million, “corresponding to the hectarage of the rainforest.” In other words, each security issued represents one hectare of the Amazon. Knez stated in an interview with TradeArabia that the group has already secured “an impressive long-term land preservation agreement for 50 million hectares of rainforest, an area larger than Spain.” The company asserts that “investors will benefit from the potential capital appreciation of the security” in large part due to “the finite size” of the rainforest it is tokenizing.

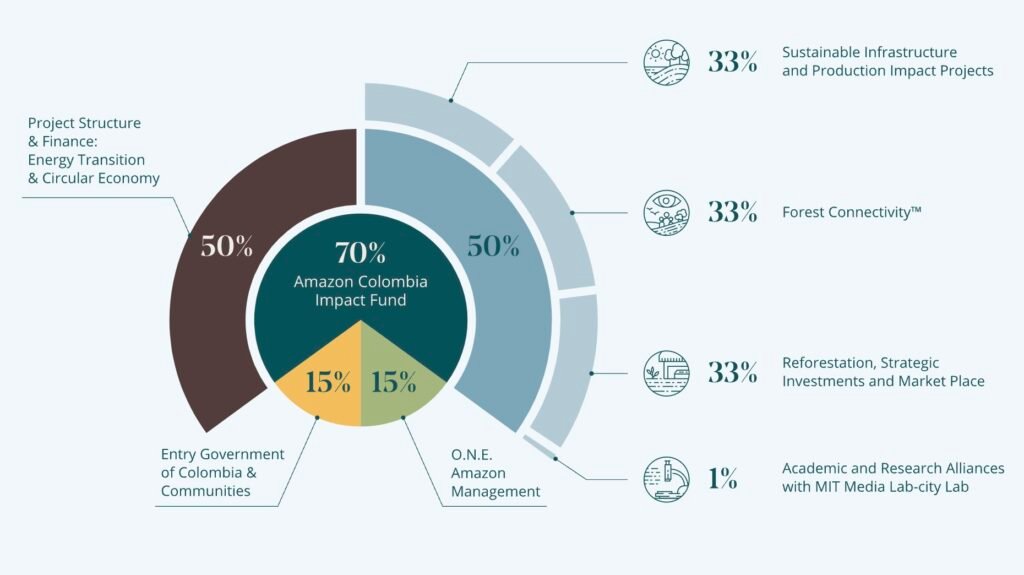

Proceeds from purchases of this security will go to the O.N.E. Amazon Impact Fund (OAIF), which is headquartered in Abu Dhabi, UAE and “will create jobs for the local Amazonian communities and accelerate the energy transition of the countries through which the Amazon rainforest extends.” At its COP28 launch, O.N.E. Amazon, along with the OAIF, was described as “the world’s first trillion-dollar nature-based asset platform.” Goldman Sachs is the “structuring partner” for the fund. The company has also stated that this fund “will invest in energy transition and circular economy projects, including infrastructure and clean energy generation projects, in addition to more localised community land preservation projects in the Amazon.” It also purports to “better the lives” of the millions who inhabit the region.

However, as we shall soon see, O.N.E. Amazon’s efforts to-date in the Amazon show that the group, despite claiming to champion ecosystem preservation and indigenous well-being, have acted predatorily with respect to indigenous Amazonian tribes. They are also backing major industrial projects in the countries it operates that do not benefit the local people or environment, arguably the opposite.

In order to help underwrite their digital asset security linked to each hectare of the Amazon rainforest, O.N.E. Amazon plans to build the “world’s first Internet of Forest (IoF)” in partnership with MIT Media Lab and the aforementioned satellite surveillance company, Satellogic. A percentage of the OAIF will go toward building out the IoF and other investments in Amazon “data enablement.” MIT Media Lab is specifically helping O.N.E. Amazon create “a framework to monitor every hectare that is tokenized against a Digital Asset Security” that will also “provide a data-driven, real-time understanding of what’s happening the Amazon biome.” On its website, O.N.E. Amazon states that the IoF will “monitor and analyze the health” of the rainforest while also “digitally connect[ing] every hectare of land.” According to O.N.E. Amazon co-founder and CEO Rodrigo Veloso, a former board member of Trump Media & Technology Group:

“The Internet of Forests is intended to ensure reliable measurements of key environmental and social metrics; serve as world – class data collection and storage infrastructure for scientific analysis of forest environments; and enable local communities to better understand how their behavior and the behavior of institutions impact the natural environment within the rainforest.”

Chris Lang, contributing editor of the REDD-Monitor substack, revealed in a 2023 report that O.N.E. Amazon has sought to trademark the “Internet of Forests” concept since 2021 and that the trademark is intended to cover the following:

“Software as a service; electronic data storage; database development; data analysis and processing; information / data processing; research on agroforestry and agroecological systems; research activities, including the use of apparatus and instruments for activities related to the operation of monitoring and measuring forestry and lands; scanning; advice and consultancy in carrying out tests and measurements for quality control; measurement and verification of carbon dioxide emissions and other greenhouse gases; aero photogrammetry; photogrammetry; land surveying; topographic surveys; geological surveys; environmental control of air and noise pollution; research in the field of environmental protection; geological research; biological research; providing scientific information, advice and consultancy relating to carbon offsetting; development of technical projects on agroforestry and agroecological systems.”

Given the mentions of carbon dioxide emissions and carbon offsetting, it seems clear that the O.N.E. Amazon security and the “Internet of Forests” underwriting it intends to integrate into the broader efforts to impose carbon markets globally. As noted in previous reporting, Latin America has been a major focus for “green” bankers and financiers in this regard and O.N.E. Amazon, like groups like GREEN+, are using deeply inequitable contractual agreements made at the local level to implement their plans. The O.N.E. Amazon contracts will be discussed in later detail shortly.

In addition, in a research paper published earlier this year in April, O.N.E. Amazon co-founders Peter Knez and Rodrigo Veloso joined O.N.E. Amazon partner Veea and Mysten Labs to develop an approach where blockchain technology could be integrated into “biodiversity conservation, offering a novel perspective on how digital resilience can be built within ecological contexts.” The paper, entitled “Preserving Nature’s Ledger: Blockchains in Biodiversity Conservation,” promotes a framework that focuses on “tokenization strategies for biodiversity species and for IoT solutions, such as sensors, drones, and satellites to monitor and record data related to species and ecosystems.”

The paper notes that the biodiversity data obtained under this framework could be used to develop new green bonds and derivatives that could be traded on a blockchain. To accomplish this, they propose the “datafication of biodiversity,” which they define as “the process of creating digital representations of various species in the ecosystem. They also propose “data repurposing cascades,” which refers to “the process of reusing collected biodiversity data for various purposes […] that are not necessarily and directly connected to conservation efforts,” i.e. commercializing the biodiversity data they obtain. One example given later on relates to how “all collected data can be used to create AI training sets aimed at identifying and resolving threats to biodiversity.” That example claims that the data could be used to train an AI that deploys “swarm intelligence drones that are in contact with sensor on the ground” to “manage threats and shocks to biodiversity.”

The paper fails to establish how these “innovations” will actually promote and protect biodiversity. The paper merely says in its conclusion that “the results of leveraging [biodiversity] data will hopefully help in biodiversity preservation via sustainable digital technology investments” (emphasis added). It seems likely that these technology investments allude to the expansion of the sensor network and the Internet of Forests, which appears to be much more about surveilling the natural world and turning it into a financial asset than actually promoting biodiversity, as well as the the aforementioned use of “swarm intelligence drones” to “manage” biodiversity.

Notably, Mysten Labs, which co-authored the paper with O.N.E. Amazon’s co-founders, is deeply tied to the Peter Thiel and DARPA-linked social media network Facebook and its efforts to make its own digital currency. Mysten Labs was founded in September 2021 by four former members of Meta/Facebook’s stablecoin project Libra, also known as Diem and Novi Financial. Evan Cheng, co-founder and CEO was previously the head of Research and Development at Novi Financial, while Sam Blackshear, another co-founder and the CTO of Mysten Labs, was previously the Chief Engineer at Novi, having contributed significantly to the creation of the MOVE programming language used by Libra/Diem while at Meta. The founding team also includes Adeniyi Abiodun and George Danezis, key contributors to Diem’s stablecoin and the aforementioned MOVE programming language –– the language now employed by Mysten Lab’s blockchain, Sui.

O.N.E. Amazon’s Partners

Though past efforts of O.N.E. Amazon have involved collaborations with groups like the aforementioned Mysten Labs, the only “official” partners it lists on its website include MIT Media Lab, Satellogic, Aecom and Veea. The latter three have significant connections to the U.S. government, namely the U.S. military and intelligence community.

MIT Media Lab was previously the force behind the creation of the Digital Currency Initiative, which partnered with the U.S. Federal Reserve on assessing the feasibility of a U.S. dollar CBDC (that effort is known as Project Hamilton). It is also known for its prior yet very deep financial relationship with sex trafficker of minors, currency speculator and financial criminal Jeffrey Epstein, who not only funded MIT Media Lab and cultivated a close relationship with its former head Joi Ito, but also brought in other major donors like Bill Gates and Leon Black. Epstein was extremely interested in cryptocurrency and previously invited crypto pioneer Brock Pierce to his island to speak on cryptocurrency. Pierce would later create the dollar stablecoin Tether (USDT) along with William Quigley, a long-time business partner of Bill Elkus, a former trustee of the J. Epstein Foundation and founding partner of Idealab, the first institutional investor in PayPal. MIT Media Lab appears to not have publicly commented on its partnership with O.N.E. Amazon.

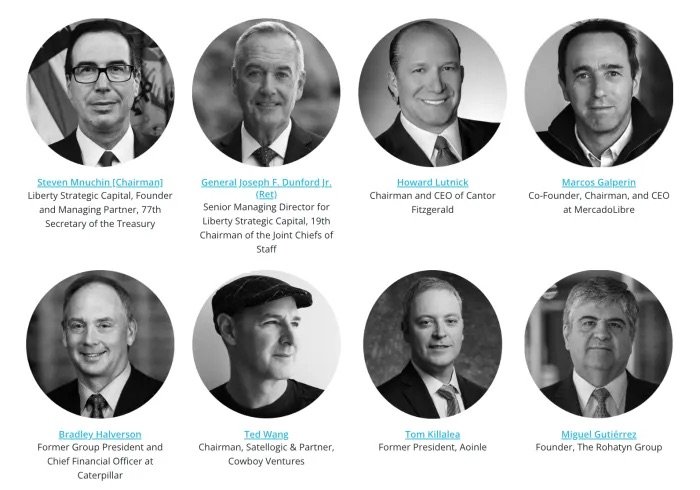

The other partner of O.N.E. Amazon in its IoF project is Satellogic. Satellogic was recently the recipient of $30 million investment from Tether (USDT) and Howard Lutnick, the long-time CEO of Cantor Fitzgerald – the custodian of much of Tether’s U.S. Treasuries, sits on the board. Lutnick and Cantor both hold 23.9% each of Satellogic shares, for a combined 47.8%. Lutnick was recently named co-chair of Donald Trump’s transition team, where he will help Trump choose cabinet and other executive appointments if Trump’s 2024 election bid is successful. Satellogic’s board is also chaired by Steve Mnuchin, Trump’s former Treasury Secretary who helped implement BlackRock’s “Going Direct” plan months before and throughout the Covid-19 crisis. “Going Direct” put the bulk of money printed for economic relief intended to mitigate the effects of lockdown policies on regular Americans into the hands of Wall Street giants like BlackRock. BlackRock, whose head Larry Fink was tapped by Trump to develop the government’s fiscal response to the crisis, used much of that money to buy shares in their own ETFs. The former Joint Chiefs of Staff of the U.S. military under Trump, Joseph Dunford, is also on the board of Satellogic.

Aside from its board, Satellogic’s co-founders, Emiliano Kargieman and Gerardo Richarte, were long-time contractors for DARPA, the NSA and other U.S. intelligence agencies prior to founding Satellogic. Kargieman recently stated that the company’s investment from Tether would help Satellogic advance more easily into the U.S. “National Security market,” i.e. intelligence contracts. Tether itself onboarded the FBI, the U.S.’ domestic intelligence agency, and Secret Service onto its platform last year, allowing them to surveil and seize Tether from wallets deemed unfriendly by the U.S. government.

In addition, Satellogic, as we reported in Debt From Above, was also a key partner in an effort called GREEN+, which seeks to use satellite surveillance to turn Latin America’s protected areas into tokenized carbon credits to be traded on the Bitcoin side-chain Rootstock (RSK) and to finance industrial projects that would construct an inter-continental “smart grid” digitally linking the Americas.

Satellogic isn’t the only concerning firm partnered with O.N.E. Amazon. Another partner, Aecom, is the successor to the CIA-linked Ashland Oil and currently contracts extensively with USAID, widely believed to be a CIA front organization. In the 1970s, Ashland Oil pled guilty to multiple counts of making illegal domestic campaign contributions, which later became part of the Watergate scandal, and of bribing government officials in several countries. During this same period, Ashland was revealed to be a recipient of large amounts of CIA funds for “undisclosed purposes,” roughly half of which were paid in cash. Ashland, the CIA and the SEC all refused to comment on the nature of these payments. The Washington Post also reported in the late 1970s that the CIA had used Ashland Oil as “a cover for an agent operating abroad.” In addition, throughout the 1970s and 1980s, Ashland Oil played a central role in a number of scandals that involved CIA veterans operating in Oman and Libya. Those veterans worked on behalf of what was known as the “private CIA” created during the Carter administration by Ted Shackley, the CIA’s “blonde ghost,” and former CIA covert operations officer Thomas Clines. As noted in One Nation Under Blackmail, the “private CIA” cabal initiated what would become known as the Iran-Contra scandal and its members, including Clines, would become its main conspirators. The same group would later help give rise to Jeffrey Epstein and the networks that enabled his sexual and financial misdeeds.

The subsidiary of Ashland that would become Aecom, Ashland Technology, was formed in 1985, when Ashland was still steeped in clandestine intelligence ties. It was formally spun off in 1990, forming Aecom. Aecom, which now describes itself as an infrastructure firm serving governments, businesses and organizations, acquired long-time USAID, World Bank and Ford Foundation contractor PADCO (Planning and Development Collaborative International). It subsequently acquired a PADCO competitor, The Services Group, and launched Aecom International Development, making the company a major contractor to USAID. The Ford Foundation has long-standing connections to the CIA and USAID itself is widely believed to itself be a CIA front (see here, here, here and here). One of Aecom’s partners on USAID contracts, the Nature Conservancy, is deeply connected to the efforts to financialize nature and use “debt-for-nature” or “debt-for-climate” swaps to force national governments in the Global South to implement certain policies favored by Nature Conservancy stakeholders, such as J.P. Morgan. Notably, a document provided by O.N.E. Amazon partner Veea to the SEC, claims that USAID is directly involved in O.N.E. Amazon’s efforts along with unspecified “UN agencies.”

Veea is a major developer of “smart city” technology that is pioneering the creep of those technologies into rural areas and farms. They are also a major provider of 5G technology. They have a deep relationship with U.S. military contractor Qualcomm, which describes itself as “the driving force behind the development, launch and expansion of 5G.” Veea is one of Qualcomm’s main partners in that endeavor. For instance, Veea is part of Qualcomm’s Rural Cloud Initiative, which seeks to use 5G connectivity to “digitally transform” rural areas and agriculture through developing its AI-powered “FarmGrid solution.” Veea is also part of Qualcomm’s Smart Cities Accelerator Program. Veea is also a major provider of technology aimed at deploying the “metaverse” and augmented reality wearables. For example, last year, they announced a merger with augmented reality hardware producer Ostendo Technologies. As will be noted later, Peter Knez’s venture before O.N.E. Amazon, the Venom Foundation, was also pushing into the metaverse. Ostendo is backed by the U.S. military’s DARPA and Peter Thiel, who co-founded the deeply CIA-linked data-mining firm Palantir. Thiel is intimately connected to Trump’s vice presidential pick J.D. Vance and previously played a significant role in Trump’s transition team during his first term in addition to being a major donor to Trump in the 2016 election. Ostendo has also worked as a contractor for the U.S. intelligence community’s DARPA-equivalent IARPA.

Veea provides the hardware that links together the Internet of Forests (IoF) sensors, which were developed by MIT media Lab and “others.” It states that building the IoF will occur in 5 phases, beginning with data infrastructure, followed by satellite and drone-provided imagery. The subsequent phases involve “environmental sensing,” “socio-environmental sensing” which appears to refer to surveilling the activities of locals living in the surveilled areas, and finally “bio-sensing” that will provide “molecule-level insights.”

Veea frames the IoF project as ultimately leading toward an “AI-driven neural network for our planet.” The effort to develop that neural network, framed as being founded on the “principle that all species and ecosystems on this planet are part of a single system,” are already underway. Called “Enterprise Neurosystem,” the goal is to “link all the relevant climate networks and data sources” for “climate projects” around the world into “a single open AI framework” and “conduct a higher order analysis across all points of reference in real time.” This “AI neurosystem” would span the entire planet and its partners include not only Veea, but Microsoft, Google, Meta/Facebook, IBM, Intel and Yahoo!, among others. In other words, the IoF of O.N.E. Amazon is intended to eventually span every forest, everywhere, with major implications for nature and society.

O.N.E. Amazon’s Dubious Track Record and Future Plans

In September 2022, O.N.E. Amazon signed an agreement with the indigenous organization FICSH, which represents the Shuar people of the Ecuadorian Amazon. FICSH, after reading the agreement more carefully, voted to cancel the agreement with O.N.E. Amazon just a few months later in early February 2023. Regional activist groups like Acción Ecológica have noted that the contract signed dramatically favored the interests of O.N.E. Amazon and put the Shuar at a major disadvantage.

For example, the surveillance systems placed in the forest as part of the agreement, i.e. systems like the Internet of Forests, would be under the exclusive control of O.N.E. Amazon, and the company could use any type of surveillance device in Shuar territory and pass that data along to anyone they choose without oversight. In addition, any development or conservation project in Shuar territory related to the agreement are to also be under the exclusive control of O.N.E. Amazon and the company also possesses final authority over what private businesses or NGOs can enter Shuar territory to execute those projects.

The Shuar are also expected to help facilitate the surveillance of its territories by both the sensor network and by satellite, i.e. Satellogic, and those that ultimately purchase the O.N.E. Amazon digital asset security are also enabled to “observe” the Shuar’s land via satellite per the contract. The proceeds from the sale from the security derived from Shuar land are also to be under the exclusive control of O.N.E. Amazon, with the Shuar only entitled to 15% of the profits that O.N.E. Amazon and its OAIF custody. The contract says the Shuar would receive half of their money within 30 days after the sale concludes and the remaining half would be disbursed annually over the remaining 30 year duration of the contract.

In addition, only O.N.E. Amazon can unilaterally cancel the agreement, meaning that the Shuar’s rapid change of opinion in the contractual agreement could see them still wait decades before they are actually free of its terms. It also opens up the possibility that O.N.E. Amazon could cancel the contracts after selling its securities but before the 30 days they have to pay the Shuar their half of their meager share of the sales. Ultimately, as REDD-Monitor’s Chris Lang noted, O.N.E. Amazon’s contract with the Shuar “would result in a panopticon-level of surveillance over” their territory, give O.N.E. Amazon control over the monetization of that data, allow O.N.E. Amazon to choose what businesses can enter into and act upon Shuar territory without Shuar consent, and allow O.N.E. Amazon to make almost all of the money. O.N.E. Amazon seems to have secured the signing of this deeply inequitable contract by paying Shuar leadership $10,000 followed by $90,000 once the contract was signed. Yet, given what the Shuar have lost and stand to lose – and what O.N.E. Amazon stands to gain – $100,00 is next to nothing.

In addition to their past contracts with the Shuar, there is also the partnership between the Colombian government and O.N.E. Amazon to consider. O.N.E. Amazon, which no longer publicly discusses its past controversy with the Shuar, instead highlights their partnership with the government of Colombia and how the OAIF will be investing in “energy transition and circular economy projects” which will ostensibly benefit both the local environment and local inhabitants.

For instance, the proposed OAIF-funded project in Ciénaga involves a “clean energy” port and industrial park as well as two offshore wind projects to be placed off the coast of the Ciénaga port. The offshore wind projects will be entirely owned by BlueFloat, a Spanish offshore wind company. BlueFloat is a portfolio company of 547 energy, which itself is part of the Houston-based Quantum Energy Partners (now Quantum Capital). Quantum, traditionally focused on the oil and gas sector, has – since 2021 – been investing very heavily in carbon capture and carbon market infrastructure companies and it was reported in June 2024 that Quantum has been attempting to sell its stake in BlueFloat for €500 million.

According to O.N.E. Amazon, the Environmental Impact Assessments for the offshore wind projects will be performed by USAID contractor and O.N.E. Amazon partner Aecom. The bulk of the power generated by this plant will not go toward powering local communities but instead will mainly power the Ciénaga industrial park including the Ciénaga desalination and “green” hydrogen production plant as well as the proposed Ciénaga “green” mineral processing zone, which will process raw minerals from Chile and Argentina (likely lithium) and other South American countries. The area of Ciénaga, per O.N.E. Amazon, has 2000 hectares of industrial “development potential.”

In addition, as noted by O.N.E. Amazon, the “stakeholders” they have engaged with respect to the offshore wind project does not include local inhabitants, indigenous groups or environmental activists. Instead, it includes “authorities in key [Colombian government] institutions involved in the project” as well as the British and Spanish embassies, which O.N.E. Amazon says are “closely collaborat[ing]” on the projects. It also states that there have been “discussions” with the International Finance Corporation and the World Bank, defined by the U.S. military as “financial weapons” of U.S. government power, about “potential support schemes” for the projects.

According to O.N.E. Amazon, locals who will benefit from these projects will merely be those employed as “workers, maintenance personnel and [other employed] possibly in related activities such as transportation and logistics.” The proposed projects at Ciénaga will “benefit” indigenous tribes by “conserving” the “black line” (línea negra) that separates indigenous territory from non-indigenous territory.

In addition to Ciénaga, O.N.E. Amazon is backing the production of biocrude from agricultural biomass. The end result of the biocrude produced will be for the aviation industry, as it is intended to produce sustainable aviation fuel (SAF). The plants will be run and operated (and presumably owned) by two foreign companies – the Dutch company BTG Bioliquids and Alder Fuels (now Alder Renewables). BTG and Alder are partners.

Alder was founded by Bryan Sherbacrow, who embezzled $5.9 million from Alder and was sentenced to 3 years in prison this past June. In January 2023, shortly before Sherbacrow was removed from his role as CEO, Alder received millions from the U.S. Department of Energy to develop its SAF production process, which has also been tested at the DoE’s National Renewable Energy Laboratory “with support from the U.S. Defense and Logistics Agency,” part of the U.S. military. Alder is also seeking to use “blockchain technology tools to account for all the emissions claims from the use of the SAF” in order to “generate the necessary records and transparency for compliance with regulatory frameworks, ESG standards and other sustainability commitments.” This will directly enable the functionality of carbon markets as it relates to air travel.

In summary, the O.N.E. Amazon’s OAIF-funded projects in Colombia profiled above are industrial projects that will greatly benefit foreign companies and are being closely developed with foreign governments (like the UK and Spain) as well as entities that are funded by or are contractors for the U.S. government. Their “environmental” benefits are dubious and, while it would create industrial hubs that could theoretically generate economic growth for the population, the bulk of the infrastructure will be owned by foreign companies, which also receive the vast majority of the profits that result from these projects.

Starlight Ventures and Jalak Jobanputra

O.N.E. Amazons’s sole known funder is Starlight Ventures, which funds companies that produce “transformative technologies to fix the world.” Its other investments focus mainly on biotechnology, lab-grown meat, carbon market infrastructure, autonomous mining vehicles and space-related technologies, especially satellite surveillance firms. The firm was co-founded by Patricia Wexler, a Venezuelan-American businesswoman who previously worked with top Disney executives and then Elevation Partners, a significant investor in Facebook, Uber and other prominent tech companies.

Starlight Ventures also has ties to the Endeavor Network, which is deeply embedded in Latin America – particularly its cryptocurrency infrastructure – and is heavily funded by the controversial Bronfman family and Pierre Omidyar, the founder of eBay and owner of PayPal from 2002 to 2015. For instance, one of its three venture partners is Santiago Bilinkis, one of the earliest fixtures in the Endeavor Network who – among other things – first connected Wences Casares, the founder of Xapo Bank, with Endeavor’s Linda Rottenberg. Bilinkis later co-founded Wanako Games with Casares and has served on Endeavor’s board of directors. Bilinkis is still involved with Endeavor’s Argentina branch, serving on its Council of Founders alongside Argentine oligarchs like Eduardo Elzstain, host of the Bilderberg-style Llao Llao Forum in Bariloche, Argentina. Starlight also invests in some Endeavor-backed companies, like Satellogic, which is also considerably connected to Endeavor’s Argentina branch.

According to an older profile written by Starlight Ventures about O.N.E. Amazon and cited by Acción Ecologica, an investor named Jalak Jobanputra is named the third co-founder of O.N.E. Amazon. Jobanputra, before founding her VC firm Future Perfect Ventures, was the director of Emerging Market Mobile Investments for Pierre Omidyar’s the Omidyar Network and also previously worked for Intel and Lehman Brothers. While at the Omidyar Network, Jobanputra closed “Omidyar’s largest for profit investment ($5M) to date in Latin America, a wireless company that created credit profiles on unbanked middle income consumers using mobile data.”

It was reportedly during her time at the Omidyar Network that Jobanputra became interested in bitcoin and cryptocurrency. More specifically, it was her “time spent in Africa analyzing the growth of the mobile money services platform M-Pesa,” which led her to believe that crypto and bitcoin adoption were more likely to succeed in emerging markets. However, Jobanputra links adoption of these technologies to having a digital ID “that you [can] have different assets associated with and can transact with.” Notably, the Omidyar Network is a long-time funder of technologies that enable CBDC issuance as well as Digital ID. In addition, through Endeavor, the Omidyar Network backs the biggest companies in Latin America’s fintech space, effectively dominating the payment rails for crypto and bitcoin and therefore centralizing control over them and neutering the supposed “decentralizing” effects of cryptocurrency and bitcoin adoption.

In Jobanputra’s case, her current VC firm has invested in a variety of crypto companies including BitGo, Blockstream and Celo. BitGo was founded by Mike Belshe, a big supporter of Trump VP pick JD Vance, alongside Ben Davenport and has previously custodied the U.S. government’s bitcoin. Blockstream is fundamentally connected to Bitcoin Core and, thus, has played an outsized role in most of the past major updates made on the Bitcoin network, making them so important to that network that Endeavor’s Reid Hoffman once suggested they would be the Microsoft or Google of blockchain (Hoffman is a key member of the Endeavor network and “PayPal Mafia,” and was previously a Blockstream board member and is also a major Blockstream investor). Celo is a “mobile first,” “carbon neutral” blockchain with a major focus on “scaling voluntary carbon markets” and stablecoins. Its investors include Reid Hoffman, Jack Dorsey and Coinbase Ventures. Celo has a particularly important relationship with Circle’s dollar stablecoin USDC, which Coinbase’s Brian Armstrong once suggested would become the U.S.’ de facto CBDC. Circle and USDC are deeply connected to BlackRock, with BlackRock holding a minority stake in Circle, Circle’s USDC being used to convert shares of BlackRock’s first tokenized fund BUIDL into digital dollars, and the Circle Reserve Fund being managed by BlackRock.

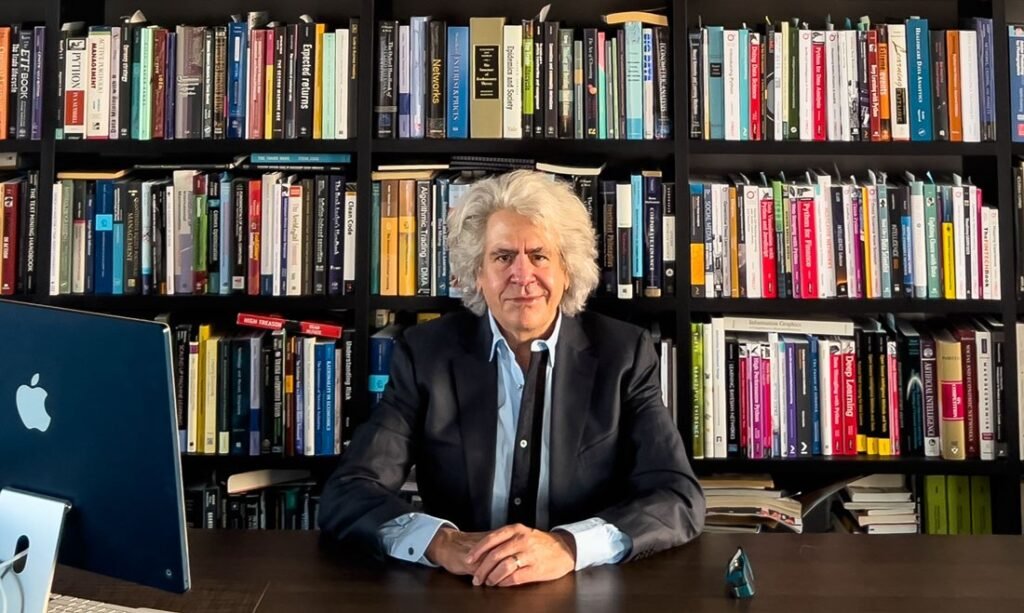

Peter Knez and the Venom Foundation

O.N.E. Amazon co-founder Peter Knez began his career at Goldman Sachs as a Quantitive Research Associate, before joining Barclays’ BGI as their Chief Investment Officer. While employed at Barclays, Knez personally oversaw the creation of their iShares brand, an essential pillar in the proliferation of the now-dominant ETF market. In a conversation with Nasdaq, Knez claimed that “ETFs really only started with iShares at BGI.” According to Knez, “there was a simple reason for developing it: we were the largest institutional asset manager without a mutual fund product and wanted to expand into retail.” The iShares ETFs “allowed us to enter the retail market and compete with Mutual Funds” by “replicating existing indexes with a product that traded on exchanges, while disclosing their holding on a daily basis and delivering liquidity and transparency in a tax efficient format.”

Due to global collateral damage during the 2008 financial crisis, BGI was eventually acquired by BlackRock in 2009, who took the iShares brand to new heights, including the fastest growing ETF in history, the IBIT spot Bitcoin ETF. When asked about BlackRock’s Bitcoin ETF, Knez implied “we are in the early innings of the ‘institutional’ regime in cryptocurrencies and blockchain as the Wild West regime ends,” and later described this institutional regime as “characterized by increased participation of institutions like BlackRock and by governments” while noting incoming “legislation providing a regulatory framework for digital assets” within the United States. Knez further claims that “BlackRock wants to participate in this regulatory momentum” and stated his believe that “BlackRock will ultimately succeed” due to their “excellent track record” while articulating suspicions that CEO Larry Fink “would not have gone public if it was not pre-approved.”

Knez, however, has stated that Bitcoin as a speculative asset is less important than the underlying blockchain technology:

“My view is Bitcoin is to blockchain much like search or pornography was to the internet. It drove early adoption, but the underlying technology is much more important. Technologies that remove important frictions and improve benefit for society, those are the ones that persist. Blockchain, in my view, is such a technology, and the institutions believe it, too. I’ve talked to BlackRock, I had lunch today with very senior people at Morgan Stanley, they believe it too. And they’re preparing for it. They’re preparing for it because they know it’s a quantum leap and they know they have to be in this game they cannot stand on the sidelines.”

In a conversation with CertiK, Knez noted that this imminent transformation was why he “couldn’t resist getting involved.” He later made reference to his former Goldman Sachs boss, Fischer Black, best known as one of the authors of the Black–Scholes equation, who “started option pricing” and “created the whole notion of synthetic replication.” According to Knez, “tokenization of real world assets is as big, or bigger than that” and will “dramatically change the way assets are managed”:

“Once you tokenize it, you can trade it. Once you can trade, it you can index it. Once you index, it you can write synthetics on it. That’s transformative in a way that’s never been transformed ever…The reason you see guys like Larry Fink pushing tokenization now is, for one, that Aladdin’s about to have the functionality he wants for his clients. [And] number two, there’s not a lot of alternatives to go scale the business. This is a way for the large institutions, whether it’s Morgan Stanley or BlackRock or the other asset managers, this is a way for them to scale their business. And so that’s why I think it’s inevitable.”

In line with these beliefs, Knez participated in the launch of a new layer one blockchain, Venom, and alongside it founded the Venom Foundation in 2020. Other Venom Foundation members include Mustafa Kheriba, the Executive Chairman of Iceberg Capital; Dr. Kai-Uwe Steck, manager of Pontinova Circle Investment Group; Osman Sultan, the former CEO of DU Telecom and Founder of Fikratech; and Shahal M. Khan, Founder of Burkhan World, Trinity Hospitality Holdings and the CEO of Burtech. In August 2023, the Venom Foundation signed a Memorandum of Understanding (MOU) with the United Arab Emirates Government to “develop and implement the National Carbon Credit System” in preparation of the country hosting COP28 that November. “Venom Foundation has provided an unparalleled solution, acting as a key infrastructure for a global ecosystem for Web3 applications, with superfast transaction speeds and unlimited scalability to meet governments’ needs.” Knez explained that the foundation is “the first company in the UAE to develop and licence its blockchain technology and shape the future of national decentralised systems and digitise operations in corporate and government enterprises.” The MOU further covers “green investment,” “adaptation to climate change,” “reducing carbon emissions,” “preparing and implementing a climate neutrality strategy,” while “enhancing partnership opportunities with the private sector.”

Knez expressed his excitement upon the signing of the MOU, commenting that the foundation is “honored and excited to join hands with the UAE Government to build the National Carbon Credit System.” The press release claims that this was “a revolutionary collaboration” which demonstrates “the UAE’s unwavering commitment to bolstering transparency, reliability, and efficiency in carbon emission management” via “the next generation blockchain technology of Venom” which boasts being “carbon neutral.” Knez, the chair of the foundation, had previously told Nasdaqthat Venom was “focused on three primary projects: stablecoins, carbon credits, and commodities” and furthered that “with respect to stablecoins” the foundation was “involved with governments and commercial banks in countries both in Africa and Asia.” Knez believes the “combination of blockchain and smart contracts” will “profoundly transform financial services” in the ensuing decade. “They will be unrecognizable, as almost every core function in financial services will be transformed.”

In order to advance this transformation, the Venom Foundation partnered with Iceberg Capital, led by Venom foundation member Mustafa Kheriba, in January 2023 to form the Venom Ventures Fund (VVF). The goal of the VVF was to create “a ten-figure war chest” with $1 billion dedicated to “accelerating the adoption of blockchain, DeFi, and web3 in MENA and beyond.” Knez was chosen to chair the venture, while readying “strategic investments” to “transform digital asset management” via the “ideal platform for us to achieve this goal,” the Venom blockchain. Interestingly, both the Venom Foundation and Iceberg Capital currently operate within the Abu Dhabi Global Market (ADGM), a “fast-growing financial center situated in the heart of the UAE’s capital.” It was founded a decade ago to “promote entrepreneurship throughout the United Arab Emirates and the wider MENA region.” Venom had previously been granted “a formal license to issue utility tokens by ADGM” and according to Forbes, became “the first blockchain to come under government agency control” and to be “monitored by a regulatory body.”

According to reporting from The Block, at the time of its announcement, the fund said it had led a $20 million investment in Nümi Metaverse and the next January announced a $5 million investment in Layer 1 blockchain Everscale, while “no deals have been announced since.” In a December 2023 tweet, the Venom Foundation announced they will “no longer continue operating in ADGM and in accordance with section 40 of the regulations, the Foundation has initiated the dissolution process.”

While there is little to show for the $1 billion fund launched in 2023, just last week, Venom announced a “historic agreement with the government of the Republic of the Philippines” in order to “digitize billions of accountable forms using its advanced blockchain technology” in “what could end up as the world’s largest blockchain use case,” according to reporting from Gulf News.

Christopher Louis Tsu, the CEO of Venom Foundation, called Venom’s selection by the Republic of the Philippines a “testament to our platform’s capabilities and the trust placed in our technology.” He furthered noted that “by digitizing checks using Venom blockchain, we are not only reducing printing and processing costs but also significantly enhancing transparency and efficiency in financial operations” demonstrating “the massive utilization of the Venom blockchain in the form of hundreds of millions of Venom tokens annually” while showcasing their “commitment to delivering scalable, secure, and innovative solutions for national-level applications.”

These aspirations for further institutional and nation-state adoption of blockchain was seemingly echoed by Knez in a discussion with CoinTelegraph in March 2023:

“It is the early innings of the institutionalization of Web3. It’s early innings, but it’s going to happen… If you want to attract institutional money, you’re going to have to seek regulation… The era of the Wild West is ending, which I think is good for everybody. So I advise them to to embrace the institutionalization, as that’s what time it is.”

Now, with O.N.E. Amazon, it appears clear that Knez is seeking to again partner with major governments to tokenize real world assets, in this case the natural world, and to enable the advancement of a global carbon market/carbon offset economy.

Rodrigo Veloso’s “O.N.E” Empire

The other co-founder and current CEO of O.N.E. Amazon is Rodrigo Veloso, a Brazilian entrepreneur who developed the O.N.E. Coconut Water brand, later sold to PepsiCo in 2012. That same year he co-founded Brazil’s first online insurance company, Segurar.com, though it appears not to have launched until 2013. Around this time, in 2013, Veloso began working at Unik Capital, which operates in both the U.S. and Brazil, and he claims to still work there even though he is not mentioned on the company website. He has also claimed to be the founder of Unik Capital and that he used his funds from selling O.N.E. Coconut Water to Pepsi to do so. However, only CEO Sylvie Proia is listed as the founder on the company’s website.

A year after joining Unik Capital, in 2014, Veloso attempted to acquire a decommissioned naval base in Puerto Rico and turn it into a “mix of Disney World and Las Vegas,” a “green city with a focus on entertainment,” marking his first foray into “green” business ventures that would later culminate with his role in co-creating O.N.E. Amazon. In addition to O.N.E. Amazon, Veloso also created another company called O.N.E. Natural Energy that specializes in producing syngas, which can be produced from “a wide range of carbon-containing substances” and is used to generate electricity or “as a building block for a range of desirable commodities, from methanol to gasoline.” O.N.E. Natural Energy currently operates in Brazil.

A few years before creating O.N.E. Amazon, Veloso played an interesting role in the efforts to take Trump Media & Technology Group (TMTG), the parent company of the Trump-centric social network Truth Social, public. Beginning in 2021, TMTG planned to merge with Digital World, a special purpose acquisition company or SPAC. The merger ultimately occurred in March of this year. The merger was controversial and fraught with scandals for Digital World. As a consequence of the insider trading allegations and fines from the SEC, former CEO of Digital World Patrick Orlando was fired from that role in March 2023 due to the scandals, though Orlando has sued the new CEO, Eric Swider, alleging Swider had planned a “coup d’etat” of Digital World to depose him.

Rodrigo Veloso is a close friend of Orlando’s and was a Digital World board member from July 2021 until December 2022. Veloso was also present on a pre-merger call with Trump, while still a board member at Digital World, which later became a key focus of the SEC investigation into Digital World that ended with the SEC suing Orlando (the suit was filed after Orlando was fired from Digital World). The New York Times reported that Veloso was acting as an adviser to Orlando on the call. In addition to the SEC charges against Orlando, Digital World was fined $18 million by the SEC. There have been no allegations of TMTG itself engaging in improper trades or other activities related to charges against Digital World and its past executives. Ultimately, the SPAC merger between TMTG and Digital World added billions to Trump’s net worth and allegedly provided a “financial lifeline” to the former president. Veloso, in addition to his ties to Orlando and Digital World, was also a board member/director of TMTG itself from September 2021 until December 2022, the same time he resigned from Digital World when the then-Orlando-led company was the subject of several investigations. Notably, during this same period of time (2021-2022), Veloso was laying the groundwork for the formal launch of O.N.E. Amazon, including efforts to trademark the Internet of Forests concept and signing the controversial agreement between O.N.E. Amazon and the Shuar in 2022.

Carbon Sink or Debt Sink?

In examining the efforts of O.N.E. Amazon and their recently announced partnership with Satellogic, it is worth dwelling on why a company like Satellogic, which is deeply tied to the stablecoin Tether and the U.S. Treasuries market through its board member Howard Lutnick, might wish to be involved with such an endeavor.

Much like a corporation, the United States government itself has a budget it must finance, partly through taxation of citizens and companies, but mostly via the issuance of new debt sold in the form of government bonds known as Treasuries. These securities are directly issued by the U.S. Treasury with the yield, or rate of the return, effectively set by the U.S. Federal Reserve and its governors via the Federal Funding Rate, commonly referred to as an interest rate. Typically, these bonds yield a higher rate of return the longer the duration for which they are issued. For example, a 30 year Treasury would yield a higher coupon than a 3 month Treasury to incentivize buyers to hold U.S. debt for greater periods of time, giving the government a longer runway to service their debt obligations. On March 15, 2020, the Federal Reserve Committee cut the targeted federal funding rate to 0% due to “the effects of the coronavirus” weighing “on economic activity in the near term” and thus “risks to the economic outlook.”

“The coronavirus outbreak has harmed communities and disrupted economic activity in many countries, including the United States,” the Fed statement said. “Global financial conditions have also been significantly affected.” Despite the ensuing lockdowns and widespread fear of the virus, President Trump praised the Fed that week, saying in a briefing at the White House that the rate cut “makes me very happy.” In retrospect, the combination of government-mandated lockdowns and the Fed’s aggressive rate cut, with unprecedented financial stimulus being distributed (with heavy profits) with collaboration from private sector stalwarts like BlackRock, systemically changed the financial system not just for the U.S., but the world at large. In fact, the Fed “struck a deal” with five other central banks including the Bank of Canada, the Bank of England, the Bank of Japan, the European Central Bank and the Swiss National Bank, to “lower their rates” to “keep the financial markets functioning normally.”

By printing trillions of dollars of newly issued debt at effectively 0% interest rates while simultaneously shuttering monetary velocity and demand alongside the businesses forced to close by their reactionary legislation, Trump’s Treasury, led by current Satellogic board Chair Steve Mnuchin, massively increased the monetary supply and the U.S. government’s debt obligations while minimizing the immediate inflationary effects of such stimulus. This unprecedented combination of Fed, Treasury and domestic policies allowed huge profits for the highest wealth bands in the nation, with those closest to the money spigot able to gobble up commodities with freshly printed dollars. Arguably, no company benefited more than BlackRock, having been a chief architect of the “Going Direct” plan, which allowed them to use these supposed pandemic relief funds to purchase large swaths of assets including from their own iShares ETF division, having acquired the Knez-led iShares from Barclay’s during the 2008 crisis after the bank denied a government bail out of their own.

The same March 2020 week as the rate cuts, Bitcoin crashed to nearly $3000, oil futures went negative, and real estate and stock markets around the world collapsed, offering an unprecedented buying opportunity to those with the capital to take advantage –– namely the recently “stimulated” BlackRock. But the U.S. government still needed a buyer of Treasuries and while finding a new place to sink this freshly issued debt, the Fed itself began “purchasing massive amounts of debt securities,” a technique utilized during the 2008 crisis known as Quantitive Easing, or QE. As Brookings notes, the Fed aimed to “restore smooth functioning” to the “Treasury and mortgage-backed securities (MBS) markets” which “play a critical role in the flow of credit to the broader economy.”

On March 15, 2020, the Fed “shifted the objective” of QE to supporting the economy, agreeing to purchase “at least $500 billion in Treasury securities” and “$200 billion in government-guaranteed mortgage-backed securities” over “the coming months.” A week later, on March 23, 2020, the Fed agreed to make the purchases open-ended, saying it would acquire securities “in the amounts needed to support smooth market functioning and effective transmission of monetary policy to broader financial conditions,” and thus “expanding the stated purpose of the bond buying to include bolstering the economy.” By June 2020, the Fed lowered the rate of purchases to “at least $80 billion a month in Treasuries” and “$40 billion in residential and commercial mortgage-backed securities” for the time being. The Fed again updated its policy in December 2020 to slow these purchases when the economy made “substantial further progress” toward the Fed’s mandate of maximum employment and price stability, and in November 2021, the Fed began tapering the pace of securities purchases.

By October 2021, Bitcoin had rocketed to nearly $70,000, and alongside it arose a new insatiable buyer of U.S. debt via government-issued securities –– dollar stablecoin issuers, led by Tether and Lutnick’s Cantor Fitzgerald. As previously reported by Unlimited Hangout:

“In the past 18 months, a new high volume net buyer of this debt has appeared in the cryptocurrency industry: stablecoin issuers. Stablecoin issuers such as Tether or Circle have purchased over $150 billion of U.S. debt –– in the form of securities issued by the Treasury –– in order to “back” the issuance of their dollar-pegged tokens with a dollar-denominated asset. For some perspective on the absolutely astounding amount of volume these relatively young and relatively small businesses have gobbled up of U.S. debt, China and Japan, historically the U.S.’ largest creditors, hold just under and just over $1 trillion, respectively, in these same debt instruments. Despite only existing for a decade, and despite only surpassing a $10 billion market cap in 2020, this leaves Tether alone at over 10% the Treasuries held by either of the U.S.’ largest nation-state creditors.”

While the likes of Tether’s USDT, alongside BlackRock-affiliated Circle’s USDC and PayPal’s PYUSD issued by Paxos, the U.S. has found partners for servicing the $35 trillion of already-issued debt alongside any future government budget as well as the modern evolution of the public-private partnership of capital creation while sustaining dollar hegemony across the globe via surveillable, programmable and seizable private bank currencies. Tether’s CEO Paolo Ardoino previously claimed that Tether froze around $435 million in USDT for the U.S. Department of Justice, the Federal Bureau of Investigation and the Secret Service on its path to becoming a “world class partner” to the U.S. to “expand dollar hegemony globally.”

Lutnick’s Cantor Fitzgerald, which holds Tether’s T-Bills, is “among the best-known bond trading houses on Wall Street” and “one of 25 primary dealers for U.S. Treasuries” which allows “direct trade with the Federal Reserve.” A report from September 2023 stated that Tether held $86.4 billion of assets in reserves with a later attestation report showing that USDT is mostly backed by U.S. Treasuries. By July 2023, the Federal Reserve raised its key interest rate to 5.5%, the “highest level in 22 years,” in hopes of making “borrowing and investing more expensive.” With rates having risen faster than ever in U.S. history from the 0% target reached in March 2020, firms such as Cantor Fitzgerald –– net buyers of short duration securities known as T-Bills – are set to receive high yields with very little risk. In Tether’s Q1 2023 Assurance Report, the stablecoin issuer held $81.8 billion with “the majority of its reserves” having been “invested in U.S. Treasury Bills” with “all new issuance of tokens” having “been invested in U.S. Treasury bills or placed in overnight Repo.”

In this same report, the company announced they would “regularly allocate up to 15% of its net realized operating profits towards purchasing Bitcoin (BTC)” via “utilizing realized profits from its investment strategy,” which relied predominantly on short duration Treasuries. In Q1 2023, Tether held approximately $1.5 billion in bitcoin. By April 2024, the firm held approximately 75,354 bitcoin, worth nearly $4.5 billion today.

In Ardoino’s statement regarding “the decision to invest in Bitcoin”, the current CEO of Tether noted “its limited supply” as a reason for why the asset has “emerged as a long-term store of value” complete with “substantial growth potential.” Whereas the U.S. government via the Treasury can continually issue these securities with no limit via a capped supply, bitcoin the asset has a predetermined issuance schedule, and an eventual total supply of just under 21 million bitcoin. The scarcity innate to bitcoin allows a debt-based financial system like the U.S. dollar system to continue to inflate into the demand inelastic, deflationary monetary policy of bitcoin. Now that the U.S. en masse has emerged, in no small part thanks to BlackRock’s iShares IBIT spot Bitcoin ETF, as the world’s largest known holder of bitcoin, complete with regulatory blessing from the likes of the DOJ and SEC, the Treasury has found willing market partners in their quest to service their debts and further dollarize the planet.

But it is perhaps within the planet itself that a new method for retaining U.S. dollar hegemony has emerged – the dollar-denominated, limited supply carbon market proposed by O.N.E. Amazon. Far from an unsubstantiated theory, Knez himself states precisely that the Amazon rainforest “should be valued in the trillions” and that his company is “enabling the market to value it as such” by “turning it into an advanced digital asset security.” In a discussion with Gulf News, Knez took this one step further in explaining why the tangible parameters of the Amazon’s size led to the creation of a limited supply of securities, providing the necessary mechanism to create a dollar-denominated debt sink out of the rainforest upon the security’s appreciation:

“At O.N.E. Amazon, we are harnessing the power of the market – the same force that has driven exploitation – to transform it into a tool for conservation. We aim to prove that the Amazon is more valuable alive than dead.

We’re not just environmentalists; we’re innovators, economists, technologists, and community leaders. Together, we’re developing a digital security asset – that represents the intrinsic value of the world’s largest rainforest’s biome. This isn’t just a financial instrument; it’s a statement, a commitment to the belief that the Amazon is valuable and ought to be priced. In terms of financial returns, investors will benefit from the potential capital appreciation of the digital security as the market values the positive environmental and social benefits of the rainforest’s biome.

Given the finite size of the Amazon rainforest, the total number of securities will be restricted to 750 million, corresponding to the hectarage of the rainforest. This creates a limited supply of digital securities.” [emphasis added]

Due to the limited supply of digital securities, O.N.E. Amazon has created an axiom for vast capital appreciation of the asset itself, allowing a further expansion of dollar-denominated liabilities and thus further eventual demand for the dollar’s underlying asset: U.S. Treasuries. Knez implies the Amazon should be valued in the trillions, and, much like he did in his role spearheading the iShares ETF brand, has created yet another growth market for the U.S. capital markets to “quantitively ease” into. Interestingly, this type of government debt expansion was theorized by RFK Jr.’s former running mate, Nicole Shanahan, in a project she led at Stanford titled “An Analysis of Carbon Credit Markets as Validation for Climate Supportive Quantitative Easing Using the Blockchain” described below:

“This project will provide a white paper for a carbon coin that works in tandem with the existing carbon credit (offset) markets. As an active venture investor in carbon credit markets such as Pachama and Joro Technologies, and a major customer of these offsets with my husband Sergey Brin, I will be leveraging the current entrepreneurial ecosystem to identify the economic, policy, and technological requirements to scale a carbon credit coin…While authors and futurists such as Kim Stanley Robinson (author of Ministry of the Future), have focused on the feasibility of governments issuing carbon coins in exchange for carbon sequestration, my argument is that a private market can first be situated to verify the accuracy of the carbon sequestration projects funded by the coin. The government can in turn, have evidence based results by which to sell government treasuries into the carbon coin network.”

These “evidence based results” of which Shanahan theorized, as it relates to the O.N.E. Amazon scheme, would presumably be the data provided by their satellite partner, Satellogic. Due to Satellogic’s board being Chaired by former Treasury Secretary Mnuchin, Cantor Fitzgerald’s Lutnick large stake of shares and board position, and their funding by leading dollar-denominated stablecoin issuer Tether, the personnel and wherewithal to create such a debt sink at a time of dire need has been assembled.

As the U.S.’ ballooning debt demands further areas to place their newly-issued debt, Knez and O.N.E. Amazon have all but directly proposed making the 750 million hectares of Amazon rainforest exactly that place.

Datafication & Debt – The New “Conservation”

O.N.E. Amazon’s stated reasons for its business model – ostensibly “preserving” and “conserving” the Amazon – reflect a broader effort to frame efforts to centralize control over the global commons and build out a surveillance grid for both people and the planet as the only “feasible” means of rescuing the planet from catastrophe. However, as this article has endeavored to show, O.N.E. Amazon’s interest is not in helping locals or indigenous groups or even in helping actually conserve the rainforest in the way most would imagine. Instead, the goal is to turn the Amazon rainforest into an exploitative farm – a farm for data that itself can be monetized and tokenized, just like the hectarage of the Amazon itself.

As the architects of Wall Street’s new web3 economy search for new ways to store the wealth they have pilfered from the public through organized wealth transfers, more forms of “digital gold” will become a necessity. While bitcoin represents one digital store of value, the race is on to tokenize real world assets, especially the natural world and natural resources, in order to perpetuate the debt-based monetary system that has enabled the theft of regular people’s wealth for centuries. Framed in altruistic terms of “helping” the environment and the have-nots, we are instead witnessing the “datafication” of all life both for profit and so that all life – including human beings and the natural world – can be surveilled, eventually down to the molecular level, and then “managed” by intelligent machines. Such a paradigm does not represent “conservation” or “preservation,” but rather the onboarding of our greatest natural treasures onto a system of hi-tech control, with every flutter of a butterfly wing and every branch swaying in the breeze being converted into bits and bytes that predatory bankers can trade and speculate on for profit.

O.N.E. Amazon is more than a company, it represents a model that others are following which seeks to borgify the natural world, and us along with it, claiming to “harness the market” to save us all from a vague yet impending doom. However, we and the forests are not being saved, we are being put in chains – forced into a prison without walls where the sensors to be placed on and in the trees and on and in our bodies will connect us to the bankers’ blockchain of choice and allow us to be traded or sold, our biological signals and processes monetized for their benefit, and the masses of people, plants and animals on this planet to be “managed” by AI-powered machines that they program and control.

Source: Unlimited Hangout

Comments

Post a Comment