Invasion Of The Water Snatchers

Invasion Of The Water Snatchers

Texas ranchers are fighting “green” hydrogen projects. “It’s a ridiculous amount of water.”

Drought has hit Schleicher County hard. Lots of the stock tanks are dry. The only plants that appear to be thriving on this part of the Edwards Plateau are scrawny mesquite trees and the ever-present prickly pear cactus. As we turned onto County Road 339, the clouds of dust from the unpaved road were so thick that I slowed down to assure there was at least 100 yards between my vehicle and the tailgate of Ray and Sandra Pfeuffer’s pickup. It was the afternoon of August 15. The dashboard in our 4Runner showed the outside temperature was 103 F. The sun was relentless. There was almost no wind. A bare handful of clouds dotted the sky.

The Pfeuffers, who raise goats and cattle on a 3,300-acre ranch about a dozen miles southeast of Christoval, led us to a remote spot in a remote county: the Carmelite Monastery of Our Lady of Grace.

Sandra wanted me to meet the nuns at the monastery because, like the Pfeuffers and many others in Schleicher County, they were dead set against a “green” hydrogen project called Tierra Alta, that has been proposed for their neighborhood by ET Fuels, an Irish corporation that’s backed by private equity firms based in Zurich and Paris. At the monastery, we were warmly greeted by Sister Mary Grace and Sister Mary Michael. Both were quick to explain why they are opposing the project. Not only would it include dozens of wind turbines that would be visible from the monastery, it would also require lots of water. Sister Mary Grace spoke first. She told me, “We are all about prayer. We are all about justice. And we are all about people.” She went on to say the project would completely change the region’s character.

Sister Mary Michael, who relied on a wheelchair, spoke softly but cut right to the chase: “We’re in a drought, and they want to take more water,” she said. “It’s a ridiculous amount of water.”

“Ridiculous” is the right word. But the water needs of the proposed “green” hydrogen-to-methanol projects are only one absurdity in a corral-full of absurdities propelled by the outrageous amount of federal money available to corporate subsidy miners under the Inflation Reduction Act. (That legislation, you may recall, became law by a single vote, cast by Kamala Harris.) And those subsidy miners are eagerly aiming to feed at the trough. However, to collect the maximum amount of federal money under the IRA for “green” hydrogen, they will have to pave dozens, or even hundreds, of square miles of ranchland from San Angelo to Fort Stockton with wind turbines and solar panels.

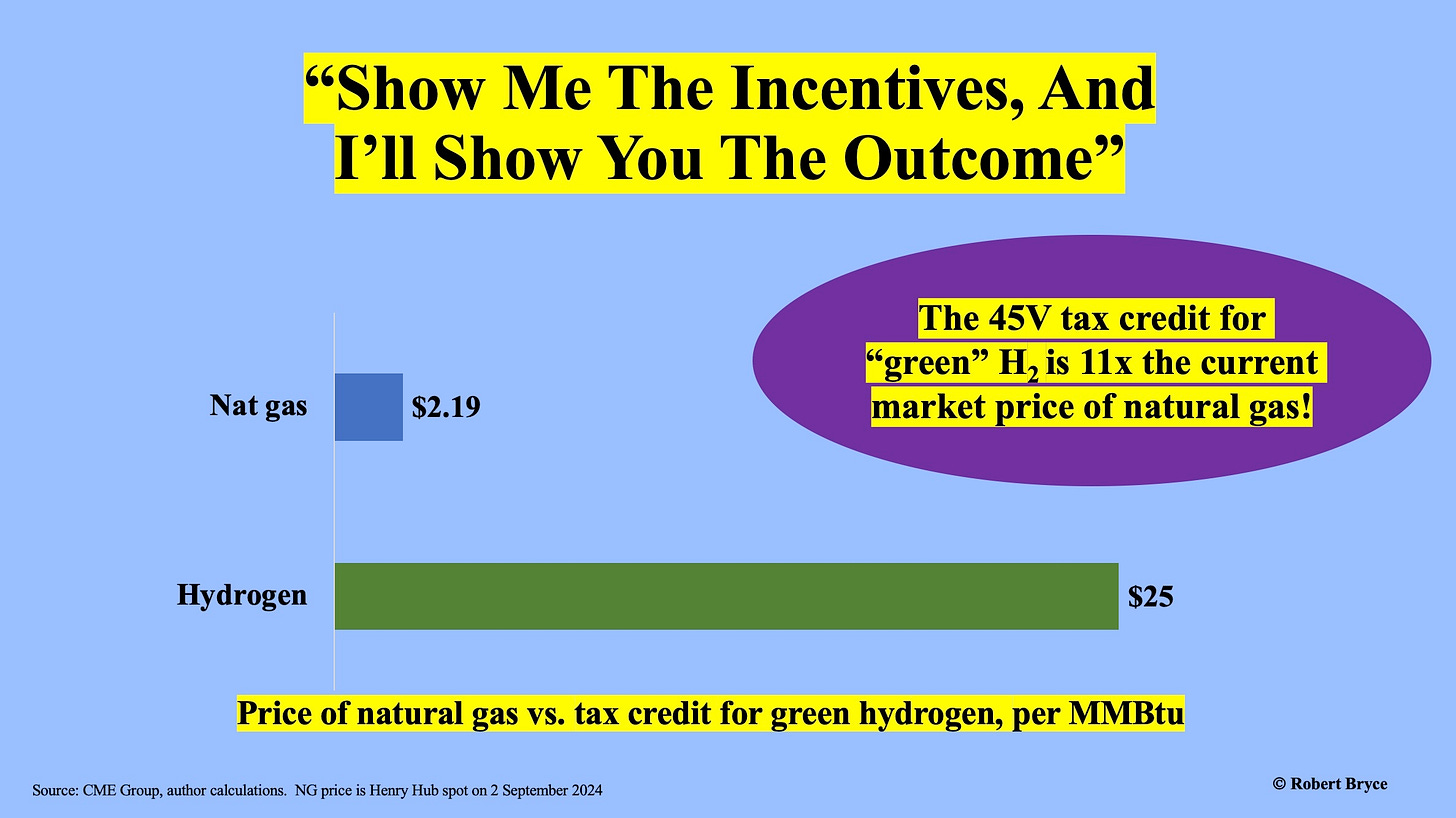

As I explained here on Substack last month, the subsidies for “green” hydrogen are 1,900 times larger than what’s given to nuclear. In that piece, I quoted the late Charlie Munger, who famously said, “Show me the incentives, and I’ll show you the outcome.” I wrote, “Under rules published earlier this year by the Treasury Department and Internal Revenue Service, hydrogen producers can collect $3 per kilogram of hydrogen under the production tax credit if they use electricity from low- or no-carbon sources.” As I noted, the energy content of hydrogen is about 120 megajoules (MJ) per kilogram. When converted into Btu, that works out to a subsidy of roughly $25 per million Btu. As seen above, that means that the subsidy for green hydrogen is 11 times the current market price for natural gas.

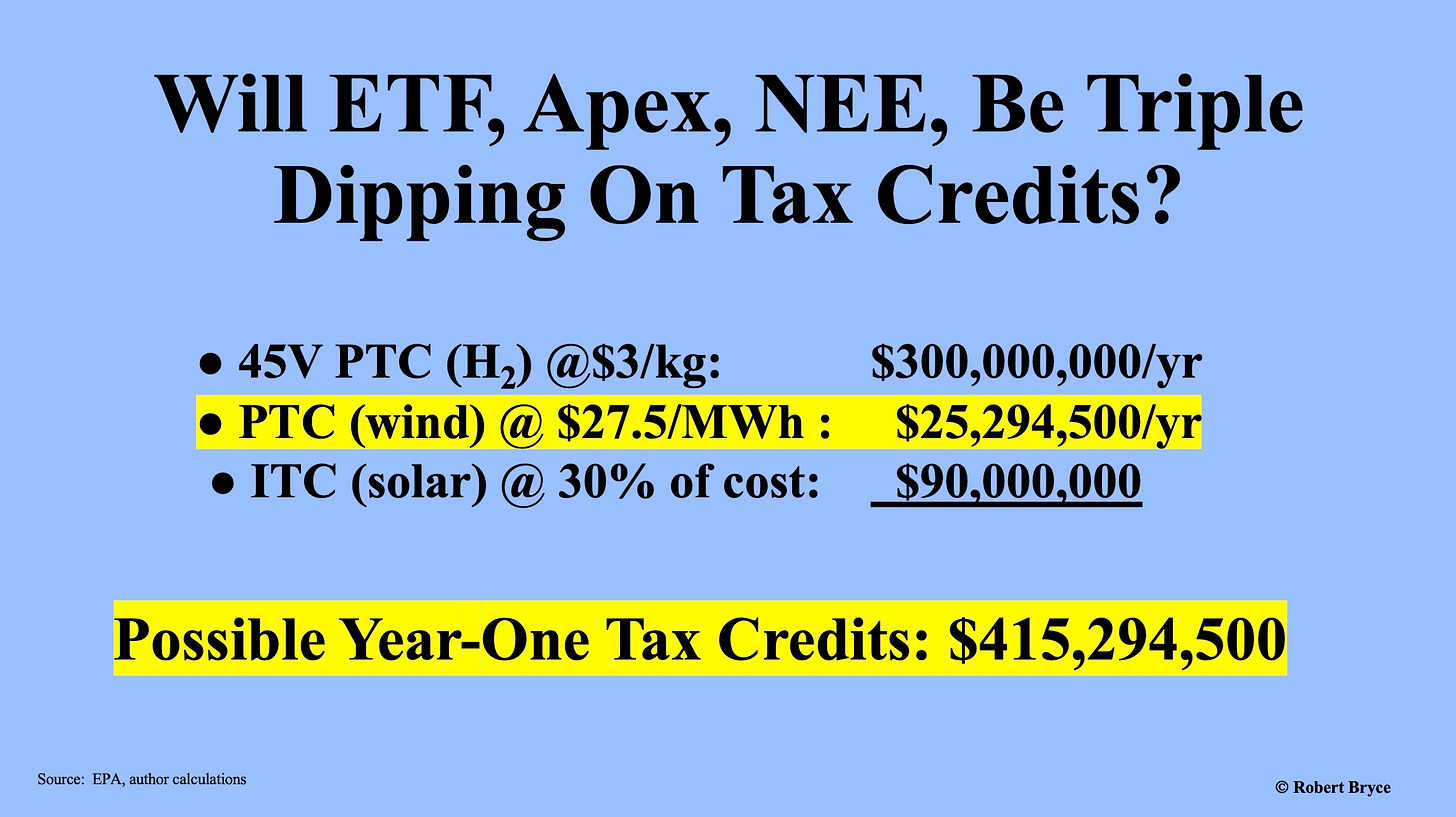

In addition, the companies that produce “green” hydrogen may — repeat, may — also be able to collect tax credits for the energy they produce from the sun and the wind. The result, as seen in the slide above, is that for a project costing $800 million, which is the estimated cost of ET Fuels’ Tierra Alta project, the developer could collect more than half of that sum courtesy of federal taxpayers. Note that I’m hedging my statement here because the rules on the tax credits are hazy. That said, it’s clear that the 45V tax credit alone for green hydrogen could provide more than a third of the project’s cost in the first year alone.

That gobsmacking level of subsidy explains why ET Fuels, NextEra Energy, and Apex Clean Energy, are trying to develop massive “green” hydrogen projects on the Edwards Plateau. ET Fuels plans to cover 30,000 acres of ranchland in Schleicher County with 300 megawatts of wind energy capacity, 300 megawatts of solar capacity, and an unspecified amount of battery storage. That capacity will fuel a bank of electrolyzers to produce enough hydrogen for a 100,000-ton-per-year “green” methanol plant. Meanwhile, NextEra and Apex are planning projects that could dwarf what ET Fuels is proposing.

When I asked the Pfeuffers why they and other leaders of The Edwards Plateau Alliance are fighting so hard to stop the hydrogen projects, they replied. “water, water, water.” Ray said, “We wouldn’t have cared if they’d built wind turbines and solar. They could’ve done whatever they wanted.” But after learning about how much water the companies wanted, Sandra said it became clear the projects “just don’t make sense.”

The ET Fuels project alone could require some 485 acre-feet of water per year or roughly 433,000 gallons per day. For perspective, that volume of water would be enough to fill more than four Olympic-size swimming pools every week. “Our aquifer can’t sustain” that much demand Ray explained. When local ranchers irrigate with center-pivot sprinkler systems, they only run their irrigation pumps for a day or two. And even that demand draws down local water wells by 15 or 20 feet until the pumping stops. The hydrogen projects will put continuous demands on the aquifer, which would be ruinous for the region’s ranchers. But that hasn’t stopped the subsidy miners.

Apex Clean Energy, a subsidiary of Ares Management Corporation, a publicly traded firm based in Los Angeles that sports a market cap of $45 billion, also has big plans. In 2022, it announced it was pursuing a “green fuels hub” at the Port of Corpus Christi that would get its fuel from a massive complex of wind and solar capacity in the region near Fort Stockton. The project, known as Big Trail reportedly aims to lease 280,000 acres of land and install some 3,200 megawatts of alt-energy capacity. A map a local resident showed me indicates the company is targeting more than 700 square miles of land in Pecos County for solar and wind development. Apex, which often uses for-profit front groups to attack its opponents, has been very aggressive in its efforts to build alt-energy projects across the country. It declined to answer a list of questions that I submitted.

Florida-based NextEra Energy, the world’s biggest alt-energy producer, is planning to lease massive amounts of land in the region. The company, which has a market cap of $165 billion, is pushing a project dubbed Achilles. According to the Pfeuffers, two landmen working for NextEra told them the company aims to lease three million acres(!) of land in west Texas for alt-energy projects. Part of the land would be used for hydrogen production and the rest would be used to produce electricity for the Texas grid. The company did not respond to my emails seeking details about their project.

While these companies are leasing land in the region for hydrogen projects, it’s also clear that they face many hurdles. Local opposition, particularly in Schleicher County, is fierce. (For the record, I would not want to tangle with the nuns or Sandra Pfeuffer.) Local aquifers may be unable to produce the vast amounts of water the projects will need. According to the Pfeuffers, who attended a local water board meeting last Thursday, test wells recently drilled by ET Fuels were not overly productive.

There is plenty of market risk. Last month, Bloomberg ran a piece headlined, “Why almost nobody is buying green hydrogen.” It explained that while some 1,600 projects are on the drawing boards, “the vast majority of those projects don’t have a single customer stepping up to buy the fuel. Among the handful with some kind of fuel purchase agreement, most have vague, nonbinding arrangements that can be quietly discarded if the potential buyers back out. As a result, many of the projects...will likely never get built.” In addition, the projects are a long distance from potential markets. Apex may want to ship its fuel to maritime customers. But Fort Stockton is 456 miles from the beaches at Corpus Christi.

Finally, it’s evident that hydrogen production is, as I explained in May, “a thermodynamic obscenity.” I wrote:

Hydrogen is insanely expensive, in energy terms, to manufacture. It takes about three units of energy, in the form of electricity, to produce two units of hydrogen energy. In other words, the hydrogen economy requires scads of electricity (a high quality form of energy) to make a tiny molecule that’s hard to handle, difficult to store, and expensive to use.

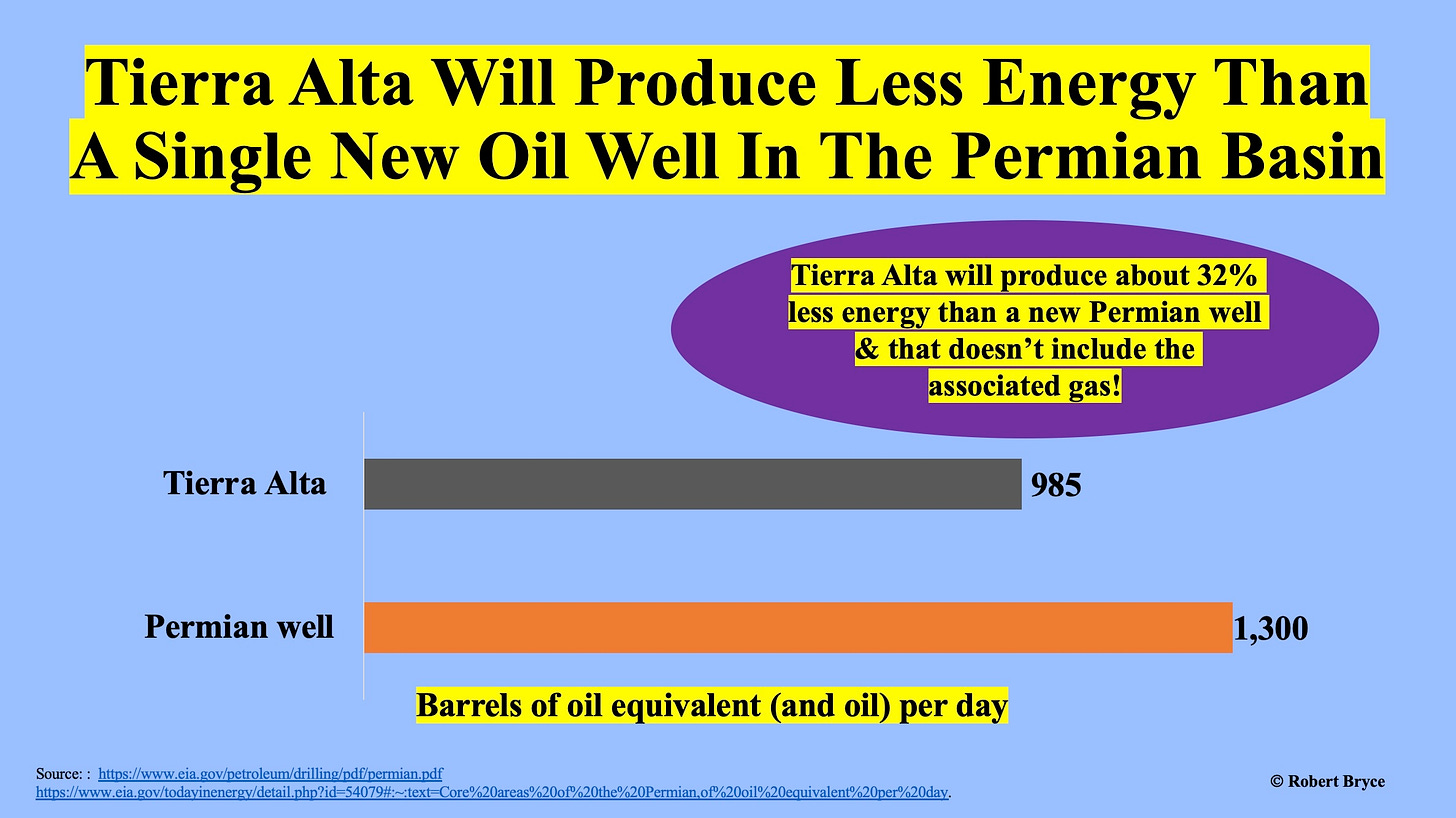

The thermodynamic obscenity of making hydrogen, combined with the need to mix it with carbon dioxide (produced from somewhere else) to manufacture methanol, means that companies will encounter friction throughout the production process. As I explained to about 200 local ranchers and citizens at a free lecture I gave in Eldorado on August 15 at the Schleicher County Civic Center, the final energy output of ET Fuels’ proposed Tierra Alta project (100,000 tons of methanol per year) will be relatively small, only about 985 barrels of oil equivalent per day.

In the big picture, particularly in Texas — which produces more oil and gas than all but two or three countries — that’s a minuscule amount of energy. As seen above, the latest data from the Energy Information Administration shows that new oil wells in the Permian Basin, which is located about 150 northwest of Eldorado, are now producing about 1,300 barrels per day. And remember, that output doesn’t include the energy in the associated gas coming out of that well. And remember, the ET Fuels project will require covering some 47 square miles of ranch land with alt-energy stuff, and all of that alt-energy stuff will require using untold tons of steel, copper, concrete, wire, and untold tons of gravel for untold miles of new roads. And remember, in the Permian, a dozen or more wells are often drilled on a single multi-acre pad. Thus, while the surface footprint of the oil and gas industry is getting drastically smaller, the alt-energy sector is hoping to cover hundreds, or even thousands, of square miles of rural America with wind turbines and solar panels in its never-ending quest for ever-larger government handouts.

The punchline here is obvious: everything about the “green” hydrogen push is ridiculous. But billions in federal tax dollars are at stake. That much cash can purchase a heap of ridiculousness.

Source: Robert Bryce

Comments

Post a Comment